From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Steel Deal Impact Uncertain Amidst Stable Production

Asia’s steel market remains neutral as plant activity shows stability amidst the evolving US Steel acquisition. Activity levels do not yet reflect the impact of news like “USW calls on Trump to reject USS, Nippon deal” and “Trump announces planned partnership between US Steel and Nippon Steel,” suggesting current production is decoupled from the uncertainty surrounding the international deal. No direct relationship could be established between Asian plant activity and these news items.

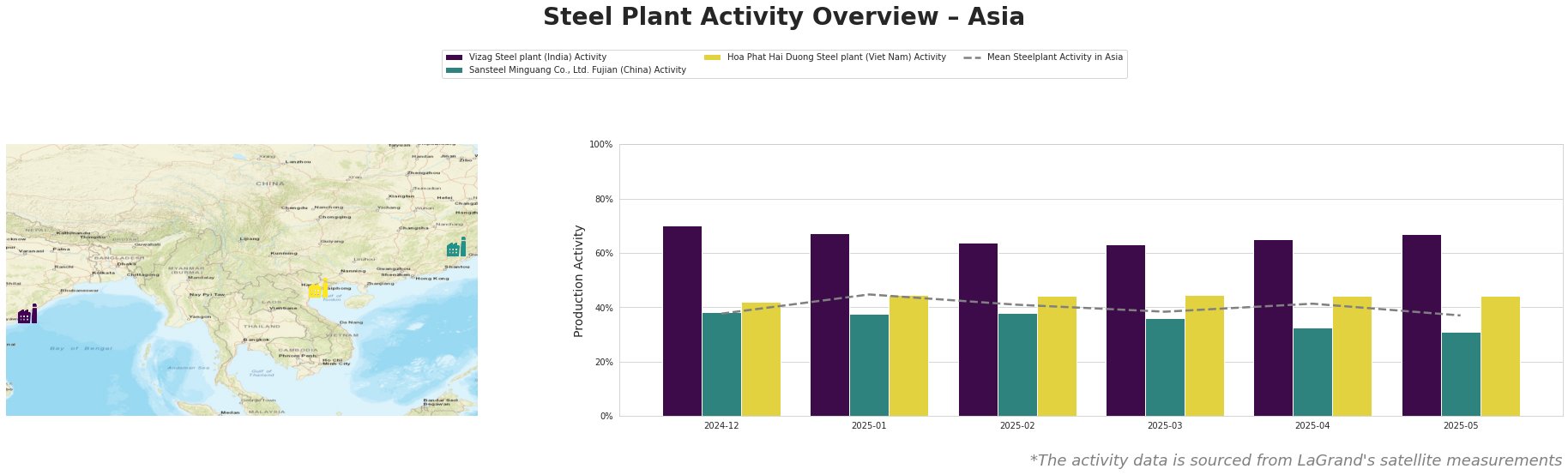

Recent monthly activity trends across key Asian steel plants:

The mean steel plant activity in Asia shows a fluctuating trend, peaking at 45% in January 2025 and dipping to 37% in May 2025.

Vizag Steel plant, an integrated (BF) steel plant in India with a crude steel capacity of 7.3 million tonnes, has consistently operated well above the Asian average, ranging between 63% and 70%. There was a consistent, small downtrend between December and March 2025, after which activity slightly increased again to 67%. As a BOF steel plant that produces rebar, rounds, and wire rod, Vizag’s continued high production indicates stable output for building and infrastructure sectors in its region. No direct connection could be established between Vizag Steel plant activity levels and the provided news articles.

Sansteel Minguang Co., Ltd. Fujian, an integrated (BF) steel plant in China with a crude steel capacity of 6.8 million tonnes, has shown a downward trend in activity, decreasing from 38% in December 2024 to 31% in May 2025. Its activity is close to the Asia average, though the downtrend might warrant monitoring. Specializing in finished rolled products like steel plates, round bars, and construction steel, the observed decline could signal softening domestic demand or production adjustments. No direct connection could be established between Sansteel Minguang activity levels and the provided news articles.

Hoa Phat Hai Duong Steel plant in Vietnam, an integrated (BF) steel plant with a crude steel capacity of 2.5 million tonnes, maintained a stable activity level around 44-45% throughout the observed period. This is also very close to the Asia average. Producing construction steel and hot rolled coil, its steady output suggests consistent demand in its local market. No direct connection could be established between Hoa Phat Hai Duong activity levels and the provided news articles.

The ongoing discussions surrounding the US Steel and Nippon Steel deal, as reported in “Trump, USS say ‘partnership’ deal reached with Nippon,” could introduce volatility in global steel markets, particularly affecting supply chains and pricing.

Evaluated Market Implications:

Given the stable production across the observed Asian plants and the uncertainty surrounding the US Steel deal and its potential global impact, steel buyers and analysts should:

- Monitor Vizag Steel’s Output: Closely track Vizag Steel’s production data as it consistently operates above the Asian average, potentially buffering against supply disruptions in South Asia.

- Assess Sansteel Minguang’s Downtrend: Investigate the reasons behind the declining activity at Sansteel Minguang in China, as it could indicate broader regional demand shifts. Contact the plant directly to confirm if this trend is expected to continue.

- Diversify Sourcing: Given the evolving US Steel situation, proactively diversify steel sourcing to mitigate potential risks associated with global market volatility.