From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Signals Production Surge Amidst US Export Shifts: Procurement Strategies

Asia’s steel market exhibits a very positive sentiment, driven by increased plant activity. While the news articles focus on the US steel market, they provide context for global trade dynamics. The observed changes in Asian steel plant activity are independent of the US-centric news. The developments in the US, as covered in the article “US steel exports up 0.8 percent in July 2025“, “US HDG exports up 1.3 percent in July 2025“, “US HDG imports up 5.7 percent in July 2025“ and “US HRC exports up 0.64 percent in July 2025“, indicate shifting trade flows that could indirectly influence global steel availability.

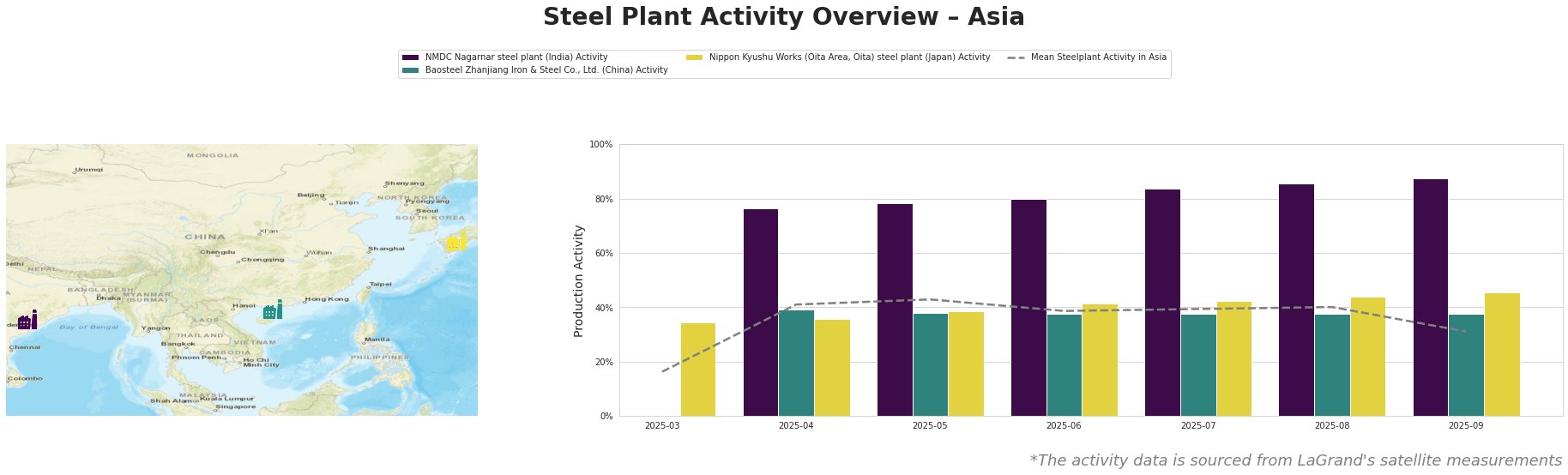

The mean steel plant activity in Asia shows a decline in September to 31.0 after a period of relative stability around 40%, which followed a significant increase from March (16.0) to April (41.0). NMDC Nagarnar steel plant in India consistently increased its activity from April (76.0) to September (88.0). Baosteel Zhanjiang in China has remained stable around 38-39. Nippon Kyushu Works in Japan shows a steady increase from March (35.0) to September (45.0).

NMDC Nagarnar steel plant, located in Chhattisgarh, India, is an integrated steel plant with a 3 million tonne crude steel capacity, utilizing BF and BOF technologies. The plant’s activity has steadily risen from 76.0 in April 2025 to 88.0 in September 2025, significantly exceeding the Asian average. The plant produces hot rolled coils, sheets, and plates for automotive, construction, energy and transport sectors. The steady increase in plant activity doesn’t align directly with any of the provided news articles, suggesting it is driven by local or regional factors not covered in this report.

Baosteel Zhanjiang Iron & Steel, located in Guangdong, China, has a large production capacity of 12.5 million tonnes of crude steel using primarily BF and BOF technologies. Activity levels at Baosteel Zhanjiang have been consistently stable at approximately 38% between April and September 2025, below the Asian average in April and May, and at the average for the months of June, July and August. This plant produces hot rolled plates, cold rolled sheets, and hot-dip galvanized plates. No direct correlation can be established between the plant’s stable production and the US-focused news articles provided.

Nippon Kyushu Works (Oita Area, Oita) in Japan, an integrated steel plant with a 10 million tonne crude steel capacity, utilizes BF and BOF technologies. The plant demonstrates a consistent increase in activity from 35.0 in March 2025 to 45.0 in September 2025, exceeding the Asian average in September. The plant is a key producer of hot rolled steel sheets and steel plates. Similar to the other plants, no direct relationship between the plant’s observed activity and the provided US-centric news articles can be established.

Evaluated Market Implications:

The consistent increase in production at the NMDC Nagarnar steel plant in India signals a potential increase in supply of hot rolled products within the Indian market. Considering this trend, steel buyers focused on the Indian market might benefit from negotiating prices with NMDC Nagarnar, potentially leveraging the increased production to secure more favorable terms.

Procurement teams tracking Asian steel markets can consider the overall increase trend of Nippon Kyushu steel plant. The news articles about US steel exports provide context about global trade flows, so it is suggested to also monitor the influence on steel availability to anticipate potential shifts in import-export dynamics.