From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Bullish Amid Kazakhstan HBI Expansion & Select Plant Activity Fluctuations

Asia’s steel market shows a very positive sentiment, driven by new HBI production capacity in Kazakhstan and fluctuating plant activity across the region. The expansion is underscored by news articles including “ERG to build $1.2 billion HBI plant in Kazakhstan with Primetals and Midrex,” “Eurasian Resources Group to become global supplier of HBI,” and “ERG to build HBI plant in Kazakhstan worth more than $1.2 billion.” These articles highlight significant investment in HBI production, but no immediate impact on the activity of the selected Asian steel plants could be established based on the available data.

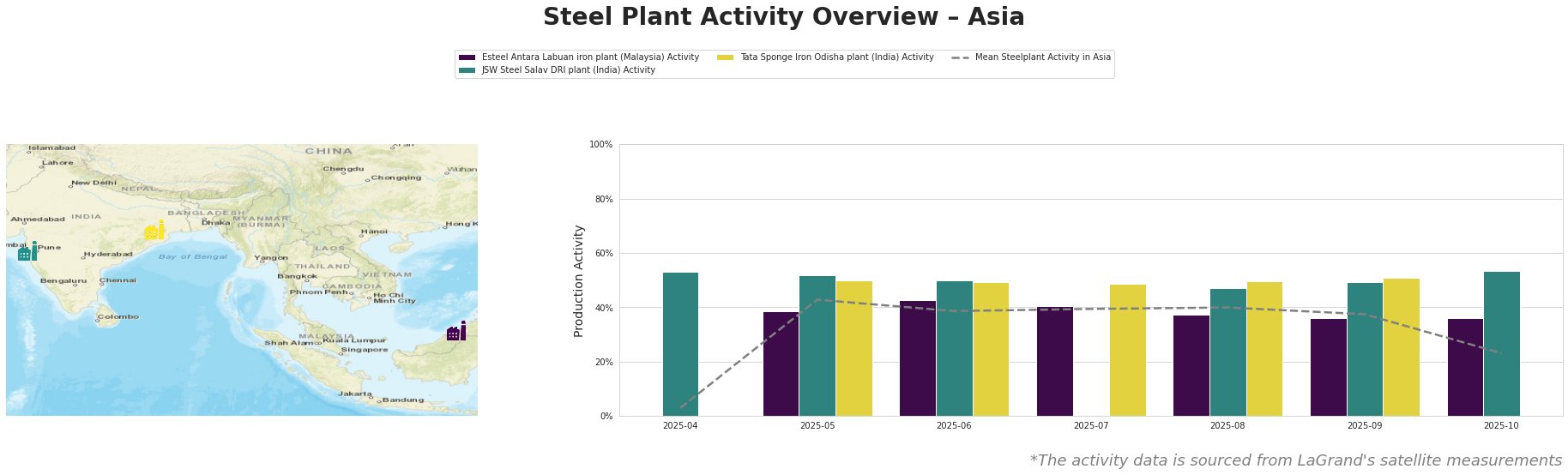

The mean steel plant activity in Asia shows a sharp decline in October 2025, dropping from 37% to 23%. The JSW Steel Salav DRI plant reported a peak activity of 53% in April 2025 and again in October 2025.

Esteel Antara Labuan iron plant, a DRI plant producing HBI in Malaysia, shows relatively stable activity between 36% and 43%. The most recent activity level for October 2025 is measured with 36%. There is no immediate connection that can be drawn between observed activity levels and the news about HBI plant expansion in Kazakhstan.

JSW Steel Salav DRI plant in Maharashtra, India, with a 1000 ttpa DRI capacity, exhibits the highest activity levels among the observed plants. Activity peaked at 53% in April and October 2025. This gas-based HYL-III DRI plant focuses on DRI and HBI production. No direct correlation could be established between the Kazakhstan HBI project announcements and the activity level of this plant.

Tata Sponge Iron Odisha plant, a 400 ttpa DRI plant in Odisha, India, shows relatively stable activity ranging from 49% to 51% between May and September 2025. No data is available for April and October. The plant operates two captive power plants and produces DRI. No direct correlation could be established between the Kazakhstan HBI project announcements and the activity level of this plant.

The Kazakhstan HBI plant developments reported in “ERG to build $1.2 billion HBI plant in Kazakhstan with Primetals and Midrex,” “Eurasian Resources Group to become global supplier of HBI,” and “ERG to build HBI plant in Kazakhstan worth more than $1.2 billion” signal a significant future increase in HBI supply, expected to come online by 2029.

Evaluated Market Implications:

The planned HBI plant in Kazakhstan, with a 2 million tons annual capacity, represents a substantial increase in global HBI supply. While the plant is not expected to be operational until 2029, procurement professionals should monitor the project’s progress, potential impact on HBI pricing, and opportunities for long-term supply contracts.

Given the stable activity at Esteel Antara Labuan and fluctuations in JSW Steel Salav and Tata Sponge Iron Odisha plant production, steel buyers focused on DRI and HBI from these specific plants should closely monitor these facilities for any potential disruptions.

Recommended procurement action: initiate early engagement with ERG to explore potential HBI supply agreements, secure favorable pricing, and diversify sourcing strategies for the long term, in anticipation of the new Kazakhstan plant coming online.