From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Faces Oversupply & Activity Slowdown Amidst European Turmoil

The Asian steel market is facing increased pressure due to oversupply, exacerbated by the downturn in the European market and US tariffs impacting global trade flows. The current situation is linked to “European stainless flats market downturn deepens“, “US tariffs hit EU stainless longs market“, and “US tariffs hit the stainless steel pipe market in the EU“. While these articles focus on the European market, they highlight the impact of redirected supply from Asia due to tariffs, potentially increasing steel availability and negatively impacting Asian prices and plant activity.

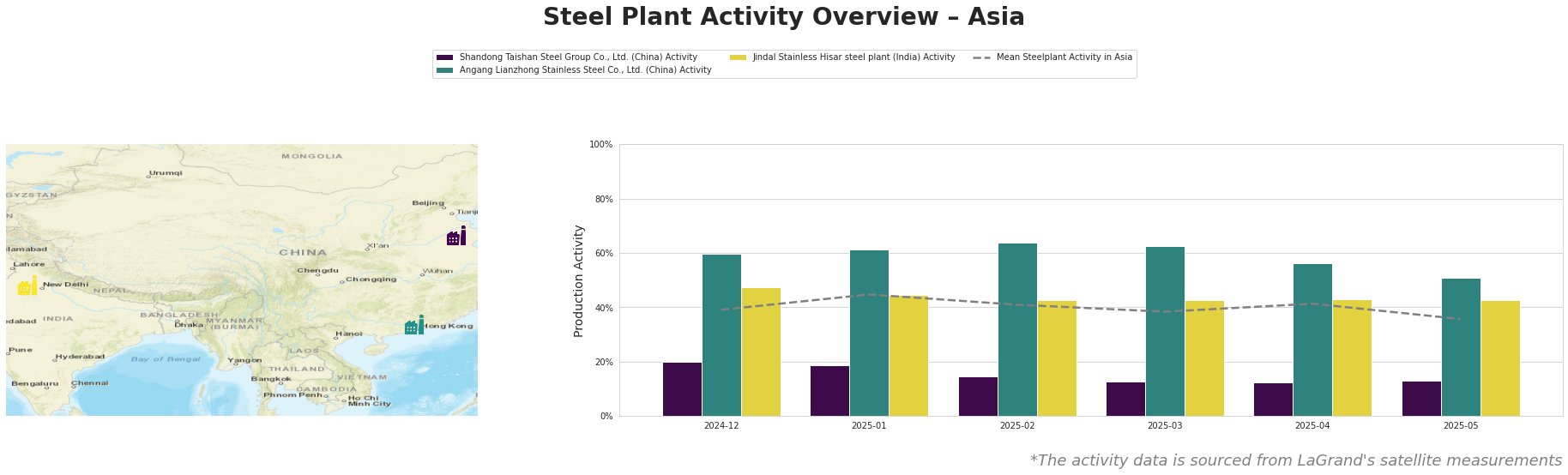

Overall steel plant activity in Asia has decreased over the past months, from 45% in January 2025 to 36% in May 2025. Shandong Taishan Steel Group Co., Ltd. shows a marked decrease in activity, reaching a low of 12% in April 2025. Angang Lianzhong Stainless Steel Co., Ltd. shows high activity values, but decreased from 64% in February 2025 to 51% in May 2025. Jindal Stainless Hisar steel plant has shown a consistently stable activity around the mid-forties percentile.

Shandong Taishan Steel Group Co., Ltd., an integrated BF-BOF steel plant with a crude steel capacity of 5000 ttpa, focuses on finished rolled products like hot and cold rolled coils, including stainless steel. Activity at Shandong Taishan Steel Group Co., Ltd. has steadily declined, dropping from 20% in December 2024 to 13% in May 2025, with a significant drop to 12% in April 2025. This activity decline may be related to the oversupply issues highlighted in the news articles, however, no direct connection can be explicitly established from the provided articles.

Angang Lianzhong Stainless Steel Co., Ltd., an EAF-based plant producing stainless steel flat billets, plates, and coils with a crude steel capacity of 3219 ttpa, has seen a decrease in activity, dropping from 64% in February 2025 to 51% in May 2025. Given their product focus on stainless steel flat products, the “European stainless flats market downturn deepens” may contribute to this activity drop due to increased competition and reduced export opportunities.

Jindal Stainless Hisar steel plant, an EAF-based stainless steel producer with a capacity of 800 ttpa, has shown relatively stable activity, hovering around 43-47%. The plant produces a wide array of stainless steel products, including hot and cold rolled coils. The plant’s steady activity suggests a more resilient position compared to the other two plants, but the exact reasons cannot be pinpointed based on the provided news articles.

Given the “European stainless flats market downturn deepens” and the impact of US tariffs described in “US tariffs hit EU stainless longs market” and “US tariffs hit the stainless steel pipe market in the EU”, steel buyers should expect continued price pressure. The increased availability of steel due to trade redirection may create opportunities for negotiation, but potential supply disruptions at plants like Shandong Taishan Steel Group Co., Ltd., require careful monitoring. Procurement professionals should diversify their supplier base and closely monitor the activity of key plants to mitigate potential risks.