From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Steel Deal Uncertainty & Vizag Plant Stability Amidst Fluctuating Chinese Output

In Asia, the steel market is showing mixed signals amid global developments affecting US Steel. While the potential acquisition of US Steel by Nippon Steel faces hurdles, “Trump OKs US Steel, Nippon ‘partnership’,” the activity levels of key Asian steel plants present a more nuanced picture. This report analyzes these developments based on recent news and satellite-observed activity. Although the Nippon Steel deal centers on US assets, potential shifts in global steel dynamics could indirectly affect Asian markets, but no direct connection can be established at this time based on the provided information.

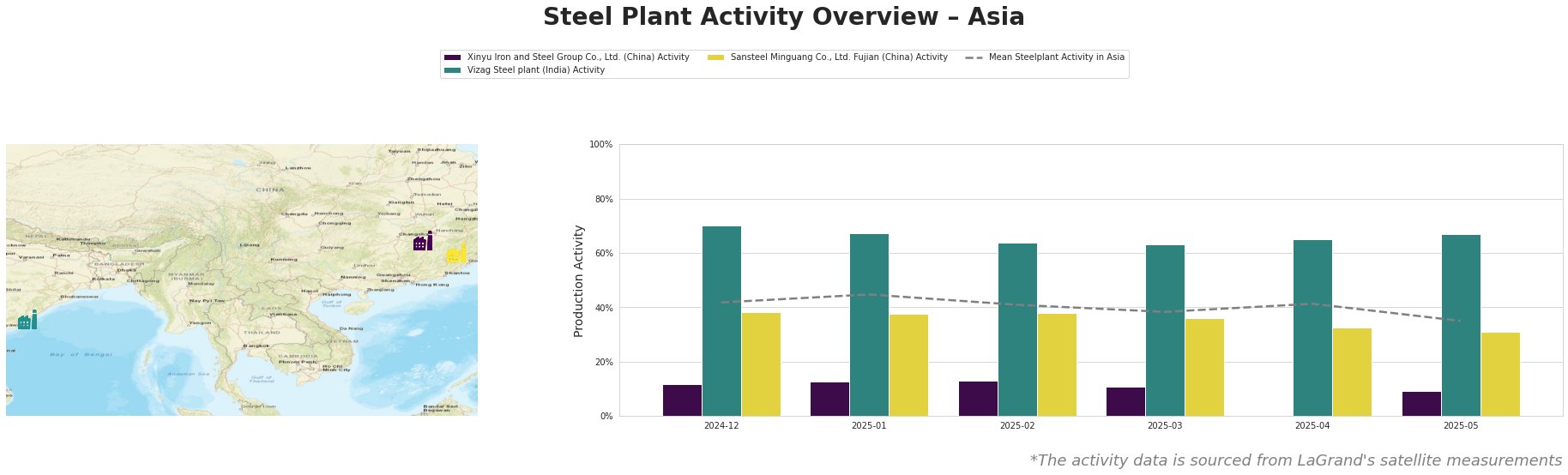

Overall, mean steel plant activity in Asia declined from 42% at the end of 2024 to 35% by the end of May 2025, the lowest level in the observed period.

Xinyu Iron and Steel Group Co., Ltd. (China): This integrated steel plant (10 million tonnes crude steel capacity, primarily BOF-based) has exhibited consistently low activity, dropping to 9% by May 2025. This is significantly below the Asian average. No direct link can be established between this decline and the news surrounding the US Steel deal.

Vizag Steel plant (India): In contrast, Vizag Steel (7.3 million tonnes crude steel capacity, BOF-based) maintained high activity, fluctuating between 63% and 70% throughout the observed period, consistently exceeding the Asian average. This suggests stable operations focused on rebar, rounds, and wire rod for building and infrastructure. Again, based on the provided information no direct connection to any news surrounding Nippon Steel can be established.

Sansteel Minguang Co., Ltd. Fujian (China): Another integrated Chinese plant (6.8 million tonnes crude steel capacity, BOF-based), Sansteel Minguang’s activity showed a declining trend, from 38% at the end of 2024 to 31% by May 2025. The decline mirrors the trend seen at Xinyu Steel, but remains slightly higher. Similar to Xinyu, no connection can be made between Sansteel’s activity and the news regarding Nippon Steel.

Given the stable high activity observed at Vizag Steel, procurement professionals seeking materials for building and infrastructure projects can likely rely on this plant as a consistent supplier. However, due to falling mean steel plant activity in Asia, procurement professionals should closely monitor price fluctuations, particularly for finished rolled products. No actions related to the US Steel / Nippon Steel deal are warranted based on the current information.