From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Tech Earnings, Tariff Concerns, and Mixed Plant Activity Signals

Asia’s steel market faces a complex landscape influenced by global trade tensions and tech sector performance, with observed steel plant activity showing recent fluctuations. The evolving trade dynamics discussed in “US stock futures dip with earnings, tariff talks in focus” are potentially influencing production strategies, though a direct correlation to plant-level activity changes is not explicitly evident.

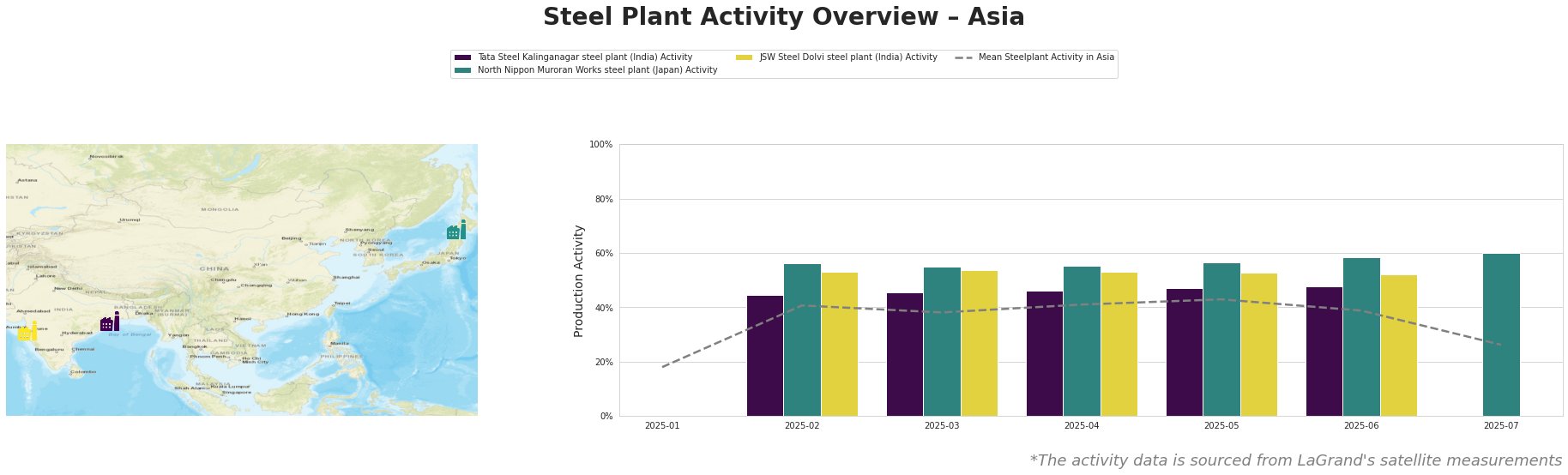

Here’s an overview of recent steel plant activity, based on satellite observations:

The mean steel plant activity in Asia peaked in May at 43%, declining to 26% in July.

Tata Steel Kalinganagar (India), an integrated BF-BOF plant with a 3 million tonne crude steel capacity, saw increasing activity from February (45%) to June (48%), followed by missing values in July. The lack of July data prevents definitive conclusions, but the earlier increasing activity, with end-user focus on the automotive industry, may be indirectly supported by news such as “Stocks Supported by Signs of US Economic Strength“, indicating a potentially positive demand environment for steel.

North Nippon Muroran Works (Japan), with a 2.598 million tonne capacity using both BF-BOF and EAF processes, shows consistent activity increases from February (56%) peaking at 60% activity in July. The plant produces semi-finished and finished rolled products, including bars and wires, for the automotive sector. The rise to 60% is significantly above the July mean of 26%. It cannot be explicitly linked to a specific news article.

JSW Steel Dolvi (India), with 5 million tonnes of crude steel capacity utilizing BF, DRI, BOF, and EAF processes, remained relatively stable. Plant activity hovered between 52% and 54% from February to June, dropping to missing values in July, with no clear relation to the provided news articles.

Evaluated Market Implications:

The potential for supply disruptions exists, particularly given the drop in overall average activity in July.

Procurement Action: Steel buyers should closely monitor the North Nippon Muroran Works steel plant (Japan), where high observed activity suggests a potential reliable supply source. However, diversification might be preferable to mitigate risk from dependence on a single plant, and closely review forecasts given the drop in overall plant activity and trade uncertainty.