From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Vizag Strength Offsets Chinese Dips Amidst US Steel Deal Uncertainty

Asia’s steel market presents a mixed outlook. Steel plant activity in China is decreasing, whereas activity in India is rising. Investment uncertainty around the US Steel acquisition by Nippon Steel does not directly affect activity in the Asian steel market. While no explicit links to Asian plants can be drawn, uncertainty around the deal may impact global steel prices and trade flows in the longer term. There is no news that directly correlates to the presented plant activity levels.

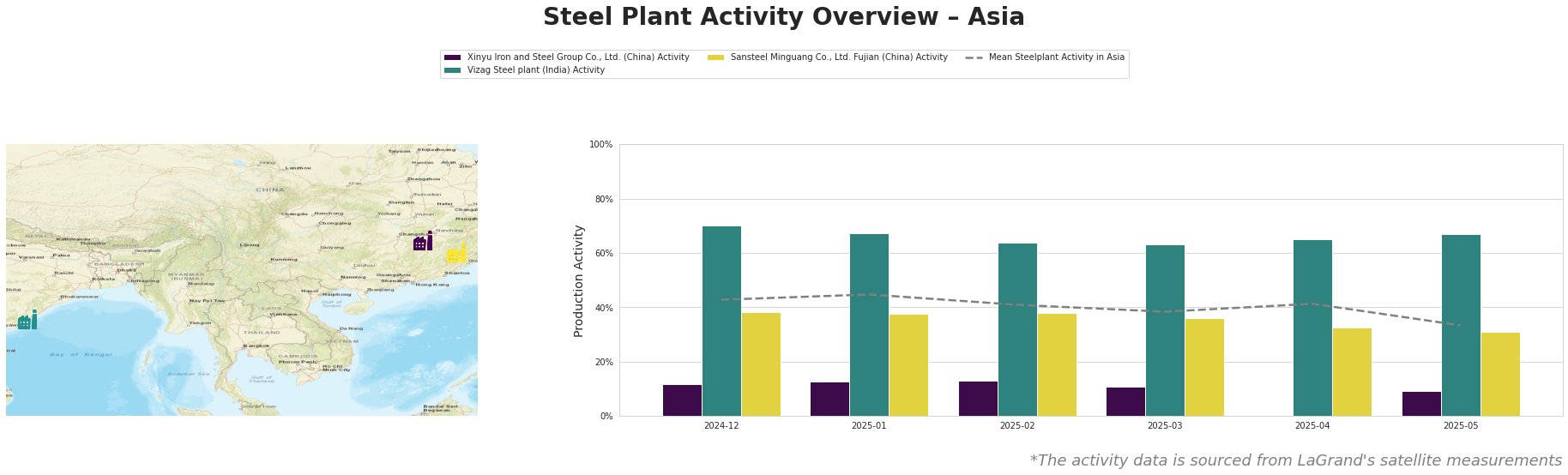

Recent steel plant activity data show divergent trends across Asia. The following table details activity levels in the observed plants over the last six months:

The mean steel plant activity in Asia has shown a declining trend since January 2025, dropping significantly to 33.0% by May 2025. This decline is driven by decreasing activity in the Chinese plants, while the Vizag Steel plant in India demonstrates consistently high activity levels.

Xinyu Iron and Steel Group Co., Ltd.: This integrated steel plant in Jiangxi, China, relies on blast furnace (BF) and basic oxygen furnace (BOF) processes for its 10 million tonne crude steel capacity, producing medium, cold, and hot rolled thin plates, thick and extra thick plates used in the energy, building, infrastructure, and transport sectors. Its activity has consistently remained far below the Asian average, falling from 12% in December 2024 to 9% in May 2025. This decline has no apparent correlation to the news articles.

Vizag Steel Plant: Located in Andhra Pradesh, India, this integrated BF/BOF steel plant has a crude steel capacity of 7.3 million tonnes, producing rebar, rounds, wire rod, billets, bar, and specialty steel for building and infrastructure. Vizag’s activity is well above the Asian average. Although there has been some variation, activity remained between 63% and 70% during the reported time. This stable, high activity level stands in contrast to the overall Asian trend. There is no apparent correlation to the news articles.

Sansteel Minguang Co., Ltd.: This integrated BF/BOF steel plant in Fujian, China, has a crude steel capacity of 6.8 million tonnes, producing steel plates, round bars, and construction steel for building, infrastructure, transport, tools, and machinery. The plant has shown declining activity, from 38% between December 2024 and February 2025 to 31% in May 2025. This decline has no apparent correlation to the news articles.

Evaluated Market Implications

The provided news articles focus on Nippon Steel’s attempted acquisition of US Steel and contain no direct impact or correlation on the Asian steel market, however, the USW calls on Trump to reject the USS, Nippon deal potentially. This can affect the world market if the deal isn’t approved. The satellite data indicates a divergence in activity, with Indian steel production at Vizag remaining strong, while Chinese plants Xinyu and Sansteel Minguang are experiencing declining activity levels.

Recommended Procurement Actions:

* Chinese Steel Buyers: The observed activity declines at Xinyu and Sansteel Minguang suggest potential supply constraints within China. Procurement professionals reliant on these plants should proactively engage with alternative suppliers within China or consider diversifying to Indian sources, given Vizag’s stable, high production.

* Market Analysts: The diverging trends between India and China warrant closer scrutiny. Analysts should investigate the underlying reasons for these trends. Further investigation into the domestic Chinese steel market dynamics is warranted.