From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge: Chinese Export Rise & Rebar Price Hike Fuel Optimism

Asia’s steel market demonstrates a very positive sentiment, driven by rising Chinese exports and domestic price increases. According to “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025“, rebar prices saw a significant increase, correlating with observed activity increases in the Ansteel Group Chaoyang Steel & Iron Co., Ltd. as described below. The news article “China increased steel exports by 1.6% m/m in July” indicates an increase in export activity, while “Stocks of main finished steel products in China up 1.3 percent in late July 2025” shows an increase in overall steel stocks. However, no direct relationship between the described stock increase and observed plant activity levels can be established.

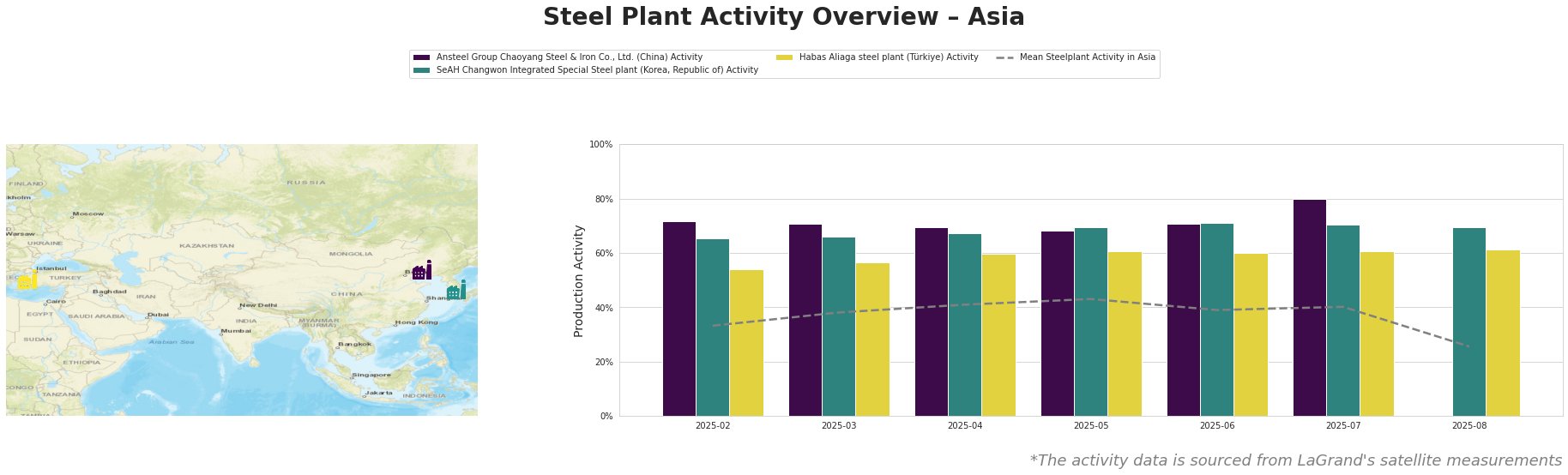

From February to July 2025, the mean steel plant activity in Asia showed a fluctuating but generally increasing trend, peaking in May at 43% before declining sharply to 26% in August. Ansteel Group Chaoyang Steel & Iron Co., Ltd. consistently operated above the mean, with a notable peak of 80% in July. SeAH Changwon Integrated Special Steel plant also maintained activity levels above the mean, showing relative stability from May to July at around 70%. Habas Aliaga steel plant exhibited the most stable activity, hovering around 60% throughout the period. The sharp drop in the average activity level from July to August cannot be directly attributed to specific news events but represents a significant shift in the market.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, China, is an integrated steel plant with a crude steel capacity of 2.1 million tonnes per annum (mtpa), primarily utilizing basic oxygen furnace (BOF) technology. It mainly produces finished rolled products like steel plate and steel pipe. Activity at Ansteel declined from 72% in February to 68% in May, followed by an increase, reaching 80% in July. This peak in July might be connected to the “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025”, suggesting increased production to meet rising demand and capture higher prices. The satellite data cannot reveal specific changes in production volumes for steel plate and steel pipes, however.

SeAH Changwon Integrated Special Steel plant, located in South Gyeongsang, South Korea, is an electric arc furnace (EAF) based plant with a crude steel capacity of 1.2 mtpa. It produces stainless steel, wire rod, coil, and seamless pipe for the automotive, energy, and transport sectors. Activity at SeAH Changwon was relatively stable throughout the observed period, fluctuating between 65% and 71%. No explicit connection between activity and the named news articles could be established.

Habas Aliaga steel plant, located in İzmir, Türkiye, is an EAF-based plant with a crude steel capacity of 4.5 mtpa. It produces semi-finished and finished rolled products, including billet, slab, deformed bar, wire rod, and hot rolled coil. Activity at Habas Aliaga remained relatively stable throughout the period, fluctuating narrowly around 60%. No explicit connection between activity and the named news articles could be established.

The increase in Chinese steel exports and rising domestic prices for rebar, coupled with high observed activity levels at Ansteel, suggest potential supply constraints within China. However, the lack of a direct connection between the general rise in steel inventories in China and the specific product output of Ansteel limits implications for specific product segments. For steel buyers and analysts, the recommendation is to closely monitor Chinese rebar prices and export volumes, as further increases could signal tighter supply and necessitate diversifying procurement sources or hedging price risks. The observed drop in mean steel plant activity in Asia from July to August further necessitates monitoring for potential future price fluctuations. Buyers of stainless steel, wire rod, coil, and seamless pipe from SeAH Changwon may expect stable supply.