From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Under Pressure: EU Anti-Dumping Duties and Declining Plant Activity

Asia’s steel market faces headwinds due to recent EU trade actions and declining plant activity. The impact of the extended anti-dumping duties detailed in “The European Commission has extended anti-dumping duties on steel fittings from Asia and Russia,” “EU extends tariffs on valve advertising for Korea, Malaysia and Russia” and “EU issues definitive AD duty on tube and pipe fittings from three countries” may contribute to observed changes in steel plant activity.

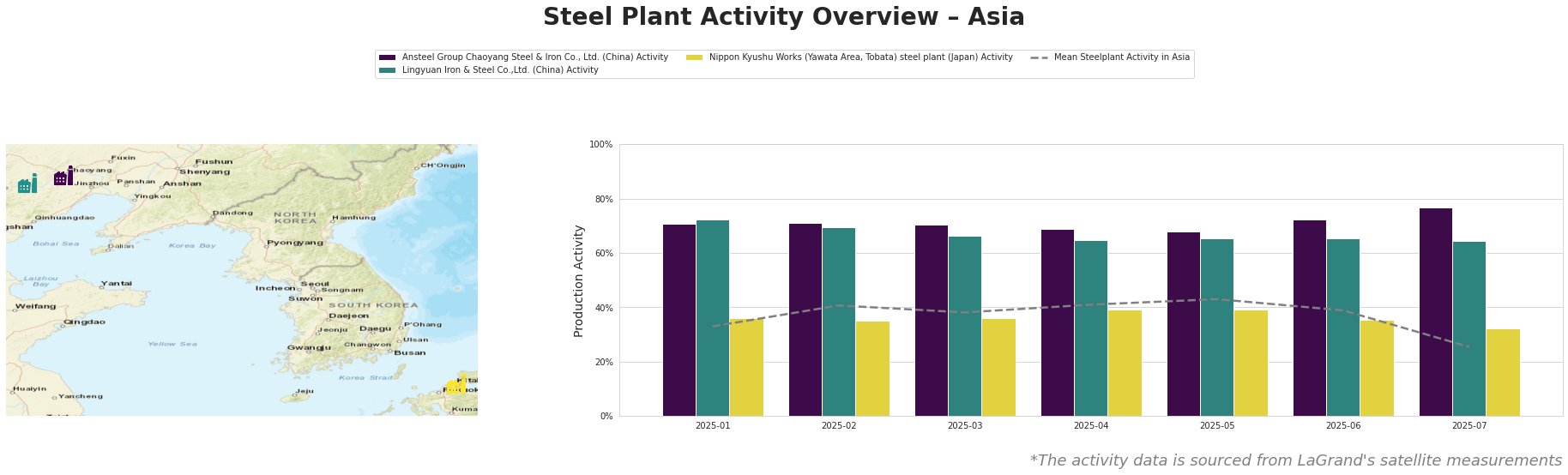

The mean steel plant activity in Asia has shown a declining trend, dropping to 25.0% in July from a high of 43.0% in May. Ansteel Group Chaoyang Steel & Iron Co., Ltd. maintained high activity, peaking at 77.0% in July. Lingyuan Iron & Steel Co.,Ltd. also operated at high levels, gradually decreasing to 64.0% in July. Nippon Kyushu Works steel plant activity fluctuated slightly but ended at 32.0% in July, below the mean.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a Chinese integrated steel plant with a 2100 TTPA capacity of crude steel produced via BOF, shows the highest activity among the observed plants. Activity increased to 77.0% in July. The high activity levels at Ansteel may indicate a strategic focus on domestic markets to mitigate the impact of EU anti-dumping duties, but no direct link can be conclusively established.

Lingyuan Iron & Steel Co.,Ltd., another integrated Chinese steel plant with a 6000 TTPA capacity of crude steel produced via BOF, shows steadily decreasing activity, reaching 64.0% in July. The reduction could stem from various factors, including domestic demand shifts or adjustments to production schedules. No direct relationship to the EU anti-dumping measures can be established based on the provided information.

Nippon Kyushu Works (Yawata Area, Tobata) steel plant in Japan, an integrated plant with a 3727 TTPA capacity of crude steel produced via BOF, experienced fluctuating activity, reaching a low of 32.0% in July, significantly below the Asian mean. The EU’s extended anti-dumping duties, particularly as highlighted in “EU issues definitive AD duty on tube and pipe fittings from three countries” which explicitly names South Korea and Malaysia as affected countries, may indirectly impact demand for Japanese steel products within the EU market, potentially affecting production.

The EU’s anti-dumping measures on steel fittings, tubes, and pipes from South Korea and Malaysia, as outlined in “The European Commission has extended anti-dumping duties on steel fittings from Asia and Russia“, “EU extends tariffs on valve advertising for Korea, Malaysia and Russia” and “EU issues definitive AD duty on tube and pipe fittings from three countries“, could lead to increased demand for steel products from other Asian countries, including China, in regions outside the EU. Given the observed decline in mean plant activity and fluctuating activity at Nippon Kyushu Works, steel buyers should:

- Diversify supply sources: Explore alternative suppliers, particularly from countries less affected by EU anti-dumping duties, such as India or Vietnam, to mitigate potential supply disruptions.

- Monitor price fluctuations: Closely track steel prices, especially for pipe and fitting products, in both Asian and European markets to identify arbitrage opportunities or potential cost increases.

- Strengthen relationships with domestic suppliers: Given the high activity at Ansteel Group Chaoyang, buyers should consider reinforcing relationships with domestic suppliers to secure supply and potentially negotiate favorable terms.