From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Under Pressure: US Tariff Uncertainty and Production Slowdown

In Asia, steel market sentiment is negative due to uncertainty surrounding US tariff policy and recent declines in regional steel plant activity. The news articles “USA: Zollverbot ist herbe Niederlage für Donald Trump,” “Was bedeutet der gerichtlichen Dämpfer für Trumps Zollpolitik?,” “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik,” “Gericht hebt Stopp von Trumps Zollplänen wieder auf,” “Washington: Hin und Her um Trumps Zölle vor Gericht – was bedeutet das?,” and “Wie geht es nach dem vorläufigen Urteil zu Trumps Zöllen weiter?” all highlight the ongoing legal challenges to US tariffs, creating instability in global trade flows. A direct link between these news articles and immediate Asian steel plant activity levels cannot be definitively established based on the provided data, but the uncertainty is expected to weigh on future production decisions.

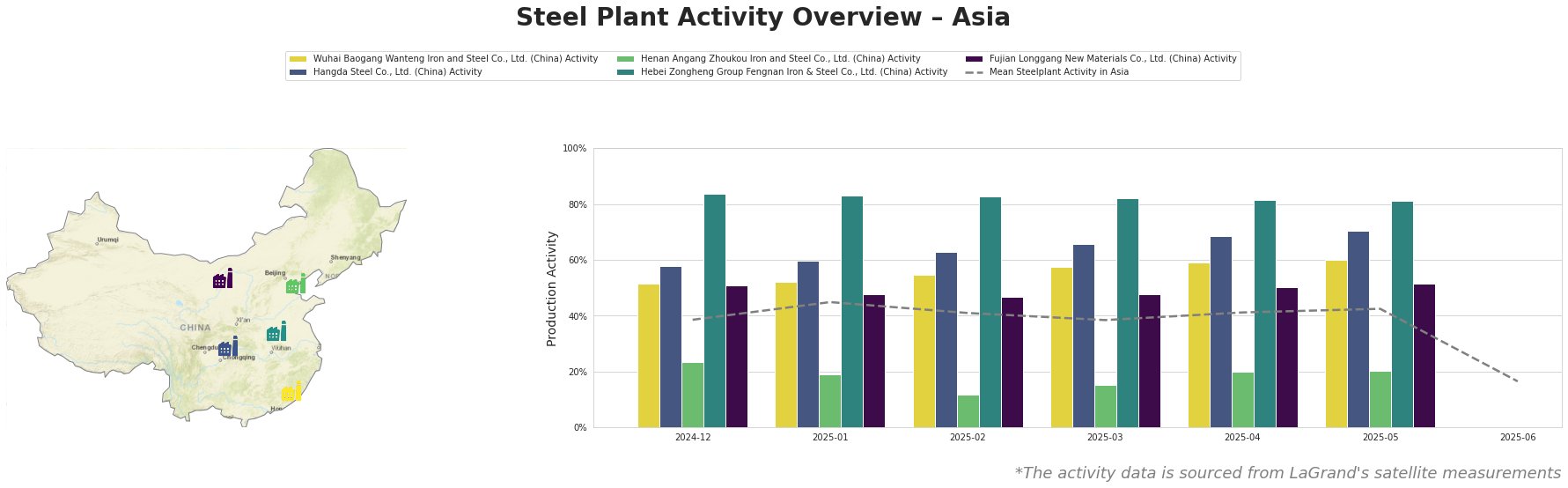

The mean steel plant activity in Asia experienced a significant drop in June 2025, falling from 42% to 16%. This sharp decline signals a substantial slowdown in regional steel production.

Wuhai Baogang Wanteng Iron and Steel Co., Ltd., an integrated BF/BOF steel plant in Inner Mongolia with a crude steel capacity of 2000ktpa, has shown a relatively stable activity level, increasing gradually from 52% in December 2024 to 60% in May 2025. However, data for June 2025 is missing, preventing assessment of whether the regional downturn affected this plant. No direct link between the plant’s activity and the US tariff news can be established based on the provided data.

Hangda Steel Co., Ltd., an electric arc furnace (EAF) based steel plant in Sichuan, demonstrates a consistent increase in activity from 58% in December 2024 to 70% in May 2025. As with Wuhai Baogang, June 2025 data is unavailable. Given its reliance on EAF technology, this plant may be less directly impacted by global iron ore dynamics than BF/BOF plants, but it is exposed to power supply disruptions. No explicit link to the US tariff situation can be confirmed.

Henan Angang Zhoukou Iron and Steel Co., Ltd., an integrated BF/BOF steel plant in Henan, operated at significantly lower activity levels compared to the regional average, ranging from 12% to 24% between December 2024 and May 2025. Like the other plants, June 2025 data is absent. The low activity suggests potential operational or market-specific challenges, but no direct connection to the US tariff news can be established.

Hebei Zongheng Group Fengnan Iron & Steel Co., Ltd., a major integrated BF/BOF steel producer in Hebei with a crude steel capacity of 7700ktpa, maintained high activity levels, fluctuating narrowly between 81% and 84% from December 2024 to May 2025. However, activity decreased to 81% in May, and June data is missing, making it impossible to assess the impact of current market conditions. There is no clear direct link between its activity and US tariff developments.

Fujian Longgang New Materials Co., Ltd., another integrated BF/BOF steel plant, has shown relatively stable activity levels, increasing gradually from 51% in December 2024 to 52% in May 2025. As with the other plants, June 2025 data is not available. Its stable output suggests a degree of resilience, but the missing June data leaves the overall impact uncertain. No direct link to US tariff news can be confirmed.

Given the observed sharp decline in the mean steel plant activity in Asia during June 2025 and the ongoing uncertainty surrounding US tariffs, which is disrupting established trade lanes and potentially pushing down prices, steel buyers should:

- Prioritize short-term contracts: Until the direction of US trade policy becomes clearer and stability returns to Asian markets, focus on securing supply through short-term contracts (e.g., monthly or quarterly) to mitigate risk. This advice is driven by the uncertainty caused by the US tariff situation and the recent overall slowdown in regional steel plant activity.

- Carefully monitor activity at Hebei Zongheng: The observed decline in activity at Hebei Zongheng in May, combined with the overall regional production slowdown in June, suggests potential disruptions. Buyers who rely on this supplier should proactively contact them to confirm production schedules and explore alternative sources.