From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: NEV Demand and South Korean Auto Boost Drive Positive Outlook

Asia’s steel market exhibits a very positive sentiment, driven by surging demand in the electric vehicle (EV) sector and increased support for the automotive industry in South Korea. The activity changes at steel plants can be directly, or indirectly, attributed to these developments. China’s NEV sector growth, as highlighted in “CAAM: Sales of new energy vehicles in China up 32.7 percent in Jan-Oct 2025,” is expected to sustain steel demand. South Korea’s policy shift, detailed in “S Korea expands car support, plans trade-in EV policy,” further reinforces this positive outlook.

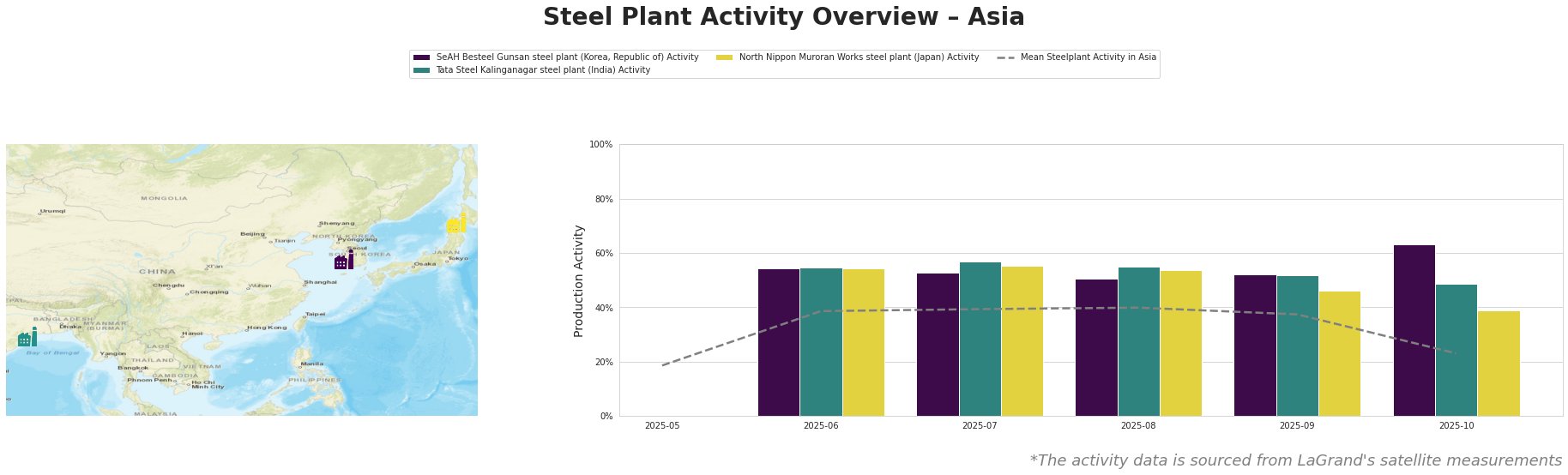

Measured Activity Overview

The mean steel plant activity in Asia saw a peak in August 2025 at 40%, before dropping to 23% in October 2025. SeAH Besteel Gunsan stood out in October with a considerable increase to 63%.

SeAH Besteel Gunsan steel plant: This South Korean plant, equipped with EAF technology and a capacity of 2.1 million tonnes of crude steel, primarily produces special steel, heavy forged steel, and auto parts. The plant’s activity initially decreased from 54% in June to 51% in August, then increased significantly to 63% in October. This recent increase in activity aligns with the South Korean government’s expanded support for the automotive industry and EV adoption detailed in “S Korea expands car support, plans trade-in EV policy“. The policy changes in South Korea could lead to more local demand and less export.

Tata Steel Kalinganagar steel plant: Located in India, this integrated steel plant uses BF/BOF technology with a 3 million tonne crude steel capacity. Activity was at 55% in June and July, then peaked at 57% in July before decreasing to 49% in October. While the “IEA’s WEO brings back no-peak oil scenario” highlights India as a key growth market, no direct connection can be established between the plant’s activity and the article.

North Nippon Muroran Works steel plant: This Japanese plant uses both BF/BOF and EAF technologies, producing 2.598 million tonnes of crude steel per year, with a focus on bars and wires for the automotive sector. The plant’s activity remained relatively stable around 54-55% from June to August, then decreased to 39% in October. No direct connection can be established between this drop and the provided news articles.

Evaluated Market Implications

The surge in China’s NEV sales, as reported in “CAAM: Sales of new energy vehicles in China up 32.7 percent in Jan-Oct 2025,” and the South Korean government’s increased automotive support, documented in “S Korea expands car support, plans trade-in EV policy,” are key drivers for Asian steel demand.

- Potential Supply Disruptions: Monitor potential shifts in South Korean steel exports due to increased domestic EV demand stimulated by new policies. The drop in overall plant activity across Asia in October 2025 needs further investigation.

- Recommended Procurement Actions:

- Steel buyers should prioritize securing long-term contracts with South Korean steel producers like SeAH Besteel, given the potential for increased domestic demand.

- Market analysts should closely monitor developments in South Korea, considering the impact of increasing local demand on export of steel.

- Procurement professionals should hedge against potential price increases driven by higher demand for automotive-grade steel, specifically from South Korean producers.