From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Tata Steel Slowdown, Nippon Steel Expansion Plans, Activity Fluctuations Observed

Asia’s steel market shows signs of nuanced shifts amid global capacity adjustments. Recent steel plant activity levels and production adjustments in India, reported in “Indian company Tata Steel produced 5.26 million tons of steel in April-June,” may exert upward pressure on prices, while capacity increases signaled by “Nippon Steel to double US crude steel production within five years,” could eventually balance supply. While there are reports of Nippon Steel expanding in India, Thailand, and potentially Slovakia, this cannot directly be related to the satellite data for the Asian steel plants provided, since they all have different locations.

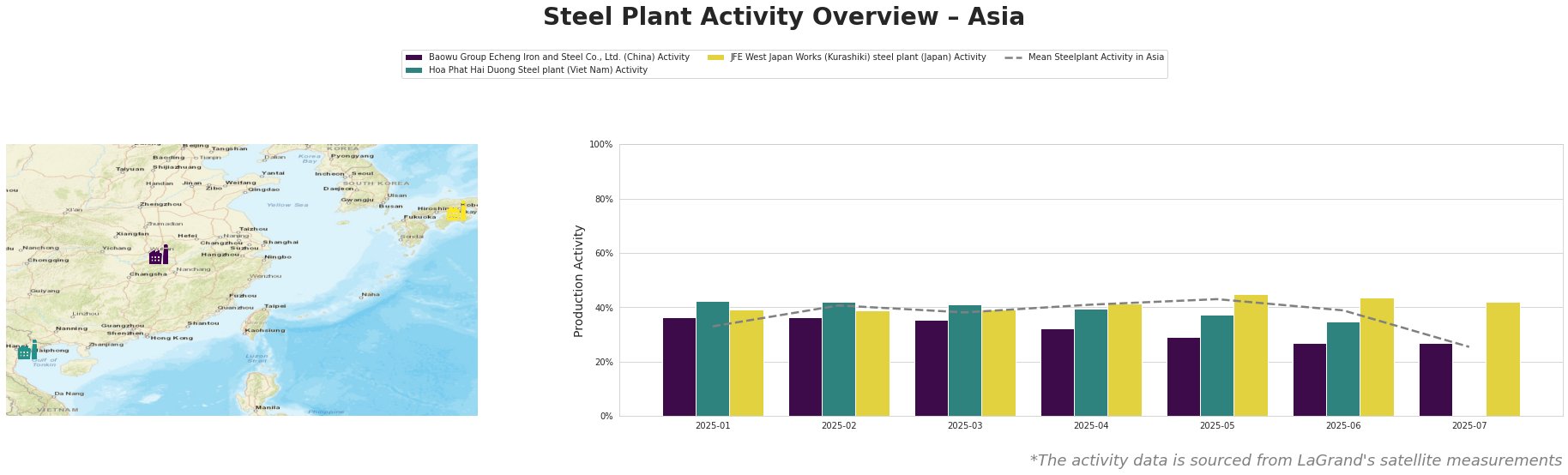

The mean steel plant activity in Asia shows a declining trend from May to July, decreasing from 43.0% in May to 25.0% in July. Baowu Group Echeng Iron and Steel Co., Ltd. shows a consistent decline, reaching 27.0% in July, its lowest observed value. Hoa Phat Hai Duong Steel plant experienced a similar decline, from 42.0% in February to 35.0% in June, with July data missing. JFE West Japan Works (Kurashiki) steel plant, after remaining stable at 39% between January and March, increased to 45.0% in May, then dropping to 42.0% in July.

Baowu Group Echeng Iron and Steel Co., Ltd., a major integrated steel producer in Hubei, China, with a crude steel capacity of 4.4 million tons and utilizing blast furnace (BF) and basic oxygen furnace (BOF) technologies to produce finished rolled products, shows a clear downward trend in activity. The plant’s activity dropped from 36.0% in January to 27.0% in July, representing the lowest recorded activity level. While the news articles highlight global production shifts, there’s no explicit news directly explaining this specific activity reduction.

Hoa Phat Hai Duong Steel plant in Vietnam, possessing a crude steel capacity of 2.5 million tons and employing integrated BF-BOF production for construction steel and hot rolled coil, experienced a gradual decline in activity from 42.0% in February to 35.0% by June. July data is unavailable. Similar to Baowu, there is no specific news available to directly explain this observed activity decline.

JFE West Japan Works (Kurashiki) steel plant, a large integrated steel plant in Japan with a crude steel capacity of 10 million tons, relying primarily on BF-BOF technology but also operating an electric arc furnace (EAF), exhibits a fluctuating activity pattern. The plant maintained consistent activity through March, followed by an increase to 45.0% in May, and a subsequent decrease to 42.0% in July. Given that the “Nippon Steel to double US crude steel production within five years” article indicates a focus on US expansion, there is no direct link to the activity levels at the Kurashiki plant.

Given the observed decrease in production at Tata Steel’s Indian facilities reported in “Indian company Tata Steel produced 5.26 million tons of steel in April-June,” potentially exacerbating supply chain tightness, especially coupled with activity declines at Baowu and Hoa Phat plants, steel buyers focusing on Indian-sourced materials should:

- Diversify Suppliers: Proactively explore alternative steel suppliers in other Asian regions to mitigate potential supply disruptions arising from reduced production at Tata Steel. Prioritize regions with stable or increasing plant activity, such as Japan, though product offerings may differ.

- Monitor Inventory Levels: Closely track current inventory levels of key steel products sourced from Tata Steel and strategically increase reserves where feasible to buffer against potential delivery delays.

- Negotiate Contract Terms: When negotiating new or renewed contracts with Tata Steel, explicitly address potential supply risks and incorporate clauses that provide flexibility in sourcing materials from alternative suppliers in case of production shortfalls. Consider price escalation clauses to account for possible price increases resulting from supply constraints.