From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Under Pressure: Demand Slump and Production Adjustments

Asia’s steel market faces mounting pressure due to weak demand signals mirrored in production adjustments. Specifically, European market dynamics, as detailed in “European HRC market slows down; factories offer discounts to fight imports” and “European HRC trading still slow, with market divided over direction of prices,” highlight challenges from import competition and price uncertainty, potentially impacting Asian export strategies. No direct relationship between these articles and observed steel plant activity can be established with the provided data. The article titled “Prices for Brazilian slabs fell by 5% in June,” notes increased Asian imports to the US, and potential US duties on Brazilian goods, suggesting shifts in global trade flows, which could indirectly influence Asian steel production and pricing.

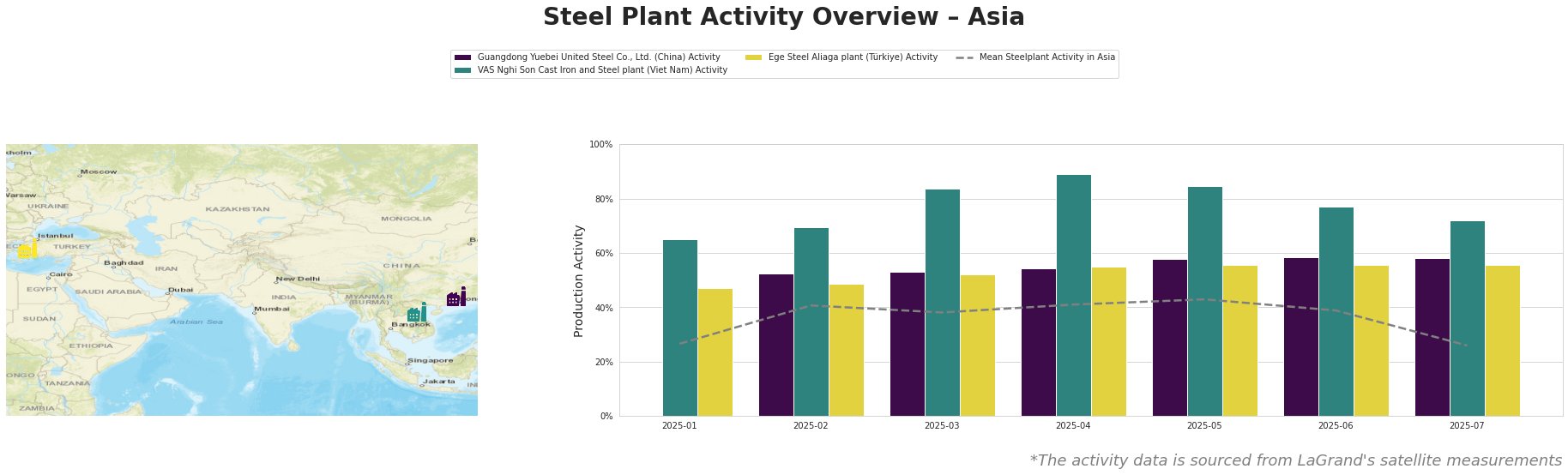

The mean steel plant activity in Asia shows a downward trend, dropping significantly to 26% in July after peaking at 43% in May. Guangdong Yuebei United Steel Co., Ltd. in China maintained a stable activity level at 58% from May to July, consistently exceeding the Asian average. VAS Nghi Son Cast Iron and Steel plant in Vietnam exhibited high activity, peaking at 89% in April before declining to 72% in July. Ege Steel Aliaga plant in Turkey showed relatively stable activity levels around the mid-50s, with a slight increase to 56% from May onwards. The overall decrease in the Asian mean activity level could be correlated to the pressures of import competition described in “European HRC market slows down; factories offer discounts to fight imports,” however, no direct link can be established from the available data.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant in Guangdong producing primarily rebar for building and infrastructure using BF/BOF and EAF technologies, maintained a consistent activity level around 58% from May to July, despite the overall Asian market slowdown. This steady production may indicate robust domestic demand or strategic advantages relative to competitors, though no direct connection to the provided news articles can be established.

VAS Nghi Son Cast Iron and Steel plant, an electric arc furnace (EAF) based steel plant in Thanh Hoa, Vietnam, producing semi-finished and finished rolled products like billet, rebar, and wire rod, saw a significant drop in activity from 89% in April to 72% in July. This decline could be a response to shifting regional demand, influenced perhaps by the global trade adjustments described in “Prices for Brazilian slabs fell by 5% in June,” however, no direct connection can be established.

Ege Steel Aliaga plant, an EAF-based steel plant in İzmir, Turkey, producing rebar and wire rod, showed a stable activity level around the mid-50s. The Turkish market is specifically mentioned in “European HRC market slows down; factories offer discounts to fight imports” as a source of imports to Europe, suggesting potential external demand supporting the plant’s activity. No direct link can be established.

Based on the observed decrease in the Asian average steel plant activity and the pressure from imports in Europe, as highlighted in the news articles, steel buyers should:

- Prioritize Short-Term Contracts: Given the uncertainty in global trade flows reflected in “Prices for Brazilian slabs fell by 5% in June“, and the overall downward trend, negotiate short-term contracts to capitalize on potential price declines.

- Carefully Evaluate Import Options: Considering the competitive import landscape, especially from Turkey, Indonesia, and Algeria, as mentioned in “European HRC market slows down; factories offer discounts to fight imports,” buyers should closely evaluate import options, focusing on suppliers with flexible delivery terms.