From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: China’s Production Cuts Drive Global HRC Price Hikes

Asia’s steel market is experiencing a positive upturn, primarily driven by factors influencing China’s production and global hot-rolled coil (HRC) prices. The market is influenced by “Global steel HRC prices hit highs” and “Global steel prices for HRC have reached a maximum“, indicating a price surge directly linked to Chinese government production cuts and incentives. Satellite data, as described below, only weakly confirms these factors.

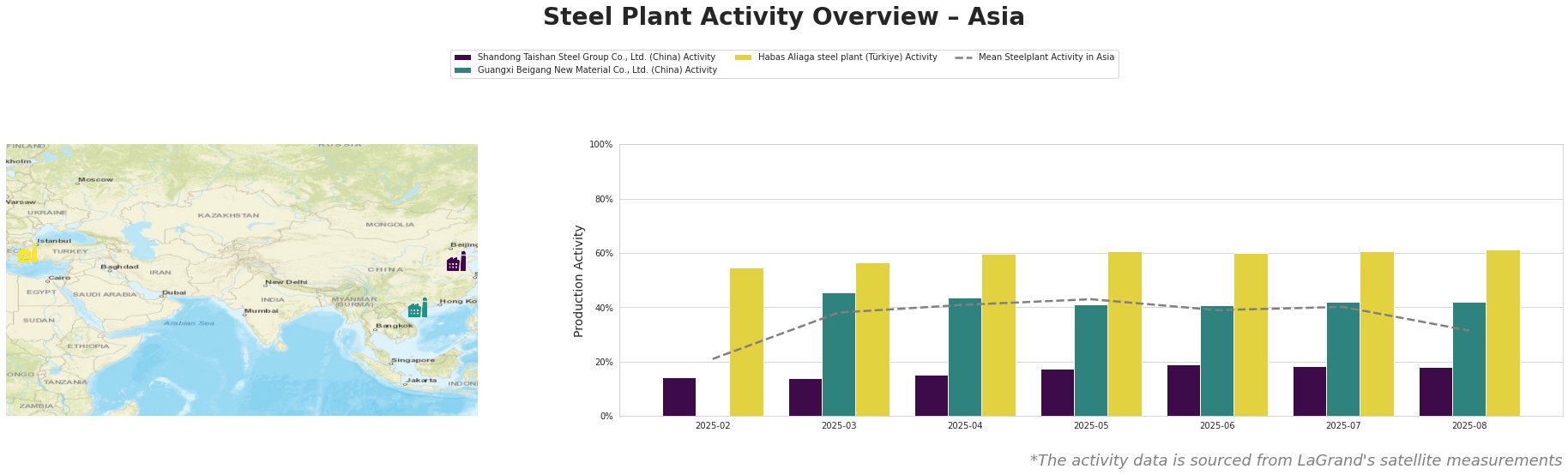

The mean steel plant activity in Asia shows a fluctuating but overall positive trend from February to May, peaking at 43.0% before declining to 31.0% in August. Shandong Taishan Steel Group’s activity shows a slow but steady rise in activity throughout the observed period, peaking at 19% in June and remaining close to this level in the following months, whereas the other two plants in this report are operating at much higher levels. Guangxi Beigang New Material Co.’s activity increased significantly from March (45%) to April (44%), then remained relatively stable. Habas Aliaga’s activity in Turkey remained very high throughout the observed period (55% to 61%). The late drop in mean activity in Asia in August cannot be directly correlated with specific events reported in the news articles.

Shandong Taishan Steel Group Co., Ltd., an integrated BF steel producer with a crude steel capacity of 5000 thousand tonnes per annum (ttpa) and hot-rolled coil production, showed a slow but consistent increase in observed activity from 14% in February/March to 18% in August. While “Global steel HRC prices hit highs” highlights Chinese government production cuts, no direct correlation can be established between these cuts and the observed steady increase in Shandong Taishan’s plant activity.

Guangxi Beigang New Material Co., Ltd., another integrated BF steel producer focused on EAF production with a crude steel capacity of 3400 ttpa and producing hot and cold-rolled coil, operated at a high and consistent level during the observed period from March to August. While there is a slight drop in activity in May, it recovers quickly. There is no clear news information linking this plant to the current market situation.

Habas Aliaga steel plant, an EAF-based steel producer in Turkey with a crude steel capacity of 4500 ttpa, specializing in billets, slabs, and hot-rolled coil, maintained consistently high activity levels, ranging from 55% to 61% throughout the observed period. No direct connection between the activity levels and the news articles can be established.

Given the rising global HRC prices driven by Chinese production cuts as detailed in “Global steel HRC prices hit highs” and “Global steel prices for HRC have reached a maximum,” and despite the observed stable activity levels at Guangxi Beigang, steel buyers should anticipate potential supply disruptions and increased costs, particularly for HRC sourced from China. Steel buyers should immediately evaluate alternative HRC sources outside of China, in particular Turkish sources, and consider hedging strategies to mitigate price volatility in the short term. Monitoring trade policies impacting Chinese steel exports and alternative supply dynamics is essential.