From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Update: Activity Plummets Amid Geopolitical Tensions – Buyers Urged to Reevaluate Procurement Strategies

The steel market in Asia is experiencing a severe downturn, underscored by significant reductions in operational activity across key plants. Reports such as US captures Maduro after strikes in Venezuela: Update highlight increasing geopolitical tensions that could further destabilize supply chains, impacting production efficiency. Recent satellite data indicates marked declines in activity levels, particularly amid escalating international conflicts which have left markets on edge.

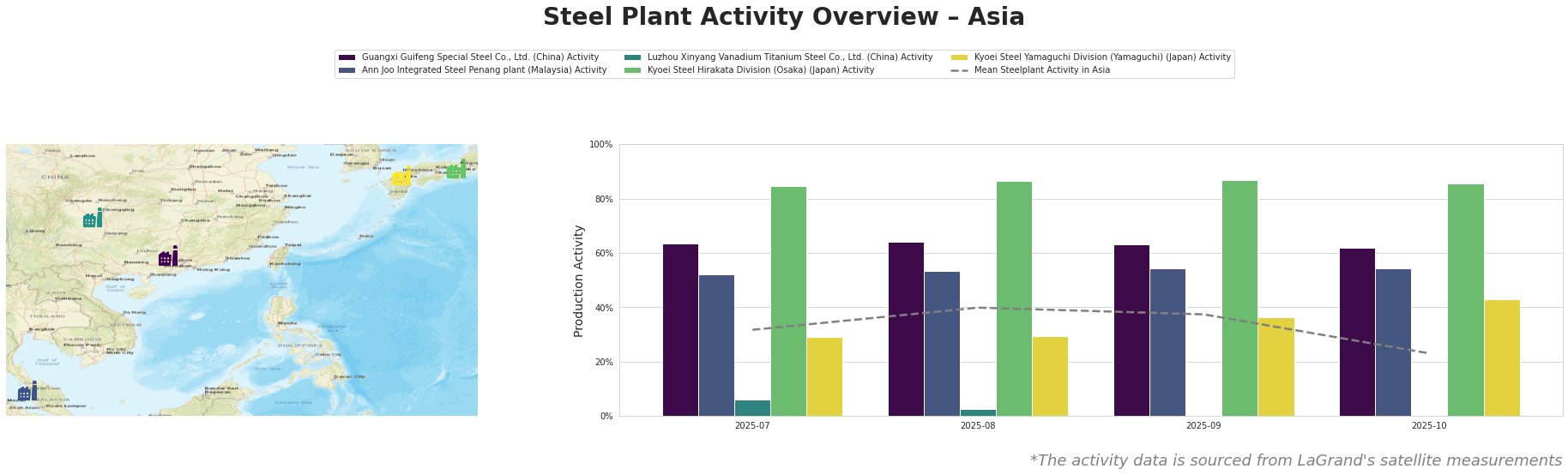

The observations indicate a steep drop in mean activity from 40.0% in August to 23.0% in October 2025, marked by particularly low levels (0%) at both Luzhou Xinyang Vanadium Titanium Steel Co. and across several Kyoei Steel divisions. This decline aligns with developments such as the US claims capture of Maduro after Venezuela strikes, suggesting wider implications for global market stability—potentially affecting steel availability and pricing.

Guangxi Guifeng Special Steel Co. has seen a slight activity reduction from 64.0% to 62.0%. Despite this, it remains relatively stable compared to others. The plant’s electric arc furnace capabilities primarily serve construction industries, but any geopolitical tension could disrupt inputs such as raw materials already strained by rising tensions.

Meanwhile, Ann Joo Integrated Steel Penang has maintained activity levels around 54%, yet the international situation’s unpredictability is a concern for their production—potential supply interruptions could arise as the geopolitical climate evolves.

For Luzhou Xinyang Vanadium Titanium Steel, decreased production to 0% reflects serious operational halts amidst the broader uncertainty, indicating possible resource and labor issues likely connected to the unstable conditions highlighted by multiple geopolitical dynamics outlined in the provided news articles.

Kyoei Steel’s divisions have experienced varied performance, with the Hirakata division sustaining nearly full capacity at 87.0% in August, now down to 86.0%—primarily affecting their product outputs in infrastructure. The Yamaguchi division illustrates stability with 43.0%, but continued geopolitical unrest necessitates vigilance among procurement teams.

Given these alarming trends and the prevalent geopolitical risks, steel procurement professionals should urgently reassess their supply chains, considering possible alternative suppliers or products to mitigate risks associated with tightening supplies and increased costs. Active monitoring of geopolitical developments is crucial for anticipating potential disruptions in steel availability and pricing.