From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Shutdown Clouds Data Amidst Plant Activity Shifts

In Asia, steel plant activity shows mixed trends amidst uncertainty caused by the US government shutdown, impacting data availability and market visibility. While no direct links can be established between the US-centric news articles and Asian steel plant activity, the shutdown’s disruption of US economic data impacts global market sentiment. Specifically, the shutdown, as highlighted in “US government shutdown delays construction data“, “Fed shutdown disrupts most USDA data releases“, “US gov shutdown lowers shroud on jobs, inflation data“, and “Government shutdown halts USDA export sales report“, limits the ability to assess downstream demand for steel in the US.

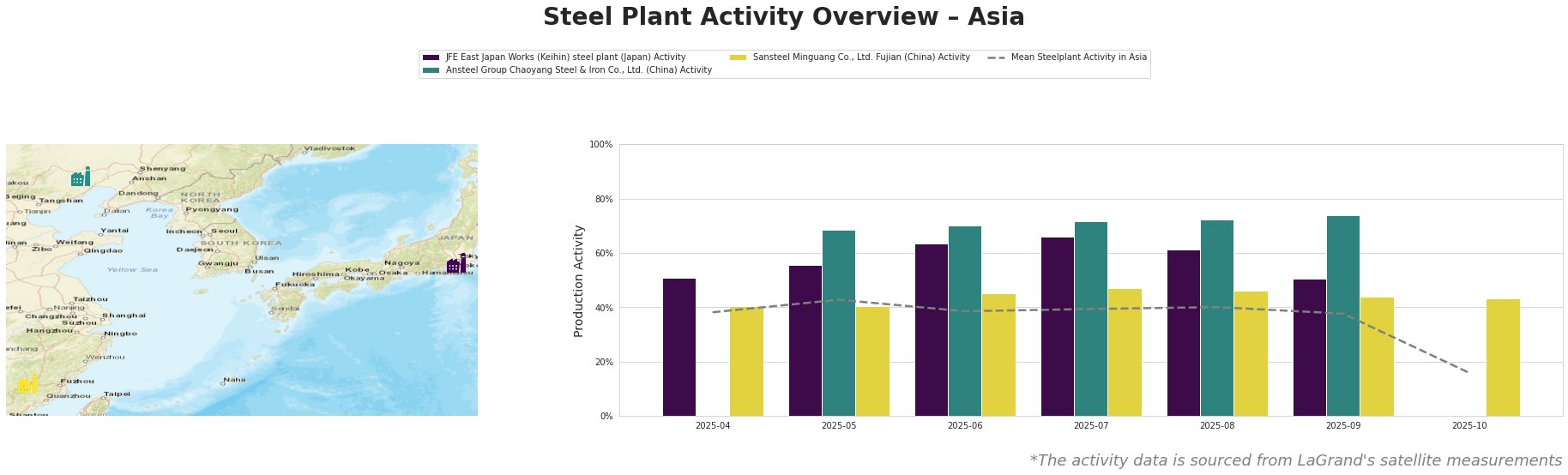

Overall, the mean steel plant activity in Asia has declined sharply in October to 16%, down from 38% in September.

JFE East Japan Works (Keihin) steel plant, an integrated BF/BOF steel plant with an EAF, showed activity levels consistently above the Asian average between April and September 2025. Starting at 51% in April, it peaked at 66% in July before dropping back to 51% in September. No data is available for October 2025. Given the plant’s reliance on BF/BOF processes and its planned shutdown by FY2023, this fluctuation could be attributed to planned maintenance, process adjustments, or facility upgrades, but no direct connection to the provided news articles can be established.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a BOF-based plant in Liaoning, China, exhibited increasing activity from 68% in May to a peak of 74% in September. No data is available for April, nor October 2025. The strong performance might be tied to regional infrastructure projects in China, but without further information, no definitive link can be made to any of the provided articles.

Sansteel Minguang Co., Ltd. Fujian, another BOF-based plant, showed relatively stable activity between 41% in April and 47% in July, before falling to 43% in October. The stable output, despite fluctuations in other plants, could reflect a consistent order book focused on its core products of steel plates, round bars, and construction steel, especially considering its position to serve end-user sectors such as building and infrastructure. No explicit link between the observed plant activity and the provided news articles can be established.

The US government shutdown, as described in “US services sector stagnates in September: ISM survey,” introduces uncertainty into global economic forecasts. While the provided news articles focus on the US, they highlight the risks of relying on potentially outdated or unavailable economic data for decision-making.

Given the uncertainty surrounding US economic data and the sharp decline in overall steel plant activity across Asia in October, steel buyers and analysts should:

- Diversify supply chains: The shutdown impacts US construction data, which is vital for demand forecasting of steel-intensive sectors. Buyers should therefore diversify their supply chains to mitigate risks associated with potentially reduced US demand which might impact specific steel product availability.

- Monitor regional indicators more closely: With US data reliability diminished in the short term, focus on regional economic indicators within Asia to assess demand and supply dynamics more accurately.

- Strengthen relationships with suppliers: Proactive communication with key suppliers becomes crucial for gaining real-time insights into production schedules and potential supply bottlenecks.