From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Shows Resilience Despite US Import Declines: Activity Stable, Procurement Opportunities Emerge

Asia’s steel market demonstrates underlying strength despite decreased US steel imports, as indicated by steady activity at key regional plants. While the provided news articles such as “US steel imports down 16.9 percent in April from March” and “US Rolled Steel Coil Imports and Exports Decline in April” highlight reduced US demand, no direct link to disruptions in Asian steel plant activity can be explicitly established based on the current data. The Asian steel plants’ activity levels appear largely unaffected by the US import slowdown.

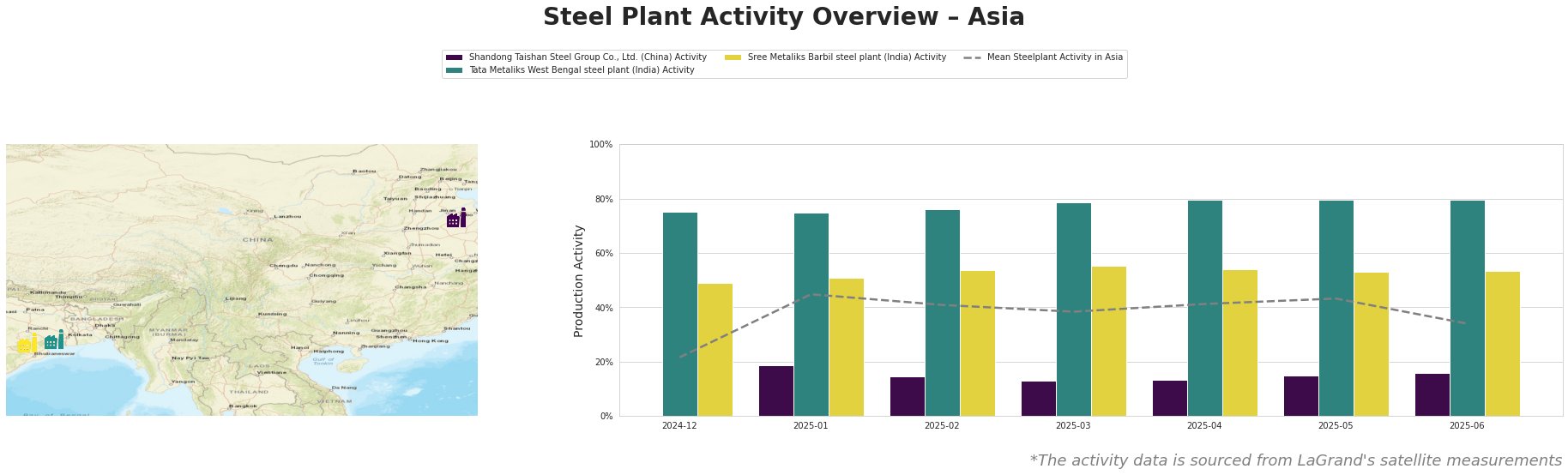

The mean steel plant activity in Asia fluctuated, starting at 22% in December 2024 and peaking at 45% in January 2025 before settling at 34% in June 2025, showing a degree of volatility in the market. Shandong Taishan Steel Group Co., Ltd. consistently showed activity levels significantly below the Asian average, ranging from 13% to 19%. Tata Metaliks West Bengal steel plant operated at consistently high levels, ranging from 75% to 80%, far exceeding the mean Asian activity. Sree Metaliks Barbil steel plant’s activity remained relatively stable between 49% and 55%.

Shandong Taishan Steel Group Co., Ltd., a major integrated steel producer in Shandong, China, with a crude steel capacity of 5 million tonnes and utilizing BF/BOF technology, has exhibited consistently low activity levels, ranging between 13% and 19% from January to June 2025. This is notably below the average Asian steel plant activity. Given the company’s focus on hot-rolled coil and cold-rolled coil production, there might be a weak relation to the mentioned US HDG import declines, but no direct link is explicitly supported by the provided information.

Tata Metaliks West Bengal steel plant, an integrated BF/BOF producer in West Bengal, India, with a crude steel capacity of 255,000 tonnes and focusing on pig iron and ductile pipes, demonstrates robust and consistent activity levels, hovering around 75%-80% throughout the observed period. This indicates strong regional demand for its products and appears unaffected by the US import trends. The plant possesses Responsible Steel Certification. No direct link can be established between the plant’s high activity and the news articles.

Sree Metaliks Barbil steel plant, located in Odisha, India, operates as an integrated steel plant utilizing both BF and DRI technologies, with a crude steel capacity of 700,000 tonnes, producing DRI, pig iron, billets, and TMT bars. The plant’s activity has been relatively stable, fluctuating between 49% and 55%. There is no explicitly evident correlation between its performance and the US import figures reported in the news articles. The plant relies on captive iron ore mines, which may insulate it from global market fluctuations to some extent, but this cannot be confirmed by the provided information.

Despite the decrease in US steel imports highlighted in articles like “US HDG imports down 24.9 percent in April from March” and “US CRC exports down 13.8 percent in April from March,” the stable activity at key Asian steel plants like Tata Metaliks and Sree Metaliks suggests continued regional demand and potential supply chain diversification. The consistently low activity at Shandong Taishan warrants further investigation.

Procurement Actions:

* For steel buyers focused on hot-rolled coil and cold-rolled coil, investigate opportunities for sourcing from Shandong Taishan Steel Group Co., Ltd. given their relatively low activity levels, potentially indicating available capacity and competitive pricing, but proceed with caution and verify product availability.

* Given the high and consistent activity at Tata Metaliks, buyers seeking pig iron and ductile pipes should secure contracts well in advance to ensure supply and mitigate potential lead time extensions.

* Closely monitor the price trends of DRI, pig iron, billets, and TMT bars produced by Sree Metaliks, given its relatively stable activity and potential for opportunistic buys based on raw material cost fluctuations in the Indian market.