From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel: Output Declines Amidst Fluctuating Iron Ore and Plant Activity

Asia’s steel market faces headwinds as evidenced by recent production declines. “China reduced iron ore production by 10.1% y/y in January-May“ and “Japanese crude steel output down 4.7 percent in May” indicate a regional slowdown, although a clear link to specific satellite-observed plant activity changes cannot be definitively established based on the provided data.

Global steel production also reflects this trend as “Global steel production fell by 3.8% y/y in May“.

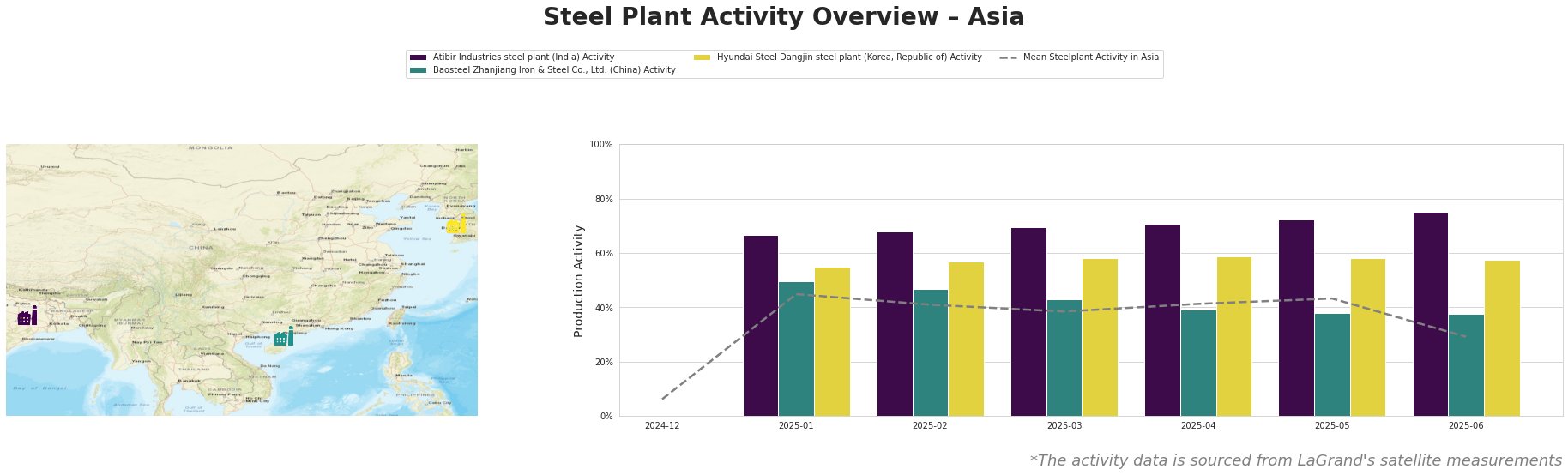

The mean steel plant activity in Asia shows a general decline from January (45%) to June (29%). Atibir Industries in India consistently operated above the Asian mean, increasing steadily to 75% activity in June. Baosteel Zhanjiang in China showed below-average activity, dropping to 38% in May and holding steady in June. Hyundai Steel in South Korea maintained above-average activity until June, when it also saw a minor dip. The article “China reduced iron ore production by 10.1% y/y in January-May” may correlate with Baosteel Zhanjiang’s low observed activity, but a direct connection cannot be confirmed.

Atibir Industries, an integrated BF-BOF steel plant in India with 600ktpa crude steel capacity, has demonstrated consistently high activity levels, reaching 75% in June. This suggests stable production, although no direct links can be made to any news article.

Baosteel Zhanjiang, a large integrated BF-BOF steel plant in China with 12,528ktpa crude steel capacity, has shown consistently below-average activity levels. The drop in activity to 38% in May and June could be related to the reported decrease in China’s iron ore and steel production (“China reduced iron ore production by 10.1% y/y in January-May”), but a causal relationship cannot be explicitly confirmed. The plant also has a Hydrogen based shaft furnace (1 million tonne)

Hyundai Steel Dangjin, a major South Korean steel producer with integrated BF-BOF and EAF production routes and a crude steel capacity of 16,600ktpa, operated at above-average levels until a slight decrease in June. No direct connection to the provided news articles can be established.

The observed drop in mean Asian steel plant activity coupled with decreased Chinese iron ore production and overall declines in Japanese and global steel production suggest a potential tightening of supply in the coming months, especially for products typically sourced from China and Japan.

Recommendations for Steel Buyers and Analysts:

- Monitor Indian Steel Prices: Given Atibir Industries’ consistently high activity and the overall decline in regional production, Indian steel prices may become relatively more competitive. Steel buyers should actively monitor and compare prices from Indian suppliers against traditional sources.

- Diversify Procurement: The potential supply constraints in China, as suggested by both the news and Baosteel Zhanjiang’s activity, justify diversifying procurement strategies to include alternative suppliers outside of China to mitigate risks associated with potential supply disruptions.

- Track Inventory Levels: Closely monitor inventory levels of steel products, particularly those sourced from China and Japan, and consider increasing safety stocks to buffer against potential short-term supply shortages.