From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Optimistic Despite Global Trade Tensions: Production Remains High Amidst Trade Shifts

Asia’s steel market shows resilience despite global trade uncertainties stemming from new EU-US agreements and rising trade protectionism, according to recent news and satellite-observed plant activity. The positive outlook is supported by sustained high activity at major steel plants in China and Vietnam. However, uncertainty remains for procurement due to the evolving international trade landscape. The “EU and US finalize trade deal, agree on protection from global steel production oversupply” and “Eurofer: EU-US trade framework leaves steel exposed” articles highlight potential disruptions in global trade flows, influencing Asian steel demand.

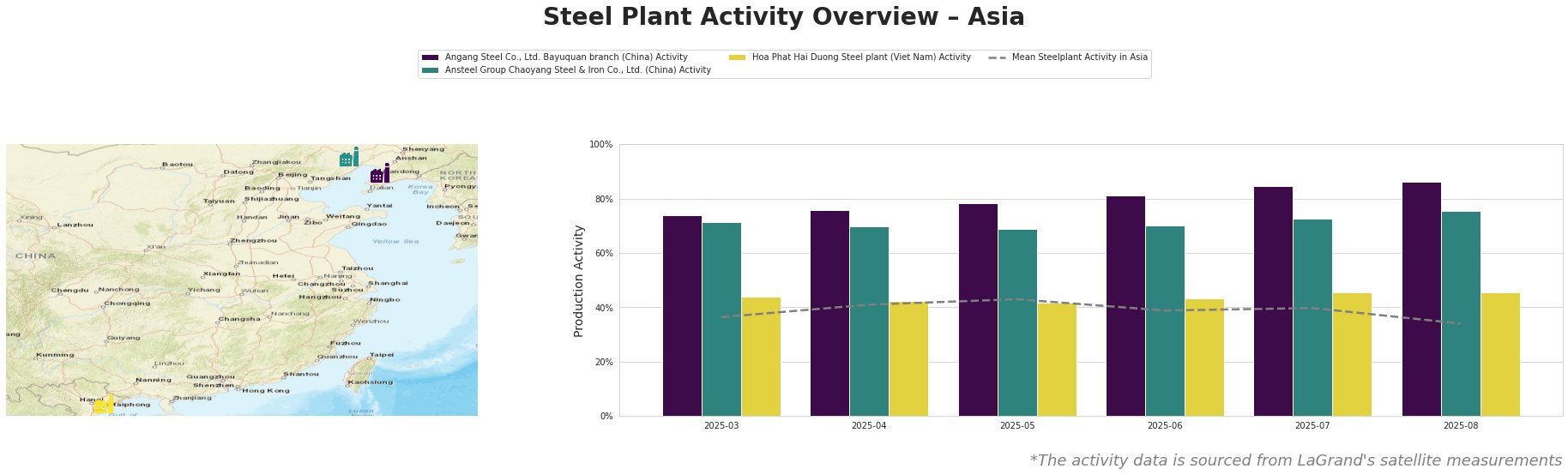

The mean steel plant activity in Asia saw a peak in May at 43% but experienced a drop to 34% in August.

Angang Steel Co., Ltd. Bayuquan branch, a major integrated steel plant in Liaoning, China, with a crude steel capacity of 6.5 million tonnes, has consistently operated at high activity levels. The plant’s activity increased steadily from 74% in March to 86% in August. This suggests robust domestic demand and efficient production, unaffected directly by news surrounding the EU-US trade deals, though indirectly it may benefit from trade diversion.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., also located in Liaoning, China, is another integrated steel plant, albeit with a smaller capacity of 2.1 million tonnes of crude steel. Its activity remained consistently high, ranging from 69% to 76% between March and August. While the activity levels are slightly lower than Angang Steel, the sustained high production suggests stable operations, also with no apparent direct impact from the EU-US trade developments described in articles like “EU details zero-tariff offer for US products“.

Hoa Phat Hai Duong Steel plant in Vietnam, with a capacity of 2.5 million tonnes of crude steel, showed stable activity, fluctuating between 42% and 46% from March to August. Compared to the Chinese plants, this facility operated at a significantly lower activity level, below the regional average. There is no direct evidence in the provided news to explain this level of activity.

While the Chinese steel plants have shown robust activity unaffected by the EU-US trade developments, the article “Canadian steelmakers push for tougher measures on imports” suggests that the global trade landscape is becoming increasingly complex. This could indirectly affect Asian steel producers, even though no direct impacts can be established based on the provided information. The article “Trade protection consultations increase the indecision of stainless steel buyers” highlights uncertainty among EU buyers but does not provide a direct connection to the Asian market activity.

Evaluated Market Implications

While Asian steel production remains robust based on activity at Angang and Ansteel, procurement professionals should note the potential for global supply chain disruptions due to evolving trade policies.

Recommended Procurement Actions:

- Monitor EU-US Trade Deal Impacts:Closely monitor the implementation of the EU-US trade deal and its impact on global steel trade flows. The article “EU and US finalize trade deal, agree on protection from global steel production oversupply” suggests potential shifts in demand and supply that could indirectly affect Asian steel producers.

- Secure Supply Contracts:Given the potential for increased trade protectionism, as noted in the article “Canadian steelmakers push for tougher measures on imports”, buyers should prioritize securing long-term supply contracts with reliable Asian steel producers like Angang Steel Co., Ltd. Bayuquan branch and Ansteel Group Chaoyang Steel & Iron Co., Ltd. to mitigate against future supply disruptions. Diversifying sources would also be prudent given the different activity levels between Chinese and Vietnamese plants.

- Assess CBAM Impact: Prepare for the implementation of the Carbon Border Adjustment Mechanism (CBAM) in 2026, mentioned in the article “Trade protection consultations increase the indecision of stainless steel buyers.” Assess the carbon footprint of your steel suppliers and explore options for sourcing lower-carbon steel to reduce future CBAM-related costs.