From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Shows Mixed Signals Amidst CBAM Concerns and Stable Regional Production

In Asia, steel markets are experiencing a complex interplay of factors, including stable regional production and global trade shifts. The satellite data shows mixed plant-level activity, but without direct relationships to the European market news. The news articles “European long steel round-up: slight improvement in apparent demand“, “European prices to rise, conditions remain difficult” and “Steel quotas vanish fast for some products as EU buyers race ahead of CBAM” focus on the European market. Therefore, direct link to Asian plant level activities could not be established.

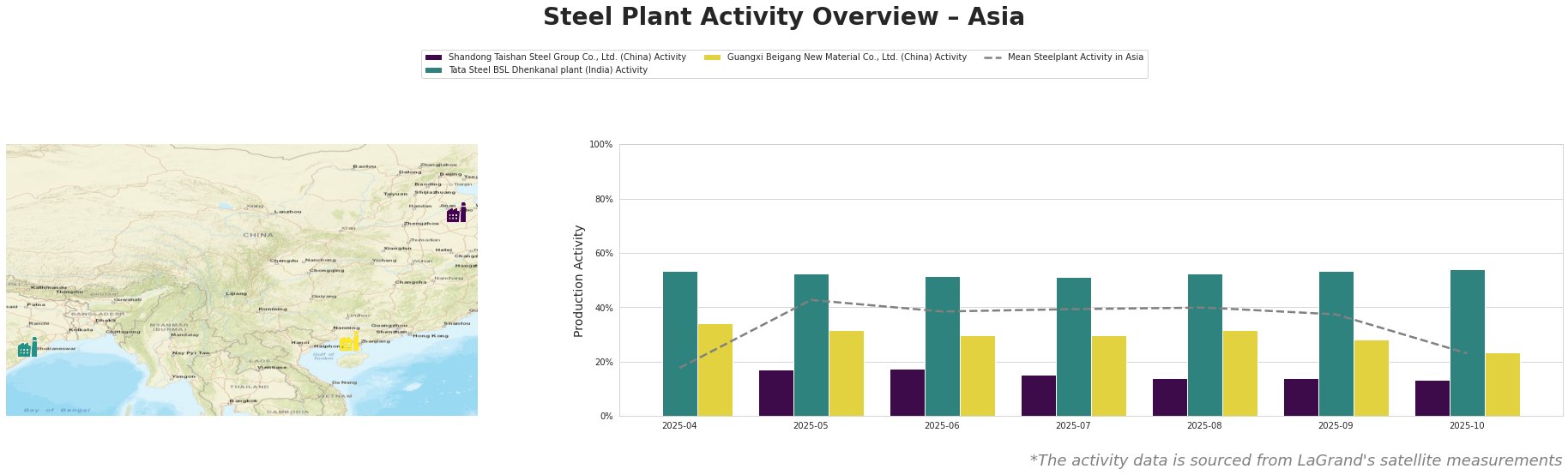

The mean steel plant activity in Asia fluctuated throughout the period, starting low at 18.0% in April, peaking at 43.0% in May, and then gradually decreasing to 23.0% by October.

Shandong Taishan Steel Group Co., Ltd., a Chinese integrated steel producer with a crude steel capacity of 5000 tonnes, primarily produces hot-rolled coil, cold-rolled coil, and stainless steel. Satellite data indicates a consistent decrease in activity from 17.0% in May to 13.0% in October. Given the lack of direct connections with the provided news articles, the reasons for this continuous downward trend cannot be explicitly explained.

Tata Steel BSL Dhenkanal plant, an Indian integrated steel plant with both BF and DRI production routes and a crude steel capacity of 5600 tonnes, shows relatively stable activity levels. Activity remained consistently high, fluctuating narrowly between 51.0% and 54.0% from April to October. As the provided news articles focus on European steel market dynamics, without connection to the Dhenkanal plant, any link to European market trends cannot be established.

Guangxi Beigang New Material Co., Ltd., a Chinese steel plant with a crude steel capacity of 3400 tonnes, utilizes both BF and EAF production routes and focuses on cold-rolled coil, hot-rolled coil, and nickel-chromium alloy slab production. Its activity decreased from 34.0% in April to 23.0% in October, with a slight increase observed mid-period. Lacking any explicit connection with the European market-centric news articles, we cannot attribute this activity variation to any of the presented factors.

Evaluated Market Implications

Based on the provided information, assessing concrete market implications for steel buyers and analysts is difficult due to the disconnect between European market news and observed Asian plant activities. The European news articles describe CBAM implementation as an important driver for steel prices in Europe. However, this information cannot be used to derive implications for Asia.

Recommended Procurement Actions:

Given the data limitations, no specific procurement actions can be recommended based on the provided information.