From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Tata Steel Profit Surge Signals Strength Despite Global Tariff Concerns

Asia’s steel market demonstrates robust performance, notably highlighted by “India’s Tata Steel Reports 116% Surge in Net Profit in Q1 FY 2025–2026“, indicating strong domestic demand. No direct link can be established between the Tata Steel announcement and observed plant activity. While “ArcelorMittal expects $150 million in financial losses from US tariffs“, its global performance remains strong as outlined in “ArcelorMittal’s net profit rises sharply in H1 2025, growth expected despite tariff pressure” and “ArcelorMittal produced 29.2 million tons of steel in 1H2025“, reflecting resilience despite external pressures. No direct relationship between overall ArcelorMittal performance and the activity of the three observed plants can be established.

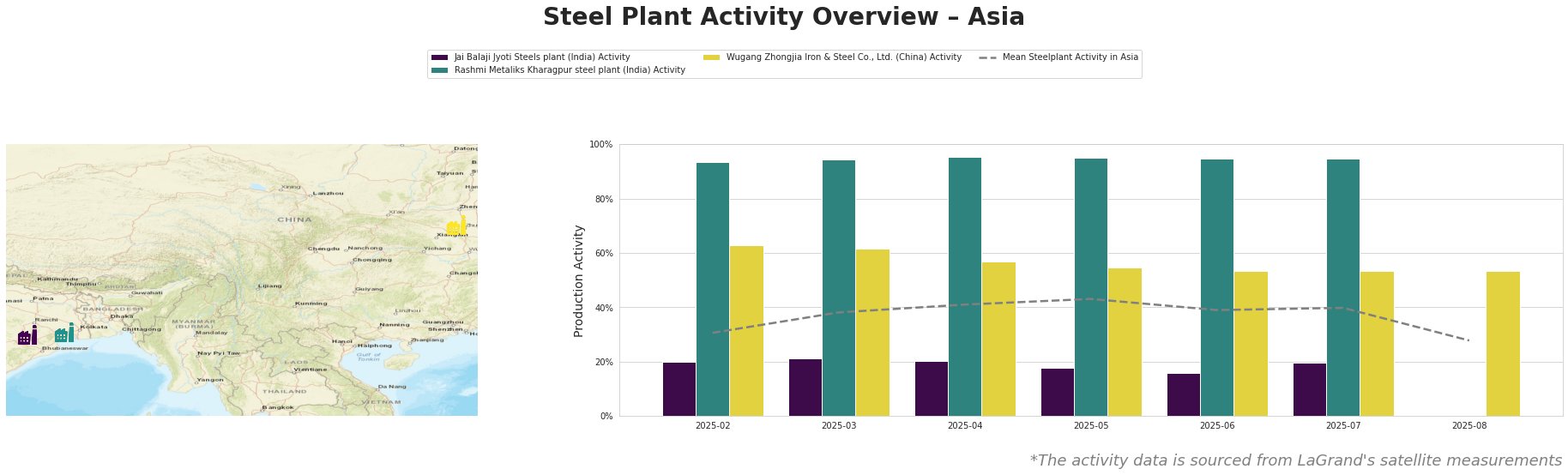

The mean steel plant activity in Asia peaked in May 2025 at 43.0% and then declined to 28.0% by August 2025. The Jai Balaji Jyoti Steels plant in India consistently showed activity levels well below the Asian mean, decreasing from 20.0% in February 2025 to 16.0% in June 2025, before rising again to 20% in July. The Rashmi Metaliks Kharagpur steel plant in India operated at very high activity levels, consistently above 93% from February to July 2025. The Wugang Zhongjia Iron & Steel Co., Ltd. in China showed a gradual decline in activity from 63.0% in February 2025 to 53.0% in July and August 2025.

Jai Balaji Jyoti Steels, an integrated DRI-EAF plant in Odisha, India, with a crude steel capacity of 92 ttpa, consistently underperforms the regional average. Activity decreased to 16.0% in June 2025, before climbing back to 20% in July. No direct link between the reported Tata Steel profit surge and the activity of Jai Balaji Jyoti Steels can be established.

Rashmi Metaliks Kharagpur, a plant in West Bengal, India, utilizing both BF and DRI processes with a 1500 ttpa crude steel capacity, consistently operated near peak capacity (93-95%) from February to July 2025. This high sustained output suggests strong demand for its product range, including DRI, pig iron, and TMT bars. No direct link between the reported Tata Steel profit surge and the activity of Rashmi Metaliks Kharagpur can be established.

Wugang Zhongjia Iron & Steel Co., Ltd., located in Henan, China, primarily focuses on ironmaking using BF technology, with an iron capacity of 1220 ttpa. The plant’s activity has steadily declined from 63.0% in February to 53.0% in July and August 2025. This decline could be indicative of broader shifts in Chinese iron production or regional economic factors. No direct link between the reported Tata Steel profit surge and the activity of Wugang Zhongjia Iron & Steel Co., Ltd. can be established.

The consistently high activity at Rashmi Metaliks Kharagpur, coupled with Tata Steel’s reported profit surge, signals continued strong demand within the Indian domestic market. Steel buyers should prioritize securing supply contracts with producers demonstrating high and stable production, like Rashmi Metaliks. Considering that “ArcelorMittal expects $150 million in financial losses from US tariffs” and is shifting production, procurement professionals should monitor ArcelorMittal’s Asian operations for potential opportunities resulting from its strategic adjustments. The declining activity at Wugang Zhongjia Iron & Steel warrants monitoring of Chinese iron supply dynamics and potential impacts on regional pricing.