From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Vietnam Production Strong Amid EU Trade Concerns

Asia’s steel market shows resilience, particularly in Vietnam, even as EU trade protectionism looms. Activity at Vietnamese plants remains robust, contrasting with a recent downturn across Asia and against the backdrop of potential trade disruptions highlighted in “EU Commission introduces anti-dumping measures against two steel derivatives,” “Excess production capacity and protectionism affect European metallurgy,” “Overcapacity, protectionism impact European steel,” “European Commission Unveils Major New Trade Measure to Shield EU Steelmakers Amid Global Overcapacity and Accelerate Green Transition,” “EU underestimates new safeguard measure price impact,” and “The market reflects on the EU’s tough trade protection proposal,” although a direct link between these measures and Asian plant activity isn’t yet clearly visible in the provided satellite data.

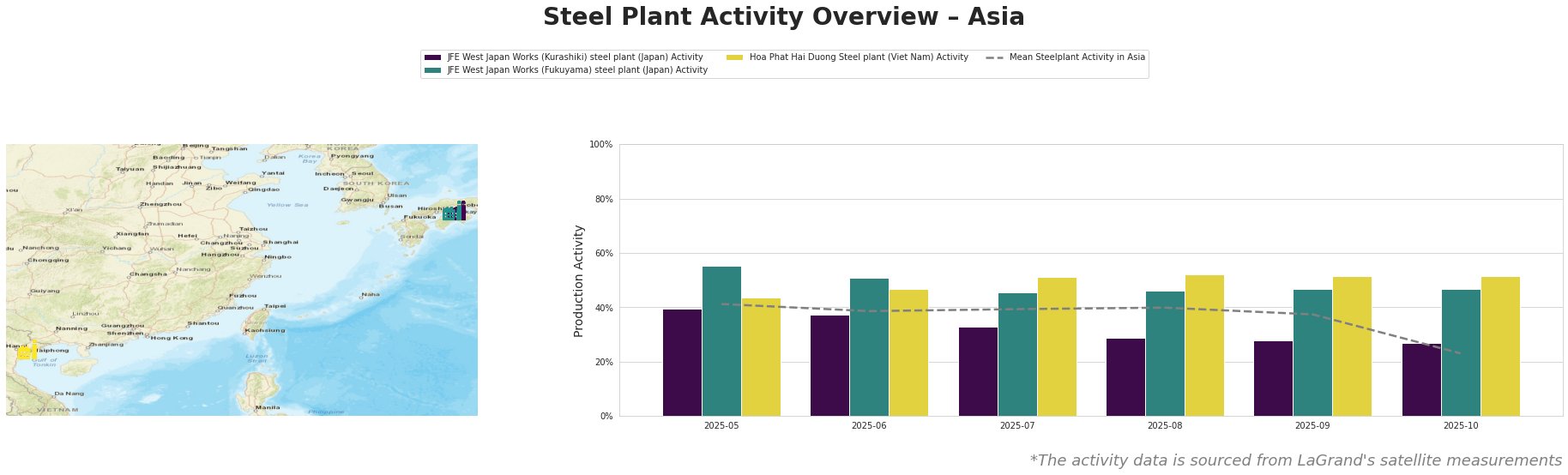

The mean steel plant activity in Asia experienced a notable drop in October 2025, falling to 23.0%, significantly lower than the levels observed in the preceding months. In contrast, the Hoa Phat Hai Duong Steel plant in Vietnam maintained a relatively stable activity level around 51-52% throughout the observed period. The JFE West Japan Works (Kurashiki) steel plant in Japan shows a declining trend, reaching its lowest activity level of 27.0% in October. The JFE West Japan Works (Fukuyama) steel plant in Japan shows relatively stable activity, fluctuating between 46% and 55%, ending at 47% in October, a moderate decline from its peak in May.

The JFE West Japan Works (Kurashiki) steel plant, an integrated BF steel plant in the Chūgoku region of Japan with a crude steel capacity of 10,000 tonnes, primarily produces semi-finished and finished rolled products for sectors including automotive and construction. Its activity has consistently decreased from 39% in May to 27% in October, a drop of 12 percentage points, the lowest among the three observed plants. The drop cannot be directly linked to the EU protectionist news articles.

The JFE West Japan Works (Fukuyama) steel plant, also in Japan’s Chūgoku region, is another integrated BF steel plant, boasting a larger crude steel capacity of 13,000 tonnes. Similar to Kurashiki, its product portfolio targets automotive and construction industries. Although activity decreased from 55% in May to 47% in October, this level is still above the Asian mean. Again, the connection to the mentioned EU news articles remains unclear from the available data.

Hoa Phat Hai Duong Steel plant in Vietnam, an integrated BF steel plant with a crude steel capacity of 2,500 tonnes, focuses on finished rolled products like construction steel and hot rolled coil. Unlike the Japanese plants, its activity remained robust at 51% in October, demonstrating resilience, while the other two facilities and the mean activity across Asia went down. This stability occurs as articles like “Excess production capacity and protectionism affect European metallurgy” note increased steel exports from Vietnam.

Given the observed activity divergence and the potential for increased EU protectionism as described in “EU Commission introduces anti-dumping measures against two steel derivatives” and the projected price increases discussed in “EU underestimates new safeguard measure price impact,” steel buyers should:

- Prioritize securing supply from Vietnamese sources: The Hoa Phat Hai Duong plant’s stable activity suggests a reliable supply of construction steel and hot rolled coil and could be considered as alternative to EU steel.

- Closely monitor EU trade policy developments: Prepare for potential price increases stemming from reduced import quotas, specifically regarding Vietnamese steel entering Europe that could be redirected to other markets, increasing competition.

- Evaluate the impact of potential trade diversion on regional pricing: As EU safeguard measures potentially redirect steel flows, investigate the implications for steel pricing within Asia itself, particularly if demand increases from countries previously reliant on EU imports.