From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Turkish Rebar Exports Surge Amidst Chinese Plant Activity Shifts

Asia’s steel market exhibits a very positive outlook, influenced by shifting global trade dynamics and varying regional production activities. Notably, the increase in Turkish rebar exports reported in “Turkish rebar exports up 21 percent in January-August 2025” contrasts with observed fluctuations in Chinese steel plant activity, although a direct causal relationship between these events and the Chinese production activity cannot be explicitly established from the provided information. It’s important to note that while the news articles suggest shifts in export and import behaviors, the provided data doesn’t clarify whether the shifts in observed plant activity are related to these changes.

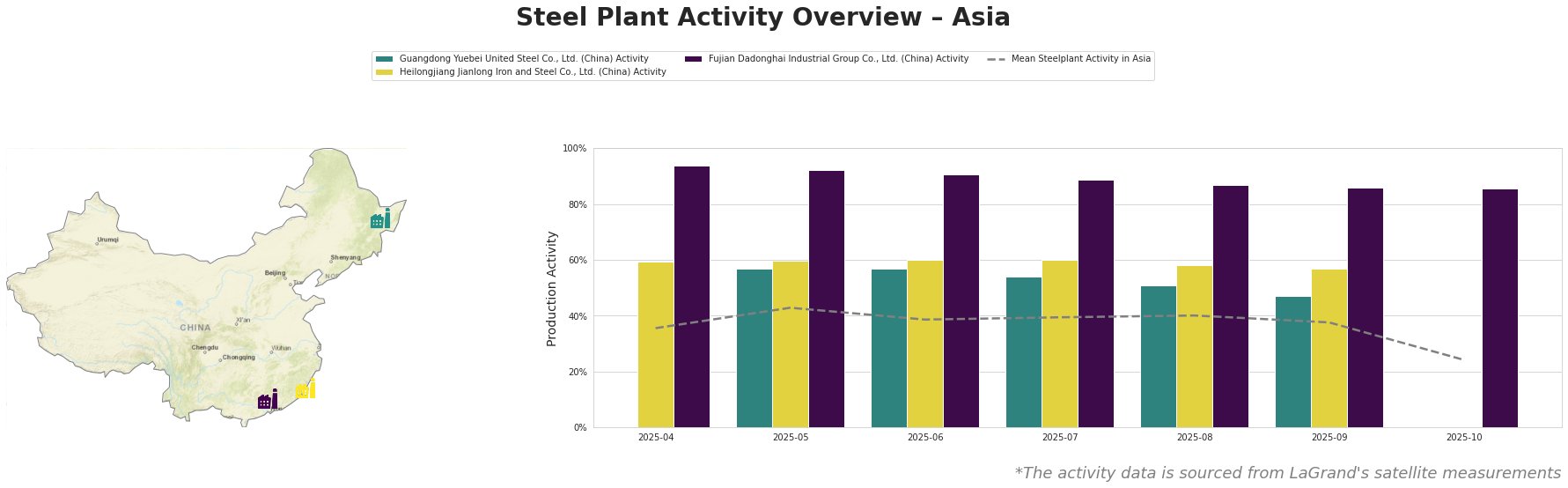

The mean steel plant activity in Asia began at 36% in April 2025, peaked at 43% in May, and then generally declined to 24% by October. Guangdong Yuebei United Steel Co., Ltd. showed a consistent decline from 57% in May to 47% in September. Heilongjiang Jianlong Iron and Steel Co., Ltd. exhibited relatively stable activity, hovering around 60% until a slight decrease to 57% in September. Fujian Dadonghai Industrial Group Co., Ltd. maintained the highest activity levels among the observed plants, starting at 94% in April and gradually decreasing to 86% by September and remaining there in October. The general downward trend in mean activity from May to October, culminating in a sharp drop in October, is notable.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant with a crude steel capacity of 2000 TTPA primarily producing rebar for the building and infrastructure sectors, experienced a decline in activity from 57% in May to 47% in September. No direct correlation can be established between this decline and the news articles provided.

Heilongjiang Jianlong Iron and Steel Co., Ltd., another integrated steel plant with a crude steel capacity of 2000 TTPA producing rebar and seamless steel tube products, maintained a relatively stable activity level around 60% between April and July, slightly decreasing to 57% in September. This plant relies on BF and BOF technologies. No direct connection to the provided news regarding Turkish export activity or US exports can be established based on the available information.

Fujian Dadonghai Industrial Group Co., Ltd., an integrated BF-BOF steel plant with a crude steel capacity of 2200 TTPA producing rebar, demonstrated the highest activity levels among the observed plants, starting at 94% in April and decreasing to 86% by September, where it remained in October. The news articles do not provide a direct explanation for this high level of production.

Based on the increased Turkish rebar exports reported in “Turkish rebar exports up 21 percent in January-August 2025“, steel buyers should closely monitor Turkish rebar pricing and availability, particularly if sourcing for projects in Yemen, Romania, or Albania, which are listed as top export destinations. The article “Turkey reduced scrap imports by 9.4% y/y in January-August 2025“, suggests potential cost savings for steel producers who can utilize alternative scrap sources or DRI, influencing pricing strategies. No explicit connection to the observed activity changes at the three specific Chinese steel plants could be established from the news data.