From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Turkish Imports Surge Amidst Activity Fluctuations

Asia’s steel market presents a mixed picture, influenced by fluctuating Turkish trade and varied plant activity levels. Recent developments in Turkey’s steel trade, as highlighted in “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025” and “Turkey’s HRC imports up five percent in Jan-Aug 2025,” coincide with observed activity at the İÇDAŞ Biga steel plant, although a direct causal relationship cannot be explicitly established based solely on this information. Similarly, the activity trends at Shandong Luli Steel Co., Ltd. and Ch’ollima Steel Complex steel plant cannot be directly linked to the provided news articles.

Measured Activity Overview

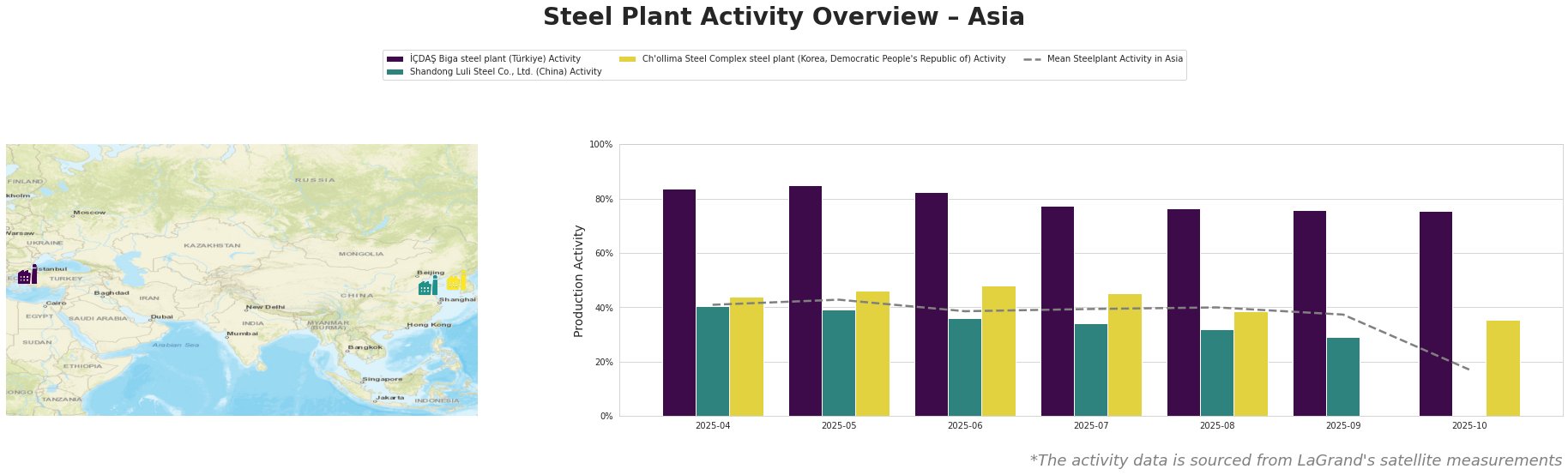

The mean steel plant activity in Asia experienced a significant drop to 17.0 in October 2025, following a period of relative stability. İÇDAŞ Biga steel plant consistently shows significantly higher activity than the Asian average. Shandong Luli Steel Co., Ltd. demonstrates a declining activity trend from April to September 2025, reaching 29.0, while the Ch’ollima Steel Complex steel plant shows fluctuating activity with a sharp drop between August and October 2025.

İÇDAŞ Biga steel plant, located in Çanakkale, Turkey, operates with an EAF-based production route and a crude steel capacity of 2.5 million tonnes per annum. It focuses on semi-finished and finished rolled products, including billets and wire rod. The plant’s activity remained consistently high throughout the observed period, hovering around the 80% mark, despite fluctuations in Turkish steel trade described in “Turkey’s wire rod exports up 1.2 percent in Jan-Aug 2025“. While this may indicate stable production, a direct causal link between the export trends and plant activity cannot be definitively established based on the provided data.

Shandong Luli Steel Co., Ltd., based in Shandong, China, utilizes an integrated BF-BOF process with a crude steel capacity of 1.4 million tonnes per annum. Its activity has consistently declined from 40.0 in April 2025 to 29.0 in September 2025. The reduction may reflect broader market dynamics in China. No direct connection to the provided news articles can be established.

Ch’ollima Steel Complex steel plant, situated in South Pyongan, North Korea, has a crude steel capacity of 760,000 tonnes per annum. The plant produces plates and wire rod. Its activity fluctuates, reaching a peak in June 2025 before declining to 35.0 in October 2025. No direct link to the provided news articles can be established.

Evaluated Market Implications

The consistent high activity at İÇDAŞ Biga, despite fluctuating trade figures, suggests a focus on domestic demand or alternative export markets. The significant increase in Turkish billet imports, as reported in “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025,” coupled with relatively stable wire rod exports (“Turkey’s wire rod exports up 1.2 percent in Jan-Aug 2025“) indicates a shift in Turkey’s steel trade balance.

Recommended Procurement Actions:

- Steel Buyers focused on wire rod in Romania, Libya and Australia: Closely monitor Turkish export prices and supply chains, due to Turkey being a key exporter of wire rod. The rising imports could potentially impact domestic pricing dynamics.

- Market Analysts focused on HRC in Turkey: closely monitor Turkish HRC imports. Since China and Russia are the largest exporters, this should be taken into account. The rising imports could potentially impact domestic pricing dynamics.

- Steel buyers of billets, blooms and semi-finished steel: closely monitor the Turkish billet, bloom and semi-finished steel markets, because Turkey has significantly increased it’s imports. This might drive price reductions on the global market. Malaysia, China, Russia, Ukraine, Vietnam, Oman and Indonesia are the largest exporting countries to Turkey, therefore their domestic prices will be impacted as well.