From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Update: Neutral Sentiment with Mixed Activity Trends Amidst Price Adjustments

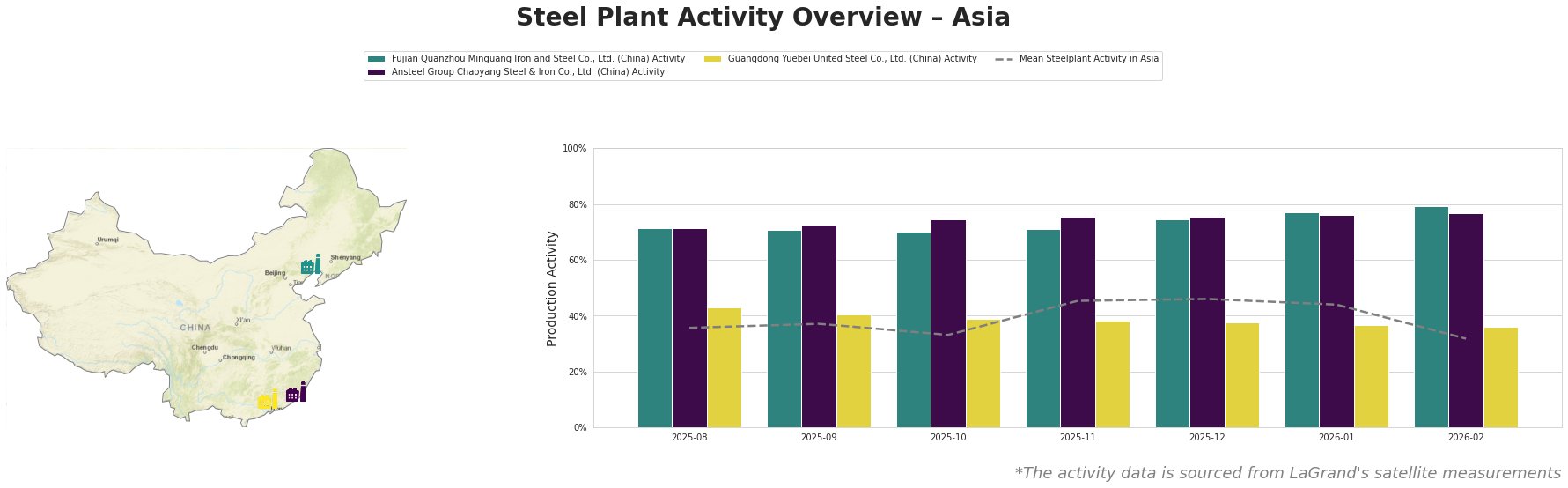

In Asia’s steel market, particularly in China, recent pricing trends have shown slight declines. The articles MOC: Average rebar price in China decreases by 0.1 percent in Jan 26-Feb 1 2026 and NBS: Local Chinese rebar prices down 0.7 percent in late January 2026 indicate a decrease in average finished steel prices, correlating with noted activities at major steel plants. Notably, these price adjustments follow a neutral shift in market sentiment and are reflected in satellite-observed activity for select plants.

The Fujian Quanzhou Minguang Iron and Steel Co., Ltd. showed increased activity at 79% in February, aligning with the China’s steel sector PMI increases to 49.9 percent in January 2026, indicating a potential for rising demand. Despite being the highest among the plants tracked, this rise could reflect anticipatory production before the Chinese New Year. However, a subsequent decline in average activity to 32% might indicate adjustments in production related to recent price drops.

Ansteel Group Chaoyang Steel & Iron Co., Ltd. exhibited stable activity, holding around 76% in January before slightly declining to 77%. This stability, in light of reported price decreases in local rebar, signifies a cautious approach amid wider supply price pressures, reinforced by the news suggesting a slowdown in new export orders.

Meanwhile, Guangdong Yuebei United Steel Co., Ltd. displayed a decrease in activity to 36%, correlating with the overall market tendency. This drop, alongside the news of NBS: Local Chinese rebar prices down 0.7 percent in late January 2026, indicates a potential correlation between market conditions and procurement levels that may prompt a reassessment of current inventory and purchasing strategies.

The observed data suggests that supply disruptions are possible, particularly for Guangdong Yuebei due to its significant drop in activity. Steel buyers should consider increasing procurement volumes in February and early March to hedge against potential supply shortages, particularly from plants that may downscale production after the Chinese New Year. Additionally, close monitoring of pricing trends in connection with plant activity can direct procurement strategies to capitalize on lower price points before anticipated fluctuations.