From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Faces Headwinds: Activity Declines Amidst European Demand Shift

The Asian steel market is facing headwinds as evidenced by declining average steel plant activity in September, exacerbated by weak global demand and shifting trade dynamics. “The global hot-rolled coil market showed mixed trends in August,” with European price increases driven by anticipated trade restrictions, but weak overall demand. This trend, coupled with the “Italian coil market starts slow after August break” where European buyers sourced material from Asia before the holiday period, suggests a potential slowdown in Asian steel exports to Europe in the coming months.

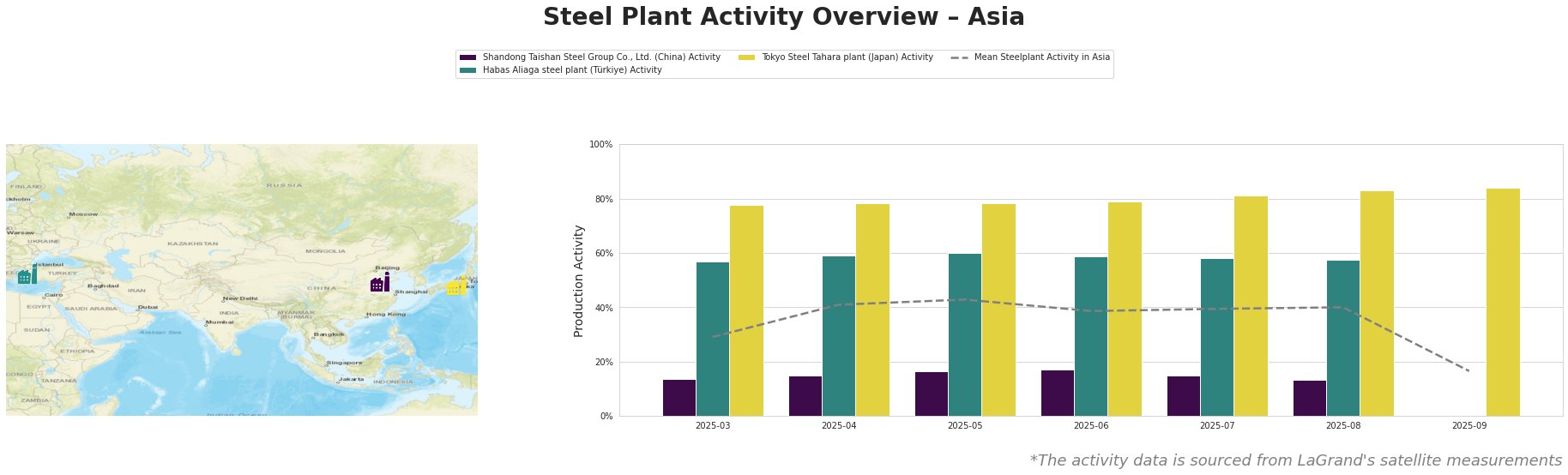

The mean steel plant activity in Asia experienced a significant drop to 17.0% in September, a considerable decrease from the 40.0% recorded in August. While Shandong Taishan Steel Group Co., Ltd. remained consistently below the Asian average with activity fluctuating between 13.0% and 17.0% before activity for September could not be assessed, Habas Aliaga steel plant in Türkiye showed relatively stable activity levels around 57.0% to 60.0% before September values were unavailable. Tokyo Steel Tahara plant in Japan consistently operated at high activity levels, increasing steadily from 78.0% in March to 84.0% in September.

Shandong Taishan Steel Group Co., Ltd., an integrated BF-BOF steel producer with a 5 million tonne crude steel capacity, has consistently operated below the Asian average. Satellite data show its activity declined to 13.0% in August, indicating ongoing production constraints potentially impacting its hot-rolled coil output, as specified within the plant details. Although further investigation is needed, it may be linked to the general trend cited in “The global hot-rolled coil market showed mixed trends in August” where China experienced minimal price declines despite high inventories and sluggish exports.

Habas Aliaga steel plant, an EAF-based Turkish producer with a 4.5 million tonne crude steel capacity, maintained relatively stable activity between 57.0% and 60.0% until August. While its activity cannot be assessed for September, the plant’s focus on hot-rolled coil production and the “Italian coil market starts slow after August break” article suggests that the plant might have benefited from European demand before the August break. However, the article also notes that Turkish quotas are now exhausted, potentially impacting future production and export volumes.

Tokyo Steel Tahara plant, a Japanese EAF producer with a 2.5 million tonne crude steel capacity specializing in hot rolled coils and sheets, shows a consistent upward trend in activity, reaching 84.0% in September. No direct link to the provided news articles can be established.

The significant drop in average Asian steel plant activity in September, combined with the dynamics described in “The global hot-rolled coil market showed mixed trends in August” and “Italian coil market starts slow after August break,” indicates potential disruptions in Asian HRC supply and a shift in European buying patterns.

Recommendations for steel buyers and market analysts:

- Monitor Turkish HRC supply: Given the exhaustion of Turkish quotas reported in “Italian coil market starts slow after August break,” steel buyers should anticipate potential price increases and reduced availability of HRC from Turkish suppliers. Consider diversifying sourcing options.

- Assess CBAM impact: European buyers should carefully evaluate the potential costs associated with the EU Carbon Border Adjustment Mechanism (CBAM), as referenced in “European steel HRC prices still trending below mill targets on low demand.” These costs may significantly impact the competitiveness of imported steel.

- Anticipate potential China supply shifts: Given that the Shandong Taishan Steel Group Co., Ltd. plant is operating at low activity levels, and the general Chinese steel market is experiencing sluggish exports, as noted in “The global hot-rolled coil market showed mixed trends in August”, European buyers should monitor for potential steel oversupply coming from China to address demand. This may affect pricing strategies.