From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge Anticipated: US Import Data and Plant Activity Signal Strong Demand

Asia’s steel market exhibits a very positive sentiment, potentially influenced by increased US import activity and varying regional plant operations. US import increases reported in “US line pipe imports up 44.3 percent in March from February,” “US standard pipe imports up 18.8 percent in March from February,” and “US tin plate imports down 5.1 percent in March from February” may be partially driven by Asian steel production. However, direct links between these news articles and observed activity levels at specific Asian steel plants could not be definitively established.

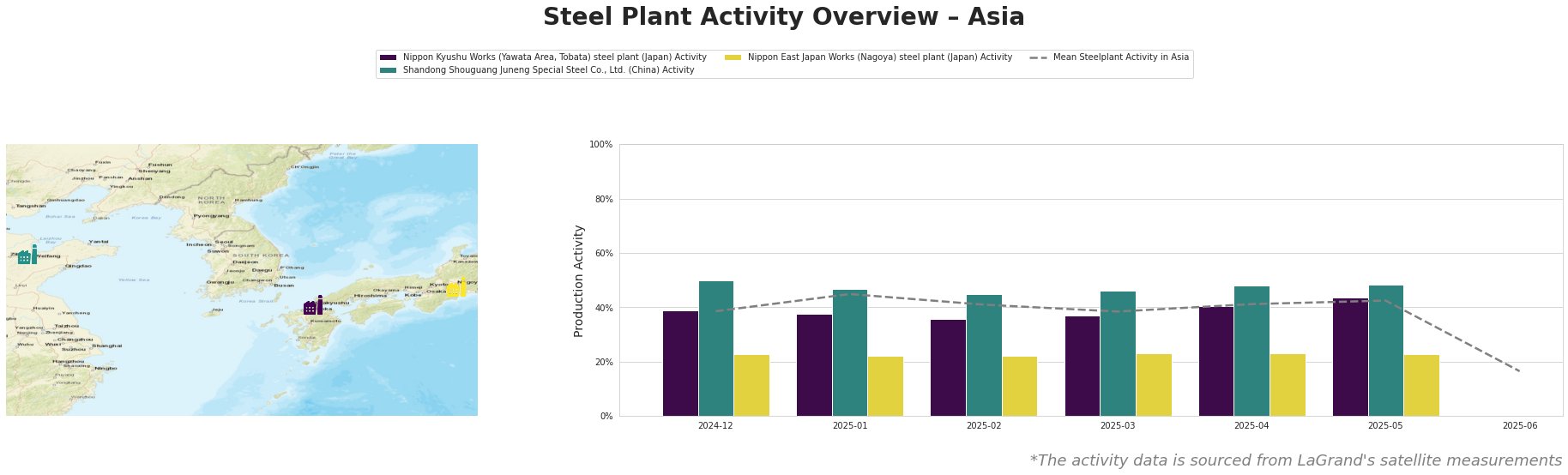

The mean steel plant activity in Asia fluctuated between 38% and 45% from December 2024 to May 2025, before dropping significantly to 16% in June 2025.

Nippon Kyushu Works (Yawata Area, Tobata) steel plant activity remained relatively stable, ranging from 36% to 43%, peaking in May 2025. This integrated (BF) plant, with a crude steel capacity of 3727 ttpa and producing thin plate, steel bars and wires, rail, steel sheet pile and steel pipe, showed activity levels slightly below the Asian mean. No direct correlation between its activity and the cited news articles could be established.

Shandong Shouguang Juneng Special Steel Co., Ltd., an integrated (BF) plant producing finished rolled products including bearing steel, high-quality carbon structural steel, alloy structural steel, billet steel, sucker rod steel, anchor chain steel, spring steel, carbon tool steel, automotive steel, petroleum casing and line pipe, displayed activity ranging from 45% to 50% during the monitored period, consistently exceeding the Asian mean. Its production includes petroleum casing and line pipe, potentially linking to increased US line pipe imports reported in “US line pipe imports up 44.3 percent in March from February,” although a direct causal link cannot be proven.

Nippon East Japan Works (Nagoya) steel plant activity remained consistently low at 22-23% throughout the observed period, significantly below the Asian average. This integrated (BF) plant, with a crude steel capacity of 6000 ttpa, produces thin plates, thick plates, steel pipes, and cast iron. There is no clear correlation between this plant’s production or output and the recent trade-related news, although it is a pipe producer.

Evaluated Market Implications:

The drop in mean steel plant activity in Asia in June 2025 (from 42% to 16%) without any additional information about specific steel plant activities is worrisome.

- Potential Supply Disruptions: The significant drop in overall activity levels in June suggests a potential supply disruption in the Asian steel market.

- Procurement Actions: Steel buyers should closely monitor the recovery of overall steel plant activity in Asia to pre-emptively avoid potential undersupply and resulting price increases. Furthermore, monitoring and understanding the impact of US import/export activity as stated in “US line pipe imports up 44.3 percent in March from February”, “US standard pipe imports up 18.8 percent in March from February”, “US tin plate imports down 5.1 percent in March from February” and “US OCTG exports up 0.62 percent in March from February” will be important to gauge supply side risks.