From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel: Muroran Works Boosts Output Amid EU-US Trade Deal Uncertainty

Asia’s steel market shows mixed signals, with plant-level activity fluctuating against a backdrop of potential global trade shifts. The impact of the EU-US trade agreement, detailed in articles like “US and EU strike trade deal, imports from EU subjected to 15 percent tariff” and “Zolldeal mit den USA Planungssicherheit – aber zu einem hohen Preis“, on Asian steel demand remains unclear, with no direct observed relationship between the news and steel plant activities in July and August.

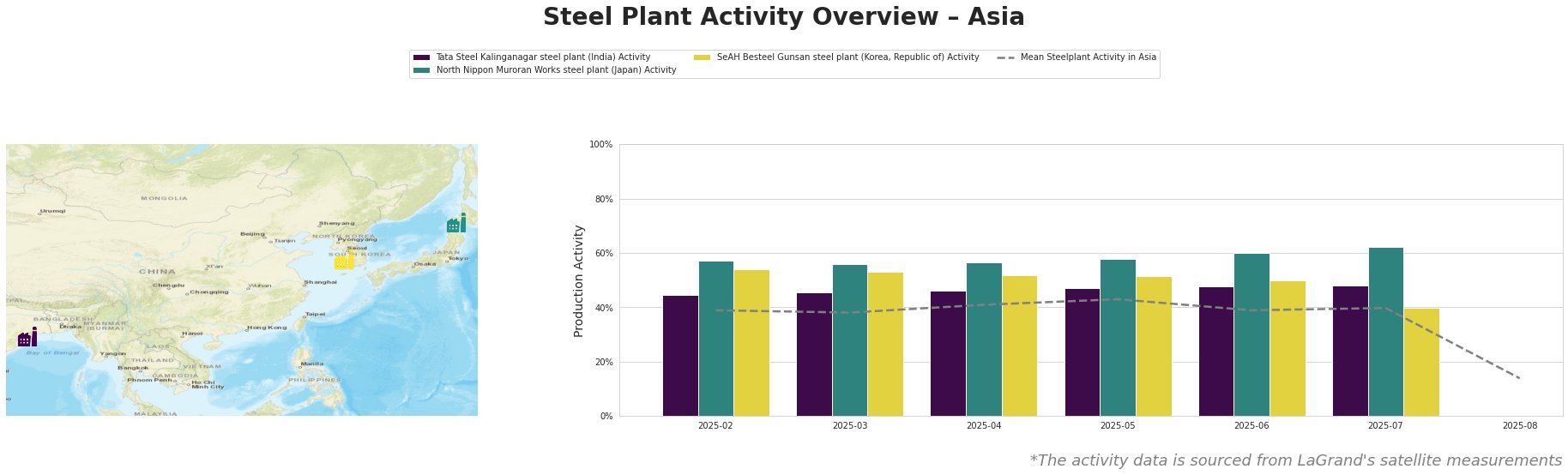

The mean steel plant activity in Asia remained relatively stable between February and July 2025, fluctuating between 38% and 43%, before experiencing a significant drop to 14% in August. Tata Steel Kalinganagar showed a gradual increase from 45% in February to 48% in June and July. North Nippon Muroran Works maintained a consistently high activity level, increasing from 57% in February to 62% in July. SeAH Besteel Gunsan experienced a notable activity drop in July, decreasing from 54% in February to 40%.

Tata Steel Kalinganagar, an integrated BF-BOF steel plant in Odisha, India, with a crude steel capacity of 3000 ttpa, primarily produces finished rolled products for the automotive sector. The plant’s activity gradually increased to 48% in June and July, slightly above the Asian average, but decreased drastically in August, and no immediate connection to the EU-US trade news can be established.

North Nippon Muroran Works, located in Hokkaidō, Japan, has a crude steel capacity of 2598 ttpa and employs both BF-BOF and EAF technologies, producing semi-finished and finished rolled products like bars and wires for the automotive industry. The plant demonstrated a consistently high activity level, reaching 62% in July, significantly exceeding the Asian average. This increased activity cannot be directly linked to the EU-US trade news, suggesting potentially stronger regional demand or other factors influencing its production.

SeAH Besteel Gunsan, an EAF-based steel plant in South Korea, has a crude steel capacity of 2100 ttpa and focuses on special steel, heavy forged steel, and auto parts for various sectors, including automotive and infrastructure. Its activity dropped significantly in July to 40%, below the Asian average, and decreased further in August. No direct link to the EU-US trade news can be established.

The substantial activity drop in August across the observed Asian steel plants and, specifically, at SeAH Besteel Gunsan necessitates caution. Steel buyers should proactively:

- Diversify sourcing: Given the fluctuations, avoid over-reliance on single suppliers or regions, especially in light of the 15% EU import tariffs, as reported in “US and EU strike trade deal, imports from EU subjected to 15 percent tariff”. This may indirectly impact demand in Asia.

- Monitor Muroran Works closely: As North Nippon Muroran Works shows consistently high activity, attempt to secure supply agreements from this plant to ensure stable access to steel, particularly for automotive-grade products.

- Assess the impact of tariffs: The “Zolldeal mit den USA Planungssicherheit – aber zu einem hohen Preis” article highlights the 15% tariffs on EU goods entering the US. Buyers should analyze if this will divert EU steel exports to Asia, increasing competition and potentially lowering prices.