From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Resilient Despite US Tariff Threats: Plant Activity Shows Growth

Asia’s steel market demonstrates resilience amidst US tariff uncertainties. Recent activity trends at key steel plants, while showing some fluctuation, generally indicate sustained production. The impact of potential US tariffs, as highlighted in “US plans tariffs on steel and semiconductor chip imports” and “Trump administration adds to Section 232 steel-derivatives list,” appears not to have significantly hampered production in Asia at present, as only minor recent activity reductions could be observed.

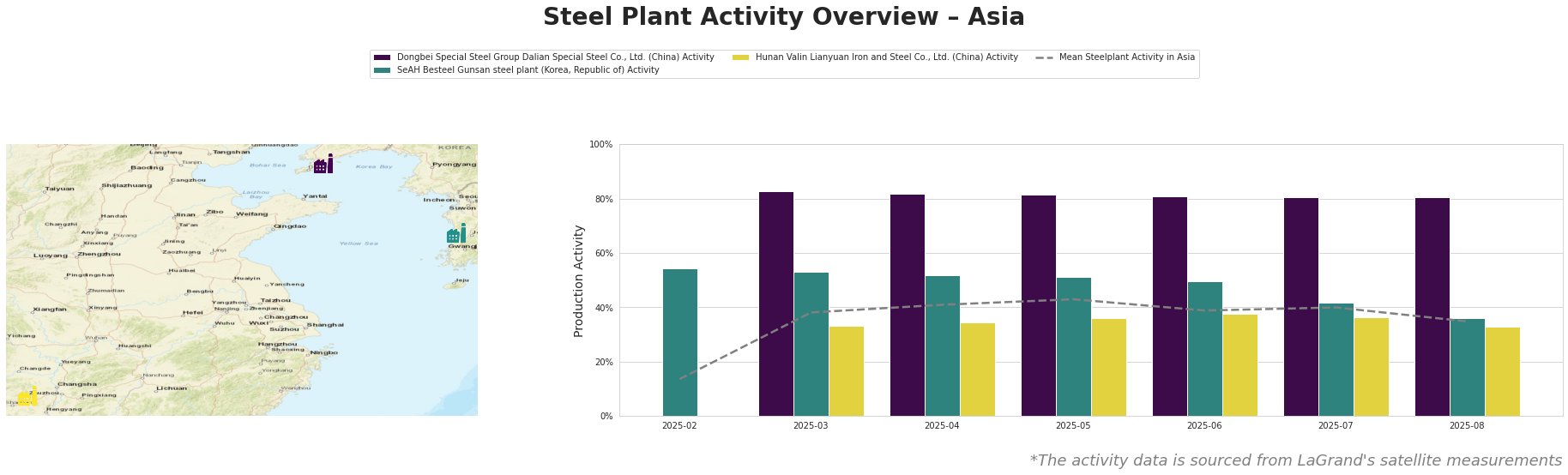

The mean steel plant activity in Asia increased significantly from February (14%) to May (43%), then gradually decreased to 35% by August.

Dongbei Special Steel Group Dalian Special Steel Co., Ltd., a major integrated steel producer in Liaoning, China, with a 1.54 million tonnes crude steel capacity and using BF/BOF and EAF production routes, has maintained a consistently high activity level around 81-83% from March to August. This stable production rate suggests the company is unaffected by immediate US tariff concerns. No direct link between the observed activity and the news articles could be established.

SeAH Besteel Gunsan steel plant, a Korean EAF-based special steel producer with a 2.1 million tonnes capacity focused on automotive and heavy forged steel, experienced a gradual decrease in activity from 54% in February to 36% in August. This downtrend potentially reflects increased caution or re-evaluation of export strategies in light of the uncertainty created by “US plans tariffs on steel and semiconductor chip imports” and “Trump administration adds to Section 232 steel-derivatives list,” but a direct link cannot be definitively confirmed.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., a large integrated steel plant in Hunan, China, boasting a 9 million tonnes crude steel capacity and producing a wide range of products including automotive and pipeline steel, shows a fluctuating activity level. The plant’s activity increased from 33% in March to 38% in June, followed by a decrease to 33% in August. No direct link between this fluctuation and the named news articles could be established.

Given the potential disruptions outlined in “US plans tariffs on steel and semiconductor chip imports” and the warning in “Tariff uncertainty threatens $490B in US manufacturing investment, report warns“, steel buyers should:

- Diversify Procurement: Given the observed activity decrease at SeAH Besteel Gunsan steel plant, consider diversifying suppliers to mitigate potential supply chain disruptions if tariffs specifically target Korean steel exports.

- Monitor Policy Changes Closely: Closely monitor tariff policy changes and seek clarification on specific product codes affected, especially concerning products potentially impacted by “Trump administration adds to Section 232 steel-derivatives list“. This will help in proactively adjusting procurement strategies.