From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Tariffs Loom Amid Fluctuating Plant Activity

Steel market activity in Asia remains neutral amidst potential trade headwinds from the US. The observed activity levels at key steel plants in Asia show variable trends. The live blog “Liveblog USA unter Trump: Trump kündigt zusätzliche Zölle gegen China in Höhe von 100 Prozent an | FAZ“ directly highlights the potential for increased tariffs on Chinese goods, which may influence the production and export strategies of steel plants in the region. The satellite observed activity changes in plants cannot be directly linked to this news.

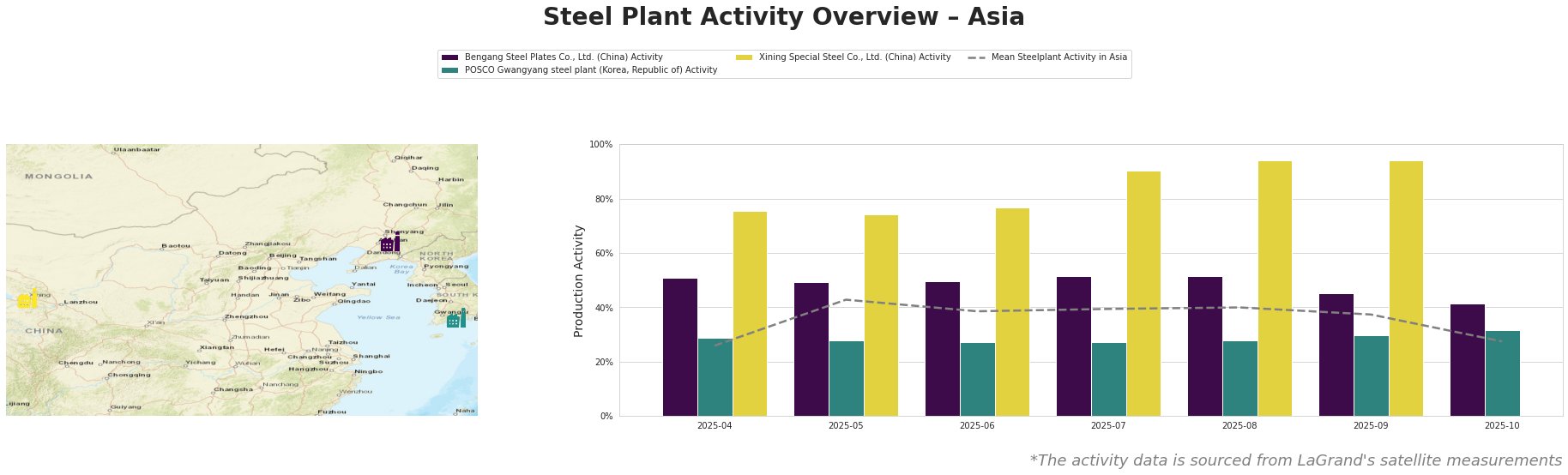

Overall, the mean steel plant activity in Asia showed a decrease in October to 27.0, a drop from 37.0 in September.

Bengang Steel Plates Co., Ltd., located in Liaoning, China, operates as an integrated BF steel plant with a crude steel capacity of 12,800 ttpa, producing automotive, home appliance, and oil pipeline steel. The plant’s activity experienced a decrease from 52.0 in August to 41.0 in October. While “Liveblog USA unter Trump: Trump kündigt zusätzliche Zölle gegen China in Höhe von 100 Prozent an | FAZ” discusses potential tariffs on Chinese goods, a direct link between this and the plant’s activity decline cannot be explicitly established based solely on the provided information.

POSCO Gwangyang steel plant, located in South Jeolla, Republic of Korea, is also an integrated BF steel plant with a crude steel capacity of 23,000 ttpa, producing hot rolled, cold rolled, galvanized, and stainless steel. Its activity has seen a slight increase to 32.0 in October, up from 28.0 in August. No direct connection between this increase and the provided news articles can be established.

Xining Special Steel Co., Ltd., located in Qinghai, China, operates as an integrated BF steel plant with a crude steel capacity of 2,000 ttpa, manufacturing automotive, bearing, and stainless steel. The plant has shown high activity levels, stabilizing at 93.0 in October, following a peak of 94.0 in August and September. Similar to Bengang Steel, while potential tariffs discussed in “Liveblog USA unter Trump: Trump kündigt zusätzliche Zölle gegen China in Höhe von 100 Prozent an | FAZ” may influence this plant, no direct impact on activity can be concluded from the available data.

Evaluated Market Implications

The potential for increased US tariffs on Chinese goods, as highlighted in “Liveblog USA unter Trump: Trump kündigt zusätzliche Zölle gegen China in Höhe von 100 Prozent an | FAZ”, creates uncertainty in the market. While no direct, immediate impact is evident in the satellite observed data, procurement professionals should consider the following:

- Chinese Steel Buyers: Given the potential for tariffs, steel buyers reliant on products from Bengang Steel Plates Co., Ltd. and Xining Special Steel Co., Ltd. should assess and potentially diversify their supply chains. The observed activity reduction at Bengang Steel (from 52.0 in August to 41.0 in October) could foreshadow future supply adjustments if tariffs materialize.

- Monitor POSCO Closely: Even though POSCO activity is slightly up, carefully monitor it since South Korean steel production might be subject to secondary effects if trade flows change or face retaliatory measures from China in the event of US tariffs. Given its large output capacity, it is a key factor to observe.

It is critical to continuously monitor policy developments and reassess supply chain risks accordingly.