From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Braces for Further Weakness Amidst Declining Activity and Uncertain Demand

Asia’s steel market faces headwinds due to weak demand and declining plant activity. “Global hot-rolled coil market seeks balance between growth in Europe and decline in China” directly highlights the contrasting trends, with China experiencing price declines due to weak domestic demand and high inventories. Satellite data indicates a significant drop in average Asian steel plant activity, potentially amplifying the negative impacts described in the news article.

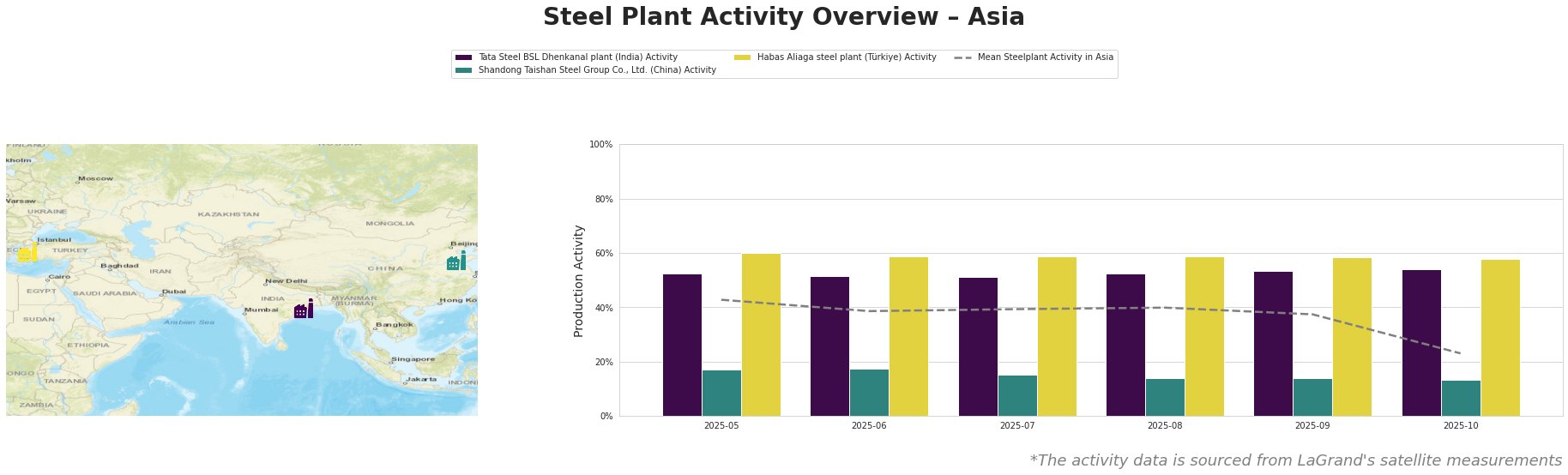

Observed Asian Steel Plant Activity Levels (in %)

The mean steel plant activity across Asia experienced a significant drop in October, falling from 37% to 23%. Tata Steel BSL Dhenkanal plant in India showed a stable activity trend slightly above the mean, ranging from 51% to 54%, but this stability contrasts sharply with the overall regional decline. Shandong Taishan Steel Group Co., Ltd. in China shows a consistent decline, falling from 17% to 13% during the period. This activity trend aligns with the weak Chinese domestic demand noted in “Global hot-rolled coil market seeks balance between growth in Europe and decline in China”. The Habas Aliaga steel plant in Türkiye maintained a relatively stable activity level around 58-60%, significantly above the Asian mean, but there is no direct correlation to the provided news articles that would explain this stability.

Tata Steel BSL Dhenkanal plant, an integrated steel plant in Odisha, India, utilizing both BF and DRI processes with a crude steel capacity of 5.6 million tonnes, has maintained a relatively stable activity level between 51% and 54%. Given its focus on hot-rolled coil and other finished products, this stable production might indicate a focus on exports or a resilience to domestic demand fluctuations in India, although no direct link to the provided news articles can be established.

Shandong Taishan Steel Group Co., Ltd., a Chinese integrated steel plant with a 5 million tonne crude steel capacity producing hot-rolled and cold-rolled coil, has seen a decrease in activity from 17% in May to 13% in October. This decline aligns with the challenges described in “Global hot-rolled coil market seeks balance between growth in Europe and decline in China,” where weak Chinese demand and high inventories are impacting the HRC market.

Habas Aliaga steel plant in Türkiye, an electric arc furnace (EAF) based plant with a 4.5 million tonne crude steel capacity producing billets, wire rod, and hot-rolled coil, has maintained a consistently high activity level around 58-60%. The steadiness of this plant, despite the overall Asian downturn, cannot be directly explained by the provided news articles, as they primarily focus on European and Chinese markets.

The sharp decline in overall Asian steel plant activity, coupled with the specific downturn at Shandong Taishan Steel Group Co., Ltd. and the weak demand conditions in China reported in “Global hot-rolled coil market seeks balance between growth in Europe and decline in China”, suggests a further weakening of the Asian steel market.

Procurement Actionable Insights:

- For steel buyers focused on Chinese HRC: Expect continued downward price pressure. Given the declining activity at plants like Shandong Taishan, be prepared for potential production cuts or supply disruptions. Diversify sourcing if possible.

- For steel buyers with exposure to the broader Asian market: Closely monitor plant activity in key regions. While Tata Steel BSL in India shows relative stability, the overall trend is negative. Negotiate contracts with built-in flexibility to adjust to potential supply chain disruptions.