From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Tariff Uncertainty Looms Amidst Mixed Plant Activity

Asia’s steel market faces potential volatility due to uncertainty surrounding US tariffs, as highlighted in “US-Regierung wendet sich im Streit um Zölle an Obersten Gerichtshof” and “US tariff take surges to $31B in August, setting new monthly high for 2025“. While some steel plants demonstrate consistent activity, others show a recent decline, potentially impacting supply. This report analyzes recent plant activity alongside tariff news to provide actionable insights.

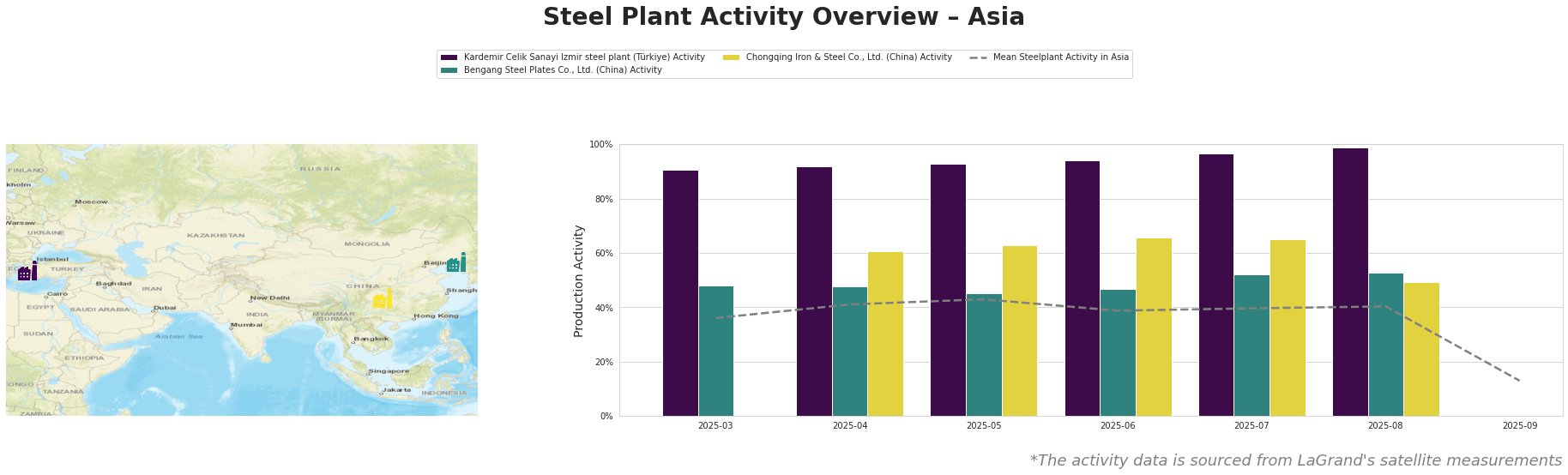

Observed steel plant activity in Asia, aggregated monthly:

The mean steel plant activity in Asia remained relatively stable from March to August 2025, fluctuating between 36% and 43%. However, a significant drop to 13% was observed in September, warranting further investigation to determine if this signals a broader market trend or isolated events.

Kardemir Celik Sanayi Izmir steel plant, an EAF-based producer in Türkiye with a 1.25 million tonne crude steel capacity, consistently operated at high activity levels. From March to August 2025, activity steadily increased from 91% to 99%, significantly exceeding the Asian average. No immediate connection can be established between this plant’s activity and the news regarding US tariffs. The plant holds a ResponsibleSteelCertification.

Bengang Steel Plates Co., Ltd., a major integrated steel producer in Liaoning, China, with a 12.8 million tonne crude steel capacity, showed moderate activity levels. Activity fluctuated between 45% and 53% from March to August 2025. No direct correlation can be established between the observed activity and the US tariff news. The plant produces finished rolled products for automotive, building, energy and transport sectors and also has a ResponsibleSteelCertification.

Chongqing Iron & Steel Co., Ltd., another integrated BF/BOF-based Chinese steelmaker with an 8.4 million tonne crude steel capacity, demonstrated fluctuating activity. Activity increased from 61% in April to a peak of 66% in June, before declining to 49% in August. The drop in August cannot be directly linked to the provided news about US tariffs. Like the other two plants, this steelmaker also holds a ResponsibleSteelCertification.

Evaluated Market Implications:

The uncertainty surrounding US tariffs, as indicated in “US-Regierung wendet sich im Streit um Zölle an Obersten Gerichtshof” and related articles, introduces risk into the Asian steel market, particularly for companies reliant on US trade. The potential for tariff reinstatement or removal, as discussed in “FAQ: Wie es mit den US-Zöllen nach dem Gerichtsentscheid weitergeht,” could significantly impact steel prices and trade flows. The overall activity levels show a concerning drop in the average activity level across the Asian steel plants.

Procurement Actions:

- Steel Buyers Focusing on US Markets: Given the legal challenges to US tariffs, as a risk mitigation strategy, steel buyers should negotiate contract clauses that allow for price adjustments based on potential tariff changes. Buyers relying on imported steel into the US should closely monitor the Supreme Court’s decision and prepare for potential tariff fluctuations.

- Market Analysts: Given that there is no clear correlation to be seen between observed activity levels of the selected three plants and the tariff dispute, Procurement Analysts in the steel sector should investigate the drop of the mean steel plant activity in Asia, particularly the large drop in September 2025. A hypothesis could be that several Asian steel plants have halted production, for whatever reason, and that this is hidden by the activities of other plants.