From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Tariff Uncertainty Lingers, Plant Activity Mixed

The Asian steel market faces uncertainty stemming from the ongoing legal battle surrounding US tariffs. The news articles “USA: Zollverbot ist herbe Niederlage für Donald Trump,” “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik,” “Gericht hebt Stopp von Trumps Zollplänen wieder auf,” “Washington: Hin und Her um Trumps Zölle vor Gericht – was bedeutet das?,” and “Wie geht es nach dem vorläufigen Urteil zu Trumps Zöllen weiter?” all detail the back-and-forth court decisions regarding the legality of US tariffs, imposed under an emergency law. This uncertainty doesn’t appear to have directly impacted short term activity levels as measured at the steel plants in Asia, however it is expected to influence longer term investment strategies.

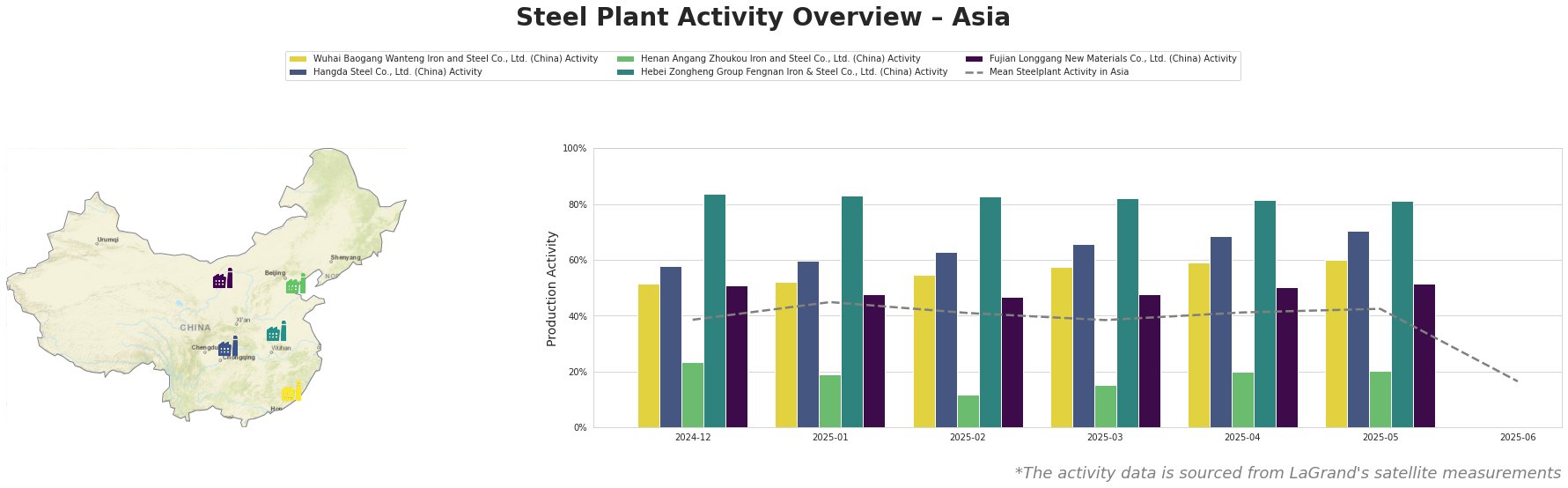

The average steel plant activity in Asia has seen fluctuations. It began at 39% at the end of December 2024, peaked at 45% in January 2025, and then generally declined to 42% by the end of May 2025, before a steep drop to 16% in June 2025. It should be noted that the numbers for June are not compete and therefore must not be over interpreted.

Wuhai Baogang Wanteng Iron and Steel Co., Ltd., located in Inner Mongolia, utilizes integrated BF/BOF production with a crude steel capacity of 2000ktpa. Its activity has shown a steady increase from 52% in December 2024 to 60% in May 2025, consistently above the Asian average. No direct connection between this plant’s activity and the US tariff news can be established based on the provided information.

Hangda Steel Co., Ltd., based in Sichuan, operates an electric arc furnace (EAF) with a crude steel capacity of 1000ktpa. The plant’s activity has shown a steady rise from 58% in December 2024 to 70% in May 2025, significantly exceeding the Asian average. No direct connection between this plant’s activity and the US tariff news can be established based on the provided information.

Henan Angang Zhoukou Iron and Steel Co., Ltd., located in Henan, uses integrated BF/BOF production with a crude steel capacity of 1750ktpa. Its activity has remained significantly below the Asian average, fluctuating between 24% in December 2024 and 20% in both April and May 2025, with a low of 12% in February 2025. No direct connection between this plant’s activity and the US tariff news can be established based on the provided information.

Hebei Zongheng Group Fengnan Iron & Steel Co., Ltd., situated in Hebei, employs integrated BF/BOF production with a large crude steel capacity of 7700ktpa. The plant has consistently operated at very high activity levels, ranging from 81% to 84%, far above the Asian average. Activity decreased slightly, by 3%, between December and May. No direct connection between this plant’s activity and the US tariff news can be established based on the provided information.

Fujian Longgang New Materials Co., Ltd., located in Fujian, utilizes integrated BF/BOF production with a crude steel capacity of 1210ktpa. Its activity has shown a slight increase from 51% in December 2024 to 52% in May 2025, remaining above the Asian average. No direct connection between this plant’s activity and the US tariff news can be established based on the provided information.

The ongoing uncertainty surrounding US tariffs, as detailed in the provided news articles, poses a potential risk to long-term steel demand in Asia. While current plant activity doesn’t show immediate impact, the legal battles and potential for re-imposition of tariffs create volatility.

- Recommended Procurement Actions: Steel buyers should closely monitor the US legal landscape and its potential impact on global trade flows. Given the consistently high activity at Hebei Zongheng Group Fengnan Iron & Steel Co., Ltd., and the uptrend at Wuhai Baogang Wanteng Iron and Steel Co., Ltd. and Hangda Steel Co., Ltd., consider diversifying supply sources to these plants to mitigate potential disruptions from other market factors and consider hedging procurement of steel products to minimize financial risk.