From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Update: Neutral Sentiment Amidst Sluggish Activity and Coal Market Shifts

Steel activities in Asia are witnessing a neutral market sentiment primarily due to recent fluctuations in plant operations and coal output amidst economic downturns. The articles titled “Viewpoint: Thailand’s LNG demand poised to remain slow” and “Indonesian coal output, exports decline in 2025” highlight significant shifts that correlate with satellite observed activity declines at key steel facilities in the region.

In Thailand, a slowdown in LNG demand and electricity consumption has been reported, attributed to mild weather and economic stagnation. Despite this, the direct link to steel plant activity levels is not established. Meanwhile, Indonesia’s coal production has declined for the first time in five years, influenced by weakened demand from markets like China and India. This decline, along with shifting energy policies, affects overall industrial energy consumption and indirectly relates to the activity levels observed in Indonesia’s Dexin Steel Morowali plant.

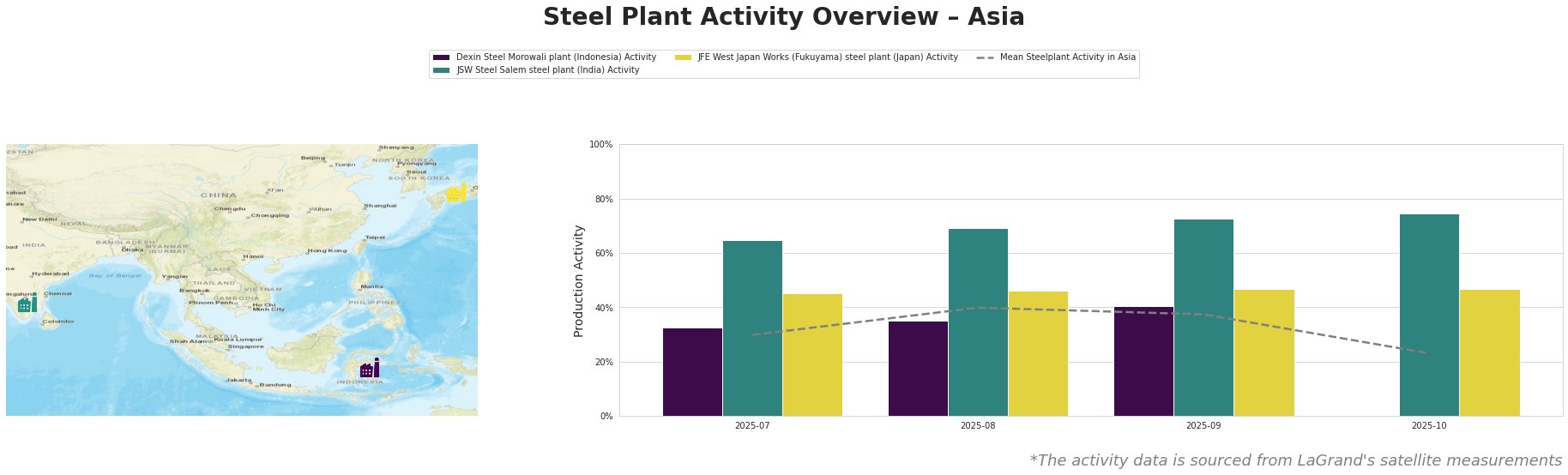

The Dexin Steel Morowali plant in Indonesia exhibited a notable decline in activity, falling from 40% in September to inactive by October 31, 2025. The drop in coal exports and production in Indonesia reported in “Indonesian coal output, exports decline in 2025” could have contributed to this decrease, showcasing a direct dependency on coal supply chains to sustain operations.

In contrast, the JSW Steel Salem plant in India has shown resilience, rising from 69% to 75% activity levels between September and October. This peak indicates stable demand from sectors like automotive and infrastructure, potentially buffered by less reliance on external coal markets.

The JFE West Japan Works (Fukuyama) plant maintained relatively stable activity, hovering near 47%, suggesting a robust operational environment but not exempt from broader market impacts, inferred from general regional trends without a direct correlation to the cited news articles.

Evaluated Market Implications:

Given the declining coal exports and production rates, steel buyers should anticipate potential supply chain disruptions, particularly from the Dexin Steel Morowali plant. Firm procurement timelines and alternative sourcing strategies might be prudent given Indonesia’s uncertain coal supply, emphasized by “Indonesian coal output, exports decline in 2025.”

Conversely, the stable performance of JSW Steel indicates areas of opportunity; buyers seeking reliability in supply could prioritize orders from this facility. Monitoring JFE West Japan Works alongside JSW could provide added assurance against regional fluctuations.

In summary, procurement strategies should be adaptable, closely monitoring coal availability while leveraging the robust performance from regional steel operations to mitigate risks associated with fluctuating energy sources.