From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Trade Actions and Plant Activity Signal Procurement Adjustments

Asia’s steel market faces a mixed outlook, influenced by U.S. trade policies and fluctuating plant activity. Recent U.S. decisions to maintain antidumping duties on steel imports from several countries, as highlighted in “US issues final results of AD review on welded pressure pipe from Vietnam“, “US to Continue Anti-Dumping duty on welded stainless steel from Three Countries“, and “US maintains AD/CVD orders on WSPP from China“, have the potential to indirectly impact regional supply dynamics. However, a direct relationship between these trade measures and observed steel plant activity levels in Asia cannot be explicitly established based solely on the provided information.

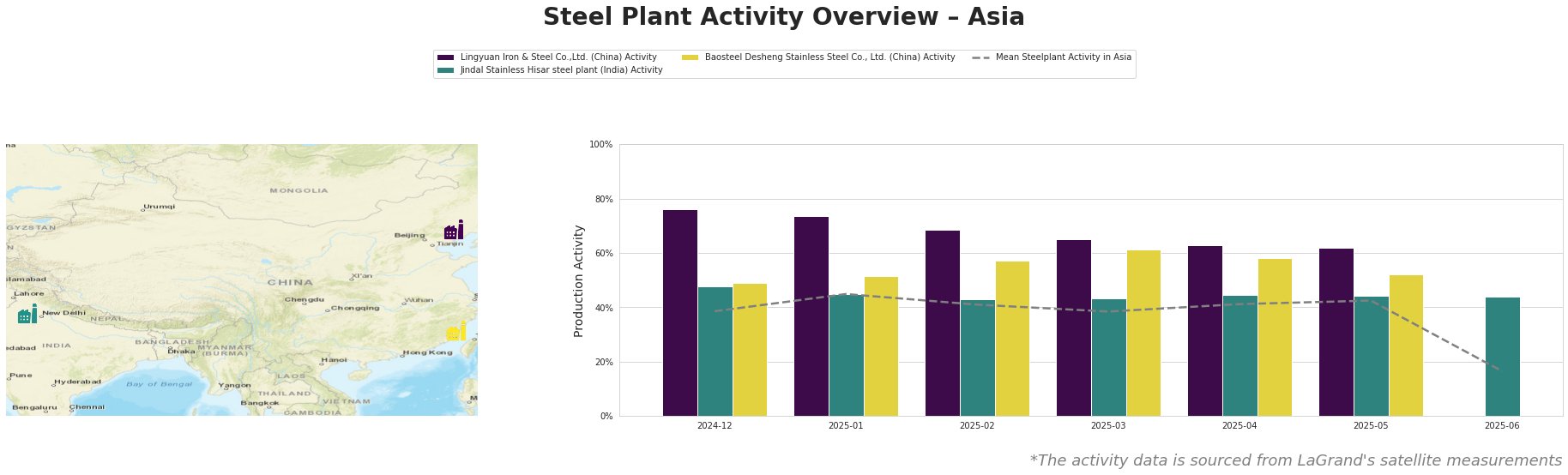

Overall, the mean steel plant activity in Asia has fluctuated, reaching a high of 45% in January 2025 and a low of 16% in June 2025. The recent steep decline observed in June warrants further investigation to determine the underlying cause.

Lingyuan Iron & Steel Co.,Ltd., an integrated BF/BOF steel plant in Liaoning, China, producing special steel bars, rebar, and welded pipe, exhibited relatively high activity compared to the Asian average, ranging from 76% in December 2024 down to 62% in May 2025. This consistent operation, followed by the absence of data in June 2025 might signal a potential maintenance period or other disruption. The provided news articles do not offer a direct explanation for this.

Jindal Stainless Hisar steel plant, an EAF-based stainless steel producer in Haryana, India, demonstrated a stable activity level around 43-48% throughout the observed period, showing no significant fluctuations or clear trends. This activity level is around the mean activity for Asian steel plants. No direct correlation to the provided news articles can be established.

Baosteel Desheng Stainless Steel Co., Ltd., an integrated BF/BOF stainless steel plant in Fujian, China, producing stainless steel products, has shown activity levels around the Asian average, starting at 49% in December 2024, peaking at 61% in March 2025, and then declining to 52% in May 2025. No data is available for June 2025. A direct link between this activity and the cited news is not evident.

Evaluated Market Implications:

Given the U.S. maintaining antidumping and countervailing duties on welded stainless steel pressure pipe from China, Vietnam, and other countries (“US maintains AD/CVD orders on WSPP from China“, “US issues final results of AD review on welded pressure pipe from Vietnam“, “US to Continue Anti-Dumping duty on welded stainless steel from Three Countries“), procurement professionals should anticipate potential shifts in regional steel flows. The absence of activity data for Lingyuan Iron & Steel and Baosteel Desheng in June 2025 introduces uncertainty.

Recommended Procurement Actions:

- For buyers sourcing welded stainless steel pressure pipe: Diversify suppliers beyond China and Vietnam to mitigate risks associated with U.S. trade actions. The finalized AD duties of 144.59% on imports from Sonha SSP Vietnam and Vinlong Stainless Steel (“US issues final results of AD review on welded pressure pipe from Vietnam“) will substantially increase costs.

- For buyers relying on Lingyuan Iron & Steel: Investigate the cause for the missing activity data in June 2025 to assess potential supply disruptions. Consider alternative suppliers of special steel bars, rebar, and welded pipe from other regions.

- Monitor Baosteel Desheng’s production: Closely observe Baosteel Desheng’s activity in the coming months to determine if the decrease in May 2025 is a temporary adjustment or the beginning of a larger decline.