From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Faces Headwinds: China Slowdown Offsets European Gains Amidst CBAM Uncertainty

Asia’s steel market faces a negative outlook driven by weakening demand in China, despite some price recovery efforts in Europe. The decline in China, as indicated by the news article “Global hot-rolled coil market seeks balance between growth in Europe and decline in China“, can not be directly linked to observed activity levels. European price increases, however, are creating market confusion due to CBAM, as described in “Blechexpo: European coil buyers question increases, Asian purchases continue“, which in turn results in shifts in procurement behavior.

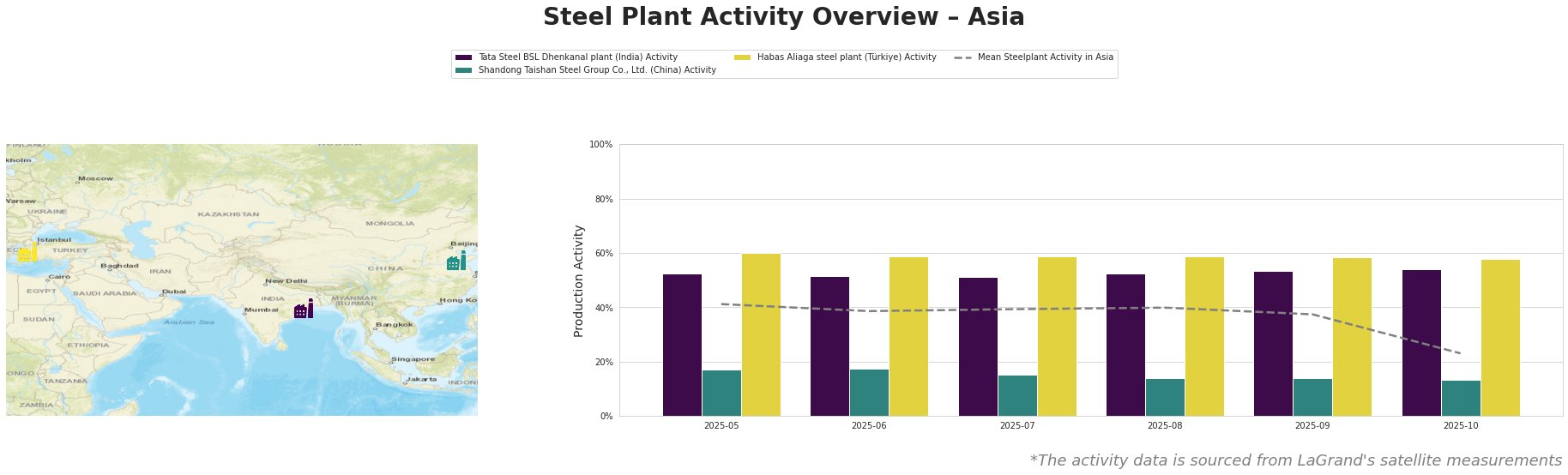

Overall, the mean steel plant activity in Asia has declined significantly, falling from 41% in May 2025 to 23% in October 2025, signalling a market-wide downturn.

Tata Steel BSL Dhenkanal plant (India): This integrated steel plant, utilizing both BF and DRI processes, has a crude steel capacity of 5.6 million tonnes per annum (MTPA) and produces hot-rolled coil, pipe, and sheet. The plant activity has remained relatively stable, hovering around 51-54% throughout the observed period. While the mean Asian steelplant activity decreased by 18% from May to October, this steelplant’s activity increased by 1%. There is no direct link to the provided news articles.

Shandong Taishan Steel Group Co., Ltd. (China): This integrated steel plant with a 5 MTPA crude steel capacity produces hot-rolled coil and cold-rolled coil. Plant activity has steadily decreased, from 17% in May 2025 to 13% in October 2025, significantly below the Asian average, but a direct connection to the news articles “Global hot-rolled coil market seeks balance between growth in Europe and decline in China” and “Blechexpo: European coil buyers question increases, Asian purchases continue” cannot be explicitly established from the provided information.

Habas Aliaga steel plant (Türkiye): This electric arc furnace (EAF)-based plant has a crude steel capacity of 4.5 MTPA, producing billet, slab, deformed bar, wire rod, and hot-rolled coil. Activity has remained stable around 58-60% throughout the observed period, higher than the mean activity across Asia, but a direct connection to the news article cannot be explicitly established from the provided information.

Evaluated Market Implications:

The decline in mean Asian steel plant activity levels alongside the news of weakening demand in China suggests potential oversupply issues, particularly for hot-rolled coil. The relative stability of Tata Steel BSL’s activity could indicate stronger domestic demand in India or a focus on exports. The situation in China is exacerbated by the reports of weak domestic demand and high inventories. The plant activity data does not indicate a direct link. The report “Blechexpo: European coil buyers question increases, Asian purchases continue” reports that Turkish buyers continue sourcing competitively priced coil from Asia.

Recommended Procurement Actions:

- Steel Buyers: Given the reported resistance to price increases in Europe and the continued availability of competitively priced Asian coil, explore near-term procurement opportunities from Asian suppliers, particularly in China. Carefully consider logistics costs and delivery timelines, especially given the potential for protectionist measures. Steel buyers should be aware of Asian suppliers shifting focus toward domestic markets in case of logistical difficulties.

- Market Analysts: Closely monitor Chinese steel inventory levels and domestic demand indicators. Any further weakening could exacerbate the oversupply situation and put downward pressure on prices globally. Also, monitor the specifics of the planned EU safeguard measures.