From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges Amid US-Japan Trade Deal: Plant Activity Shows Mixed Signals

Asia’s steel market exhibits a very positive sentiment, influenced by the recent US-Japan trade agreement. The impact of the “US, Japan reach trade deal; steel tariffs remain” is expected to boost demand. While the “Japan’s steel industry welcomes tariff deal with US“, direct links between this welcome and observed activity levels are difficult to establish definitively from satellite data alone.

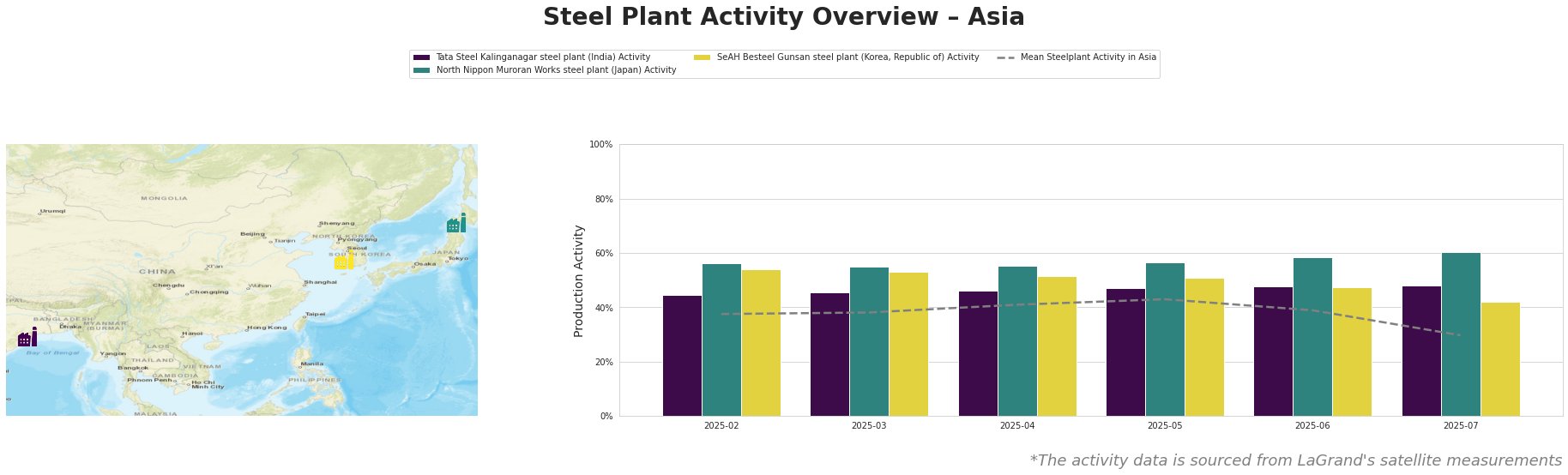

Overall, the mean steel plant activity in Asia shows a decline in July, reaching 30%, after peaking at 43% in May. Tata Steel Kalinganagar steel plant shows consistently average increase over the observed period, peaking at 48% in June, remaining constant in July. North Nippon Muroran Works steel plant shows the highest activity of all plants, peaking at 60% in July. SeAH Besteel Gunsan steel plant shows a decline since February, reaching its lowest point in July at 42%.

Tata Steel Kalinganagar, an integrated steel plant in Odisha, India, with a 3000 thousand tonnes per annum (ttpa) BOF capacity, shows a steady activity increase, reaching 48% in June and remaining constant in July. This increasing activity does not directly correlate to the US-Japan trade deal news, suggesting other market forces are at play. The plant’s focus on finished rolled products for the automotive sector positions it to benefit from increased regional automotive demand, but a direct link cannot be established based on available information.

North Nippon Muroran Works, located in Hokkaidō, Japan, operates both BOF (1448 ttpa) and EAF (1149 ttpa) processes within its integrated steel plant. The plant’s activity steadily increased, reaching 60% in July, which is the highest value recorded among the observed plants. Given the positive sentiment expressed in “Japan’s steel industry welcomes tariff deal with US”, this increased activity could be a response to anticipated demand increases following the trade agreement. Furthermore, the plant’s production of bars and wires, with a focus on the automotive sector, could be benefiting from the reduced tariffs on Japanese auto exports to the US, as reported in “Japan secures tariff reduction from US, pledges $550 billion investment“.

SeAH Besteel Gunsan steel plant, situated in North Jeolla, South Korea, utilizes a 2100 ttpa EAF process. Its activity declined from 54% in February to 42% in July. Despite the overall positive market sentiment, the news articles do not provide a direct explanation for this decline. Its production of special steel and auto parts suggests potential exposure to the automotive industry, but the decrease in activity indicates other factors influencing production, for which, a clear link cannot be established based on provided information.

The US-Japan trade agreement, while fostering a positive outlook, presents nuanced implications. The news item “US, Japan reach trade deal; steel tariffs remain” highlights that the 50% tariffs on steel imports remain unchanged, potentially limiting the upside for Japanese steel exports to the US. The agreement does not address the 50% tariffs on steel, as reported in “Trump announces trade agreement with Japan“.

- Potential Supply Disruption: The decline in activity at SeAH Besteel Gunsan steel plant, a key special steel producer, could lead to potential supply constraints for specific grades of steel, particularly impacting the automotive sector.

- Procurement Actions:

- Steel buyers should closely monitor the supply situation from South Korean special steel producers and explore alternative sources, given the activity decline at SeAH Besteel Gunsan.

- Given the increased activity at North Nippon Muroran Works, steel buyers reliant on Japanese steel should engage with Nippon Steel to secure supply commitments, particularly for bars and wires used in automotive applications.

- Monitor US steel import policies to understand how the news reported in “US, Japan reach trade deal; steel tariffs remain” may impact the market dynamics of steel.