From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Shows Resilience Amidst EU Trade Concerns: Ansteel and Yantai Lead Production Surge

Asia’s steel market demonstrates continued activity despite growing apprehension surrounding potential EU trade barriers targeting Asian exports, as evidenced by the observed activity data. This report analyzes recent steel plant activity in Asia, linking it to news articles discussing potential EU trade measures and offering actionable insights for steel buyers. Activity changes at Ansteel and Yantai Walsin Stainless Steel do not appear to be directly impacted by the news articles “German steel industry calls for comprehensive EU trade measures to address global overcapacity,” “European Commission consultation on steel trade measures finds local industry favors TRQs,” “German steel industry calls for stronger EU steel trade defense against Asian overcapacity,” and “EU steel quotas must not disrupt distribution and SMEs” as these articles discuss the EU Market, not the Asian market.

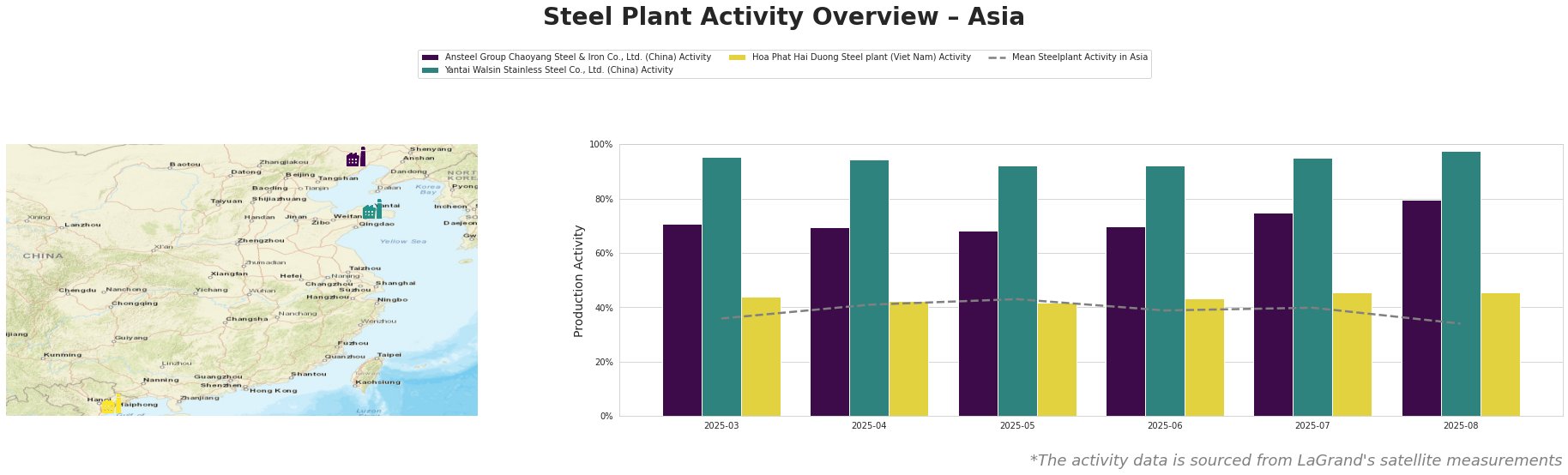

Here’s a summary of plant activity, expressed as a percentage, where 0% represents the lowest historical activity and 100% the highest:

Across Asia, the mean steel plant activity fluctuated between 34% and 43% from March to August 2025, dipping to 34% at the end of the measurement period.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a Liaoning-based integrated steel plant with a 2,100 thousand tonnes per annum (ttpa) BOF crude steel capacity, consistently operated above the Asian average. The plant activity saw a notable increase from 75% in July to 80% in August. This increase occurred despite increasing apprehension of potential EU trade measures. There is no evident connection between Ansteel’s activity and the news articles “German steel industry calls for comprehensive EU trade measures to address global overcapacity,” “European Commission consultation on steel trade measures finds local industry favors TRQs,” “German steel industry calls for stronger EU steel trade defense against Asian overcapacity,” and “EU steel quotas must not disrupt distribution and SMEs.”

Yantai Walsin Stainless Steel Co., Ltd., a Shandong-based plant with a 1,400 ttpa EAF crude steel capacity, maintained high activity levels, consistently exceeding 90%. August saw a peak activity of 98%, significantly above the Asian average. Yantai’s focus on special steel products and stainless steel billets seems to insulate it from immediate EU trade concerns focused on commodity-grade steel. There is no evident connection between Yantai’s activity and the news articles “German steel industry calls for comprehensive EU trade measures to address global overcapacity,” “European Commission consultation on steel trade measures finds local industry favors TRQs,” “German steel industry calls for stronger EU steel trade defense against Asian overcapacity,” and “EU steel quotas must not disrupt distribution and SMEs.”

Hoa Phat Hai Duong Steel plant in Vietnam, an integrated steel plant with a 2,500 ttpa BOF crude steel capacity, operated below the Asian average. Activity rose slightly from 44% in March to 46% in August. There is no evident connection between Hoa Phat’s activity and the news articles “German steel industry calls for comprehensive EU trade measures to address global overcapacity,” “European Commission consultation on steel trade measures finds local industry favors TRQs,” “German steel industry calls for stronger EU steel trade defense against Asian overcapacity,” and “EU steel quotas must not disrupt distribution and SMEs.”

Given the continued high activity at Yantai Walsin, which produces specialized stainless steel products, and the potential for EU trade measures to redirect commodity steel flows, steel buyers should:

- Secure Stainless Steel Supply: Prioritize securing long-term contracts with stainless steel suppliers like Yantai Walsin to mitigate potential price volatility driven by redirected trade flows.

- Diversify Sourcing: Explore alternative steel sources outside of regions potentially impacted by EU trade measures to ensure supply chain resilience. Closely monitor commodity steel prices, as there are no observations that support a disruption of the supply of these products.

- Monitor Policy Developments: Closely monitor EU trade policy developments and their potential impact on specific steel product categories to proactively adjust procurement strategies.