From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Report: Strong Growth Driven by India-EU FTA

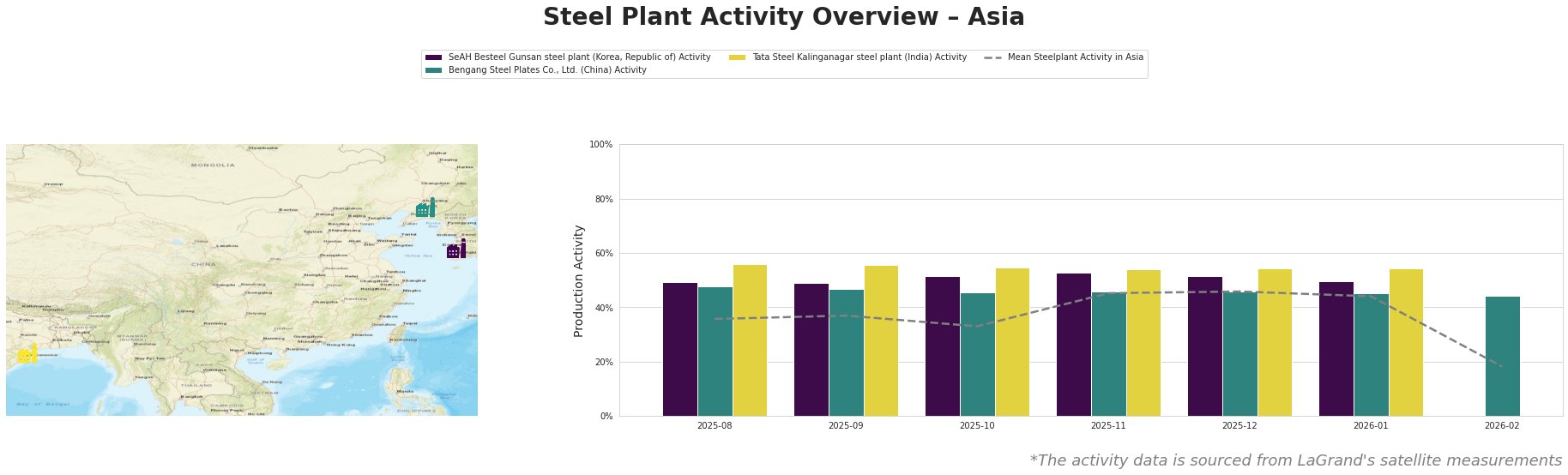

The Asian steel market shows a very positive outlook as significant changes unfold, particularly due to the “EU and India have agreed on a historic trade deal”. The newly finalized Free Trade Agreement (FTA) not only eases tariffs, allowing European automakers and steel exports increased access to India but also is expected to boost activity levels at steel plants. Observations reveal that the Tata Steel Kalinganagar plant maintained a robust 54% activity level, while SeAH Besteel Gunsan and Bengang Steel saw varied engagement but remained generally steady amidst this evolving landscape.

The Tata Steel Kalinganagar plant remains the highest performer, consistently operating at 54% activity across the observed period, indicating strong demand likely linked to India’s export capabilities bolstered by the FTA. The drop to 18% mean activity in February, albeit noted for general seasonal adjustments, is not directly related to any recent events from the FTA discussions.

The SeAH Besteel Gunsan plant, with its focus on electric arc furnace (EAF) technology, showed stability despite a slight decline in recent months, aligning with the overall positive sentiment in the automotive sector and rising demand for quality steel products as seen in the articles “India-EU Free Trade Deal Explained” and “Why European automakers will benefit from the EU-India Free Trade Agreement.”

Conversely, the Bengang Steel Plates Co., Ltd. plant is stable, maintaining activity around low to mid-40% levels, suggesting a reliable production flow that supports infrastructure projects amidst the import tariff reductions from the FTA.

Given the ongoing developments led by the India-EU trade agreement, procurement professionals should consider:

-

Focus on Tata Steel Kalinganagar: Given its consistent high performance, buyers should prioritize contracts with this plant to ensure supply stability.

-

Monitor SeAH Besteel Gunsan’s output, noting any fluctuations as it endeavors to meet automotive demands. Engaging in flexible contracts may provide better terms aligned with potential production decreases.

-

Leverage discounts at Bengang Steel while ensuring further understanding of the implications of fluctuating tariffs post-agreement.

These insights guide strategic purchasing decisions directly tied to current market conditions and plant performance, ensuring that stakeholders remain competitive as the steel landscape evolves rapidly.