From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Downturn: China Production Cuts Signal Continued Pressure on Prices

Asia’s steel market faces increased headwinds as Chinese production cuts intensify downward price pressure. S&P Global’s report, “Asian steel market to remain under pressure in Q4 – S&P Global,” anticipates continued market pressure due to weak demand and high production. This aligns with the news that “China cut steel production to a four-year low in October“, which indicates a tangible supply response to reduced domestic consumption. While Klöckner & Co’s increased shipments are noteworthy, as reported in “Klöckner’s Q3 shipments increase, high-margin focus continues,” this report focuses on their global operation, and a direct relationship to the Asian market downturn and Chinese production cuts cannot be established.

China’s steel production declined sharply in October, as noted in “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%.” This drop is attributed to weakening consumption, especially in the real estate sector. The articles forecast a potential drop below 1 billion tons of steel production by 2025, marking a significant shift.

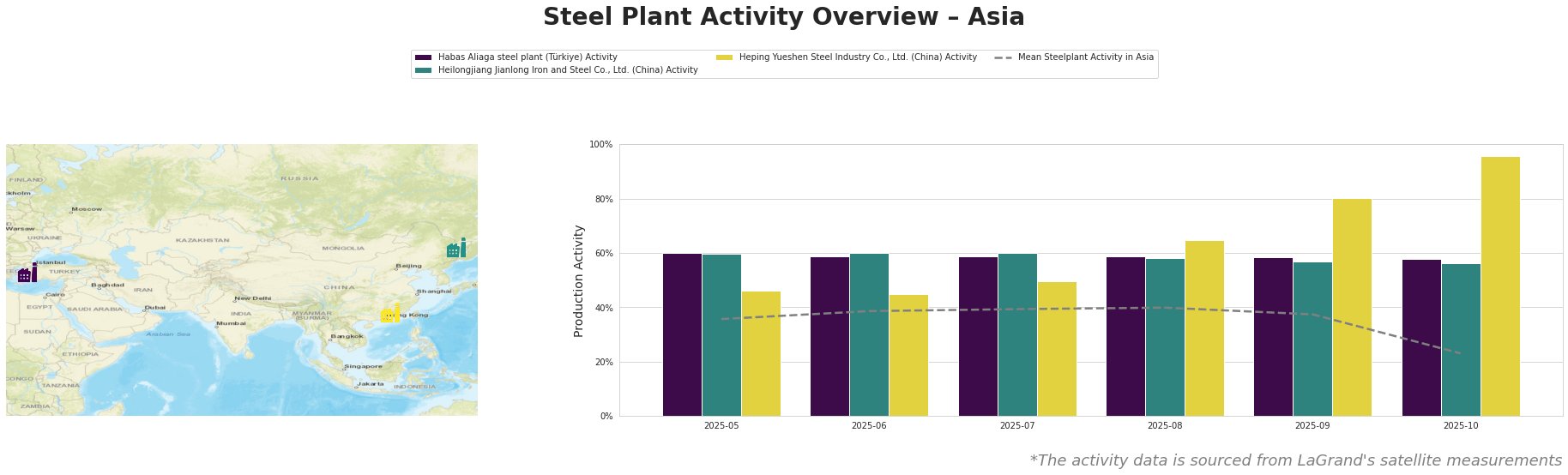

The mean steel plant activity in Asia shows a marked decline in October, dropping to 23% from a high of 40% in August.

Habas Aliaga steel plant (Türkiye): This EAF-based plant, producing semi-finished and finished rolled products, has maintained a relatively stable activity level around 60% throughout the observed period, showing only a slight decrease to 58% in the most recent month. Given its location outside of China, the observed stability does not directly correlate with the news articles detailing production cuts driven by weakened domestic demand in China.

Heilongjiang Jianlong Iron and Steel Co., Ltd. (China): This integrated BF-BOF steel plant in Heilongjiang experienced a gradual decline in activity from 60% in May to 56% in October. This reduction aligns with the “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%” articles, indicating a direct impact of the production cuts on this specific plant, although the magnitude of the observed activity reduction is not equivalent to the national average production decrease of 12%.

Heping Yueshen Steel Industry Co., Ltd. (China): This EAF-based plant in Guangdong saw a substantial increase in activity, rising from 46% in May to 96% in October, counter to the general trend of production cuts in China. No direct connection to any of the provided news articles can be established. It’s possible this plant is increasing production for export, benefiting from reduced domestic competition, or serving a niche market unaffected by the broader downturn.

The decline in the mean steel plant activity in Asia correlates with reports of production cuts, primarily in China, directly impacting plants like Heilongjiang Jianlong. The divergent activity of Heping Yueshen warrants further investigation.

Given the “Asian steel market to remain under pressure in Q4 – S&P Global” article and the observed production cuts at Heilongjiang Jianlong, steel buyers should anticipate continued downward pressure on steel prices, particularly for products originating from regions affected by the cuts. Buyers reliant on Chinese steel should:

- Actively negotiate prices: Leverage the reported oversupply and production cuts to secure more favorable terms, especially from suppliers in regions experiencing production slowdowns.

- Monitor Heping Yueshen’s export activity: The increase in activity warrants close monitoring, as it could either signal a change in the general trend, or an export opportunity, depending on the products offered.

- Consider diversifying supply chains: Mitigate risk by exploring alternative suppliers outside of China, particularly for products where domestic Chinese production is being curtailed.