From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Optimistic Despite Chinese Emissions; Indian Exports Surge

Asia’s steel market displays overall positive sentiment with rising Indian exports despite emission concerns in China. India’s increased exports, highlighted in “India increased steel exports by 22% y/y in April-August,” contrast with the environmental challenges revealed in “Emissions in China’s steel industry rose by 20.8% y/y in July.” While the Indian export surge doesn’t directly correspond with specific plant activity data provided here, the Chinese emissions report doesn’t show an obvious correlation with the satellite data from Shandong or Gansu plants.

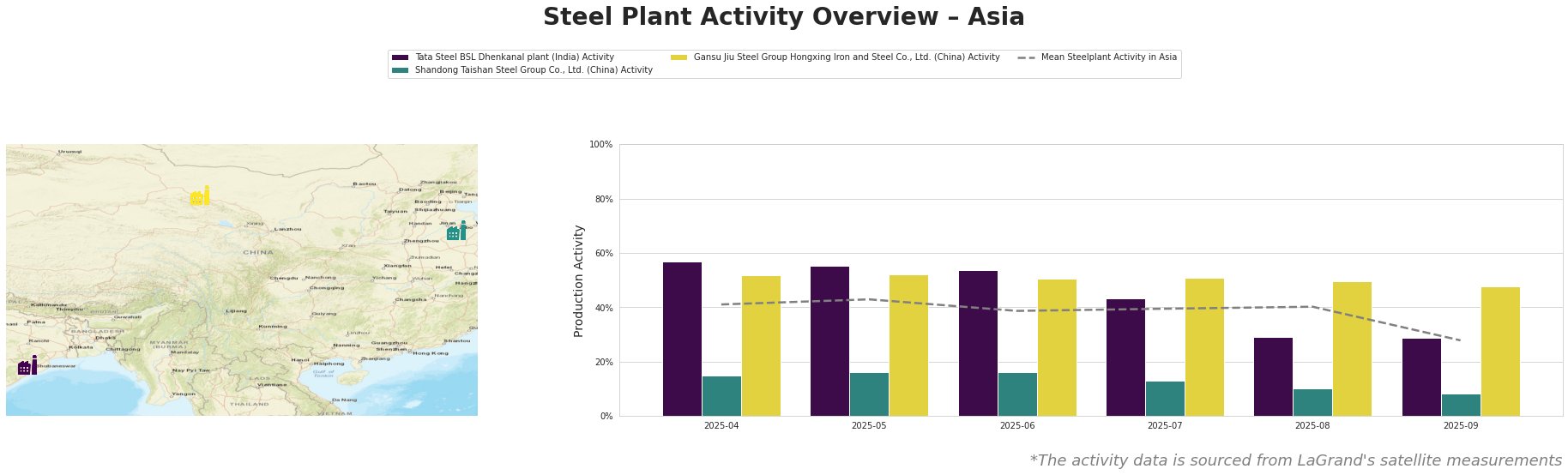

The mean steel plant activity in Asia shows a significant decline in September, dropping to 28.0% after remaining relatively stable around 40% in the preceding months. The activity at Tata Steel BSL Dhenkanal plant (India) declined sharply from 57.0% in April to 29.0% in September. Shandong Taishan Steel Group Co., Ltd. (China) has experienced a consistent decrease in activity from 15.0% in April to 8.0% in September. Gansu Jiu Steel Group Hongxing Iron and Steel Co., Ltd. (China) Activity has remained relatively stable, starting at 52.0% in April and declining to 48.0% in September. Notably, the Dhenkanal plant in India showed activity levels consistently above the Asian average until July, after which it declined rapidly.

Tata Steel BSL Dhenkanal plant, located in Odisha, India, operates with integrated BF and DRI processes, producing semi-finished and finished rolled products like hot rolled coil and pipe. Its activity level decreased from 57% in April to 29% in September. This significant drop could potentially be related to increased exports from India as mentioned in “India increased steel exports by 22% y/y in April-August,” potentially shifting focus away from domestic production in September. However, no direct connection can be definitively established with the available data.

Shandong Taishan Steel Group Co., Ltd. in Shandong, China, uses integrated BF processes. Its activity has steadily declined from 15% in April to 8% in September, consistently below the average. No direct correlation can be drawn between the activity decline at this plant and the reported emissions increase in the Chinese steel industry from “Emissions in China’s steel industry rose by 20.8% y/y in July,” as the decline predates the reporting period.

Gansu Jiu Steel Group Hongxing Iron and Steel Co., Ltd., based in Gansu, China, employs integrated BF processes. Activity has been relatively stable compared to the other plants, decreasing slowly from 52% in April to 48% in September, and staying consistently above the mean activity in Asia. There’s no clear connection between this plant’s activity and the emissions report “Emissions in China’s steel industry rose by 20.8% y/y in July“.

Given the observed decline in activity at the Tata Steel BSL Dhenkanal plant and the overall drop in mean Asian steel plant activity, steel buyers should consider the potential for short-term supply constraints, specifically for hot-rolled coil and pipe products. Procurement professionals should assess inventory levels and potentially diversify suppliers to mitigate risks associated with potential regional production slowdowns. While Indian exports are up, internal production fluctuations, especially at major plants, can impact domestic availability.