From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: Vietnam Imports Rise Amidst US Export Shifts, High Plant Activity Signals Continued Growth

Asia’s steel market exhibits a very positive sentiment, fueled by rising import demand and sustained plant activity. In Vietnam, “Vietnam’s steel imports up 11.6 percent in April from March” signals growing domestic consumption, although year-to-date figures show a slight decrease. While Vietnam’s steel import increases cannot be directly linked to the satellite observed activity, it demonstrates positive economic activity. Conversely, shifting US trade dynamics, including “US iron and steel scrap exports down 11.9 percent in March from February” and “US steel exports up 3.6 percent in March from February,” highlight evolving global supply chains, with the US potentially re-routing exports to other markets, impacting Asian availability.

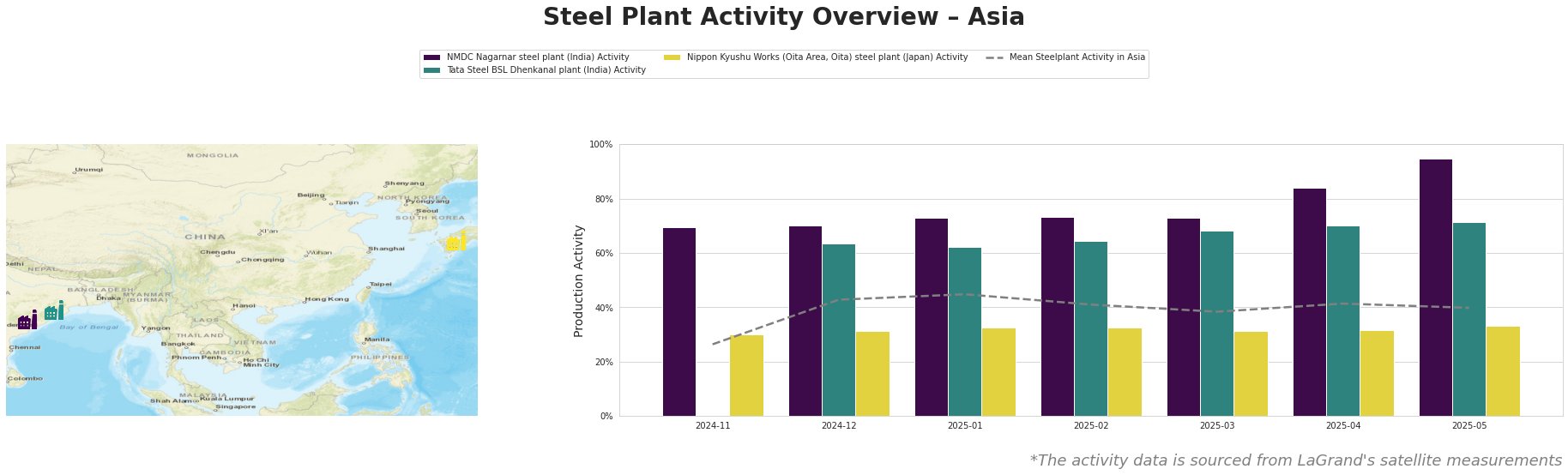

The mean steel plant activity in Asia has shown fluctuating but overall positive trends in the past months, hovering around 40-45% but significantly increasing from November 2024, where it was at 26%.

The NMDC Nagarnar steel plant in Chhattisgarh, India, an integrated BF-BOF plant with a 3 million tonne crude steel capacity, shows a strong upward trend, reaching 95% activity in May 2025, significantly above the Asian average. This high activity level doesn’t have a direct connection to the cited news, but is indicating strong domestic output. The Tata Steel BSL Dhenkanal plant in Odisha, India, an integrated BF and DRI plant with a 5.6 million tonne crude steel capacity, maintained high activity levels above the Asian average, peaking at 71% in May 2025. There is no direct connection to the cited news articles, however the activity indicates strong domestic performance. Activity at the Nippon Kyushu Works (Oita Area, Oita) steel plant in Japan, an integrated BF-BOF plant with a 10 million tonne crude steel capacity, has remained relatively stable at around 30-33% since November 2024, below the average, suggesting consistent, though not exceptional, production levels. No direct connection can be established between this activity level and the provided news articles.

The increase in Vietnam’s steel imports aligns with the rise in scrap imports (“Vietnam’s steel imports up 11.6 percent in April from March”), potentially driven by EAF-based steel production. Conversely, decreased US scrap exports (“US iron and steel scrap exports down 11.9 percent in March from February”) might indicate tighter global scrap supply, potentially increasing scrap prices for Asian EAF producers. The rise of slab imports in the USA (“US slab imports up 11.8 percent in March from February“) indicates a demand for slabs that may impact supply chains in Asia. “Pakistan’s scrap imports up 1.7 percent in Apr from Mar“, with a large year-on-year increase, shows that the need for raw materials is still present.

Evaluated Market Implications:

-

Potential Supply Disruptions: Decreasing US scrap exports could lead to higher scrap prices in Asia, impacting EAF-based steel producers. Focus for steel buyers should be on markets that can still provide competitive price points.

-

Recommended Procurement Actions: Steel buyers should closely monitor scrap price trends and explore alternative sources. Given the strong activity at NMDC Nagarnar, coupled with rising domestic steel demand in Vietnam, buyers should consider securing supply agreements with Indian producers for hot rolled coils, sheets, and plates, especially as NMDC is ResponsibleSteel certified. Given that US steel exports also increased, steel buyers may want to watch that market in case of increasing import opportunities.