From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: VW Tariff Impact & Indian Plant Activity Analysis

Asia’s steel market is facing potential disruptions as automotive demand may be impacted by US tariffs affecting Volkswagen, while Indian steel plant activity shows recent declines. “Volkswagen stung by tariffs, but trade deal based on US investments may be coming“, “Audi cuts forecast over US tariffs and restructuring costs“, “Gewinn von VW bricht um ein Drittel ein – Zölle kosten Autohersteller 1,3 Milliarden Euro” highlight tariff pressure on VW, a key end-user. Satellite data shows decreasing activity in major Indian steel plants, potentially indicating supply-side responses or demand shifts. No direct relationship can be established between the VW news and activity levels.

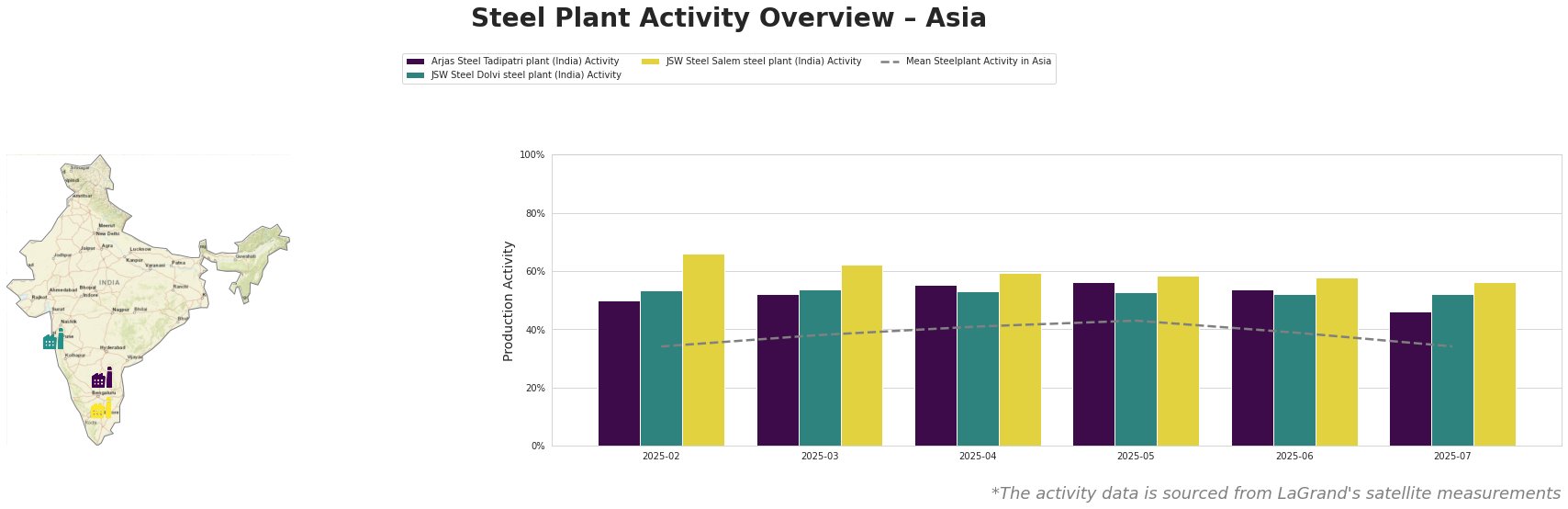

Mean steel plant activity in Asia peaked in May 2025 at 43% and then decreased to 34% in July 2025. Arjas Steel Tadipatri plant shows a similar trend, peaking in May at 56% and dropping to 46% in July. JSW Steel Dolvi plant remained relatively stable, fluctuating between 52% and 54%. JSW Steel Salem plant saw a consistent decrease from 66% in February to 56% in July, consistently outperforming the mean activity across all plants.

Arjas Steel Tadipatri plant, located in Andhra Pradesh, India, has a crude steel capacity of 325 ttpa using BOF technology, and an iron capacity of 324 ttpa with BF technology. The plant produces finished rolled and semi-finished products like bars and profiles. Activity decreased from 56% in May 2025 to 46% in July 2025. No direct connection to the VW news articles can be established.

JSW Steel Dolvi plant, located in Maharashtra, India, has a crude steel capacity of 5000 ttpa using EAF technology and an iron capacity of 5200 ttpa, utilizing both BF (3600 ttpa) and DRI (1600 ttpa) methods. Its product range includes wire rod, cold rolled, and galvanized steel. The plant’s activity has remained relatively stable around 53% since February 2025, with a slight decrease to 52% in June and July. No direct connection to the VW news articles can be established.

JSW Steel Salem plant, based in Tamil Nadu, India, possesses a crude steel capacity of 1030 ttpa and an iron capacity of 945 ttpa, relying on BF technology. It produces hot rolled bars and wire coils. This plant showed a steady decline in activity from 66% in February 2025 to 56% in July 2025, significantly exceeding the average Asian plant activity level. No direct connection to the VW news articles can be established.

The reported profit declines for Volkswagen, as highlighted in “Volkswagen stung by tariffs, but trade deal based on US investments may be coming”, “Audi cuts forecast over US tariffs and restructuring costs”, “Gewinn von VW bricht um ein Drittel ein – Zölle kosten Autohersteller 1,3 Milliarden Euro” could potentially decrease demand for steel used in automotive manufacturing. The observed decline in steel plant activity in India, particularly at Arjas Steel Tadipatri, may be an early indication of this demand shift.

Procurement Actions: Steel buyers who are dependent on automotive steel should closely monitor price trends, especially for products supplied by Arjas Steel Tadipatri. Consider diversifying suppliers and securing short-term contracts to mitigate potential supply disruptions. Steel analysts should monitor trade negotiations between the US and the EU, as a resolution in favor of Volkswagen could stabilize demand. Given that no explicit links between the VW news and the activity of the JSW plants can be established, no immediate actions are advised, but continued observation is recommended.