From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Trump Tariffs Uncertainty Lingers Amid Fluctuating Plant Activity

The Asian steel market faces continued uncertainty due to the ongoing legal challenges to US tariffs. The news articles “Trump’s tariff push overstepped presidential powers, appeals court says,” “US-Gericht erklärt Donald Trumps Strafzölle für illegal,” and “US-Berufungsgericht erklärt Großteil von Trumps Zöllen für unzulässig” highlight the potential for significant shifts in global trade dynamics, although no direct relationship to specific Asian steel plant activity levels could be immediately established via satellite observations.

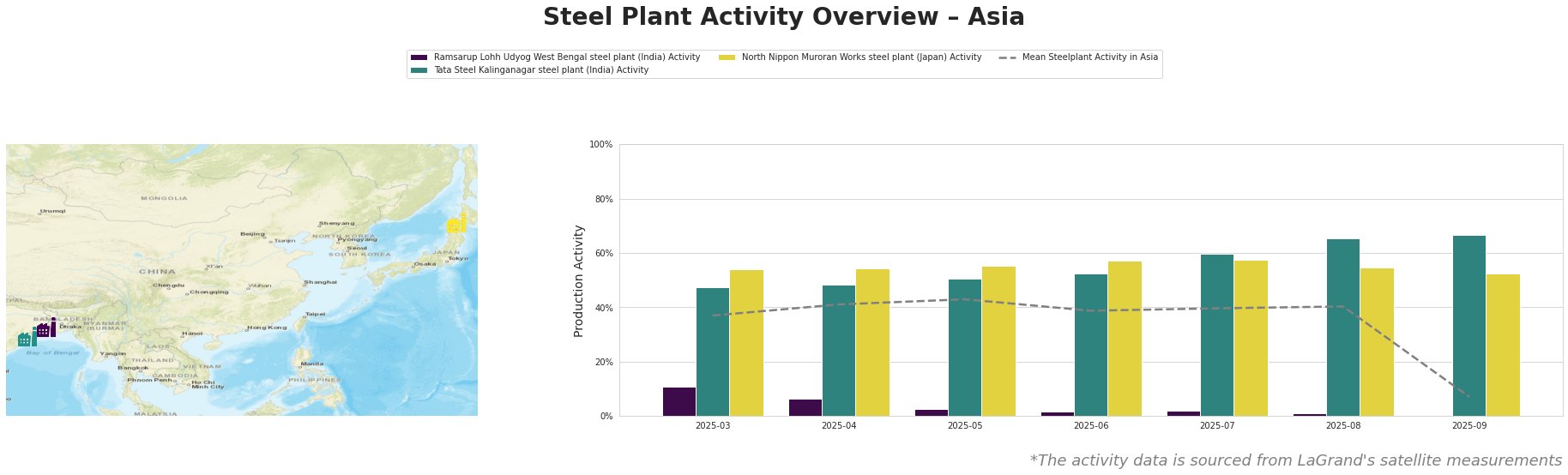

The mean steel plant activity in Asia experienced relative stability between March and August 2025, ranging from 37.0% to 43.0%. A sharp drop to 7.0% was observed in September 2025, but the reasons for this drop are not apparent from the provided news articles.

Ramsarup Lohh Udyog West Bengal steel plant: This integrated steel plant in West Bengal, India, primarily uses BF and DRI processes and has a DRI capacity of 182 ttpa. Activity at this plant has steadily declined from 11.0% in March 2025 to a low of 1.0% in August 2025 and no activity data in September. This sharp decline in activity is not directly linked to any of the provided news articles about US tariffs.

Tata Steel Kalinganagar steel plant: This integrated BF-BOF steel plant in Odisha, India, with a crude steel capacity of 3000 ttpa, shows a consistent increase in activity from 48.0% in March 2025 to 67.0% in September 2025. The plant is powered by a captive iron ore mine. This increase is not directly connected to the US tariff situation described in the news articles.

North Nippon Muroran Works steel plant: This integrated BF-BOF-EAF steel plant in Hokkaidō, Japan, has a crude steel capacity of 2598 ttpa. Its activity levels remained relatively stable between March and August 2025, fluctuating between 54.0% and 58.0%. However, a slight drop to 52.0% was observed in September 2025. There is no evident connection between this plant’s activity and the US tariff news.

Given the ongoing legal challenges to the US tariffs, as reported in “Experten-Analyse: US-Zölle: «Chancen vor Supreme Court sind eher gering»,” “FAQ: Wie es mit den US-Zöllen nach dem Gerichtsentscheid weitergeht,” and “US-Regierung wendet sich im Streit um Zölle an Obersten Gerichtshof,” steel buyers should prepare for potential price volatility and supply chain adjustments.

Recommended Actions:

* Diversify Sourcing: Considering the uncertainty surrounding US tariffs, steel buyers who rely heavily on US markets or materials influenced by those tariffs should actively explore alternative sourcing options within Asia.

* Close Monitoring of Ramsarup Lohh Udyog: Due to the persistent drop in activity observed at the Ramsarup Lohh Udyog plant, steel buyers should monitor this situation very closely. This plant is a key supplier of billets, transmission lines and wires to the energy sector.

- Monitor Legal Developments: Stay informed about the progress of the US government’s appeal to the Supreme Court. A ruling against the tariffs could lead to a rapid restructuring of global trade flows and price adjustments, while a favorable ruling would solidify the current tariff regime.