From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge: JFE-JSW JV Fuels Optimism Amidst Production Fluctuations

Asia’s steel market displays a very positive outlook, driven by strategic joint ventures and expanding production capacities, even as individual plant activity experiences fluctuations. The planned expansion in India, highlighted in “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion,” and reinforced by “Japan’s JFE Steel to invest $1.75 billion in JV with JSW Steel to run BPSL mill” and “JFE-JSW integrated steel plant joint venture“, aims to capitalize on India’s growing steel demand. While these news articles strongly indicate future growth, no direct immediate impact on satellite-observed plant activity is yet discernible in the current data.

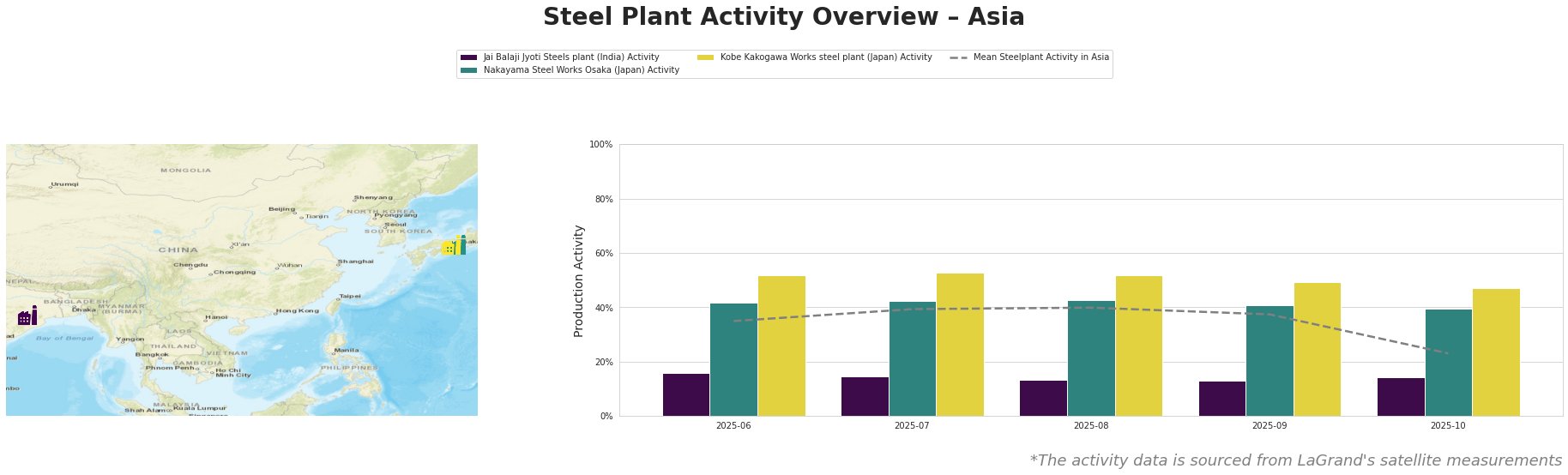

The average steel plant activity in Asia declined significantly from 40% in August to 23% in October.

Jai Balaji Jyoti Steels plant, located in Odisha, India, has a capacity of 92 ttpa for EAF crude steel and DRI iron production. Despite being an integrated DRI plant, the satellite data reveals consistently low activity levels, ranging from 13% to 16% between June and October 2025, substantially below the Asian average. Although “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion” indicates investment in Odisha, no direct link can be established to the activity of this plant based on the available data and news.

Nakayama Steel Works Osaka, based in Kansai, Japan, focuses on electric arc furnace (EAF) steel production with a 660 ttpa capacity, producing coils, plates, bars, and wire rods primarily for the building, energy, and transport sectors. Observed activity remained relatively stable, fluctuating between 40% and 43%, consistently above the Asian average. There are no news articles provided that could be explicitly linked to these activity patterns.

Kobe Kakogawa Works steel plant, also in Kansai, Japan, operates as an integrated BF-BOF steel plant with a large 6000 ttpa crude steel capacity and 11953 ttpa iron capacity, supplying plates, sheets, and wire rods to the automotive, building, and transport industries. Activity decreased from 52% in June to 47% in October, remaining above the Asian average, but showing a downward trend. There is no clear connection between this activity drop and any of the provided news articles.

The news of significant investment and capacity expansion in India, especially within the Odisha region, coupled with stable to declining production in Japan suggests a possible shift in steel production focus. Procurement professionals should closely monitor spot prices for steel, especially coils, plates, bars and wire rods from Japanese producers, due to their recent production decreases, to detect possible price increases. They should also consider diversifying procurement to Indian producers in the medium-term, as the JFE-JSW joint venture comes online, potentially creating a more competitive market. Focus procurement efforts especially for JSW Kalinga Steel Limited to secure long-term supply agreements, as these could offer favorable terms given the increased production capacity driven by the JFE-JSW partnership.