From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Turkish Rebar Exports Surge Amidst Fluctuating Scrap Imports; Chinese Plant Activity Remains Elevated

Asia’s steel market exhibits a generally positive sentiment, driven by strong export performance from Turkey despite shifts in scrap import patterns. Turkish steel exports are up, indicated by “Turkish rebar exports up 21 percent in January-August 2025” and “Turkey’s wire rod exports up 1.2 percent in Jan-Aug 2025”. There is no direct observed link between these news items and satellite-observed activity changes in Chinese steel plants. However, the increase in Turkish exports coincides with generally steady, high-level activity at the observed Fujian Dadonghai Industrial Group Co., Ltd. plant in China.

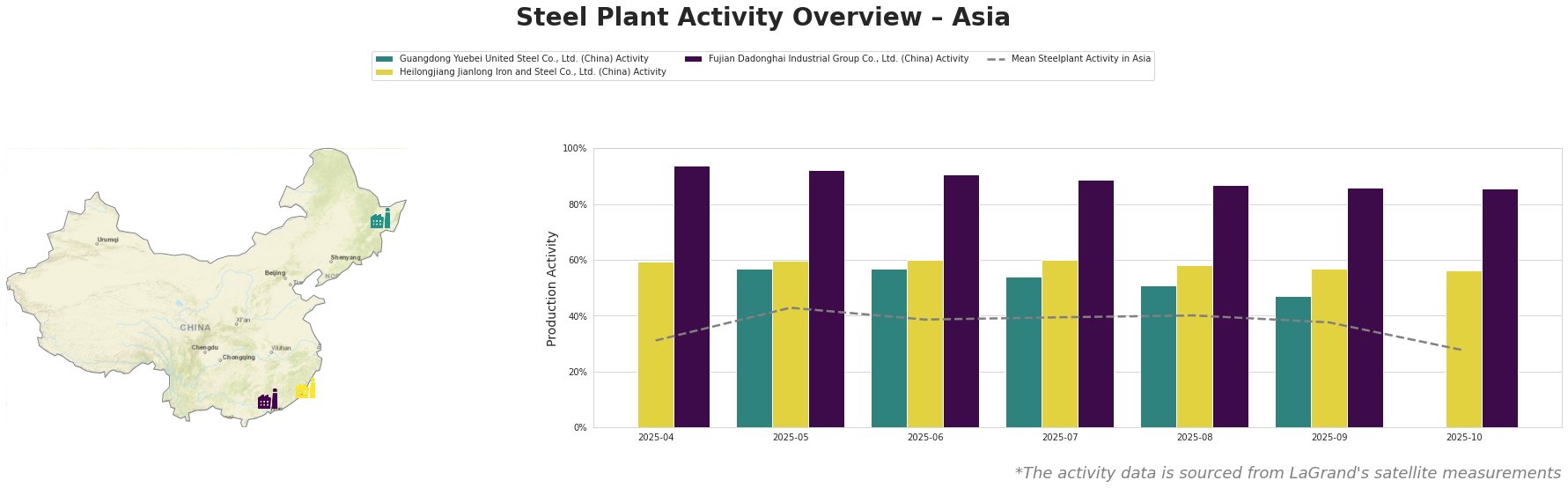

The mean steel plant activity in Asia peaked in May 2025 at 43%, then experienced a gradual decrease, reaching a low of 28% in October 2025. Guangdong Yuebei United Steel Co., Ltd. shows a clear declining trend in activity from May (57%) to September (47%). Heilongjiang Jianlong Iron and Steel Co., Ltd. has maintained a relatively stable activity level around 60% throughout the observed period, experiencing only a minor drop to 56% in October. Fujian Dadonghai Industrial Group Co., Ltd. consistently shows high activity, ranging from 86% to 94%, indicating robust production levels. This is significantly above the mean activity level across all observed Asian plants.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant with a crude steel capacity of 2000 ttpa, primarily produces rebar for the building and infrastructure sector, utilizing both BF and EAF processes. The plant’s activity has steadily decreased from 57% in May to 47% in September. No direct connection can be established between this decrease and the news articles provided.

Heilongjiang Jianlong Iron and Steel Co., Ltd., another integrated steel plant with a 2000 ttpa crude steel capacity, focuses on hot rolled ribbed steel bars, seamless steel tube products, and rebar. Its activity remained relatively stable at around 60% from May to October. No direct connection can be established between this stable activity and the news articles provided.

Fujian Dadonghai Industrial Group Co., Ltd., an integrated steel plant producing rebar with a crude steel capacity of 2200 ttpa, demonstrates consistently high activity levels. The plant’s activity has only slightly decreased from 94% in April to 86% in October. While “Turkish rebar exports up 21 percent in January-August 2025” highlights increased export competition, no direct relationship can be established with the maintained high activity.

Despite strong Turkish rebar export figures, “Turkey reduced scrap imports by 9.4% y/y in January-August” indicates a potential constraint on future production if scrap availability tightens.

Evaluated Market Implications:

- The news “Turkey reduced scrap imports by 9.4% y/y in January-August” may indicate a potential future constraint on Turkish steel production, despite the current export strength shown in “Turkish rebar exports up 21 percent in January-August 2025”. This could lead to supply disruptions in rebar, particularly to the key export destinations of Yemen, Romania and Albania.

- Procurement Action: Steel buyers should closely monitor Turkish scrap import data and consider diversifying their rebar supply sources to mitigate potential risks associated with Turkish production constraints. Specifically, explore alternative sources for rebar beyond Turkey.

- Procurement Action: Given the increased Turkish exports, steel buyers, specifically in Romania, Libya and Australia (as mentioned in “Turkey’s wire rod exports up 1.2 percent in Jan-Aug 2025”) should secure contracts early in anticipation of potential price increases or supply shortages driven by increased demand.