From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge: Ansteel Activity Strong Amidst EU-US Trade Tensions

Steel markets in Asia exhibit a very positive sentiment, particularly driven by robust production at key Chinese steel plants. Recent shifts in steel plant activity occur amidst ongoing trade discussions between the EU and US, although their direct impact on Asia remains limited. The observed activity cannot be directly linked to trade negotiations reported in “The US demands «balanced» EU digital rules in exchange for lowering steel tariffs,” “EU: No tariff agreement expected in the first trade talks with the US,” and “EU-US steel pact hinges on digital rules: Lutnick“.

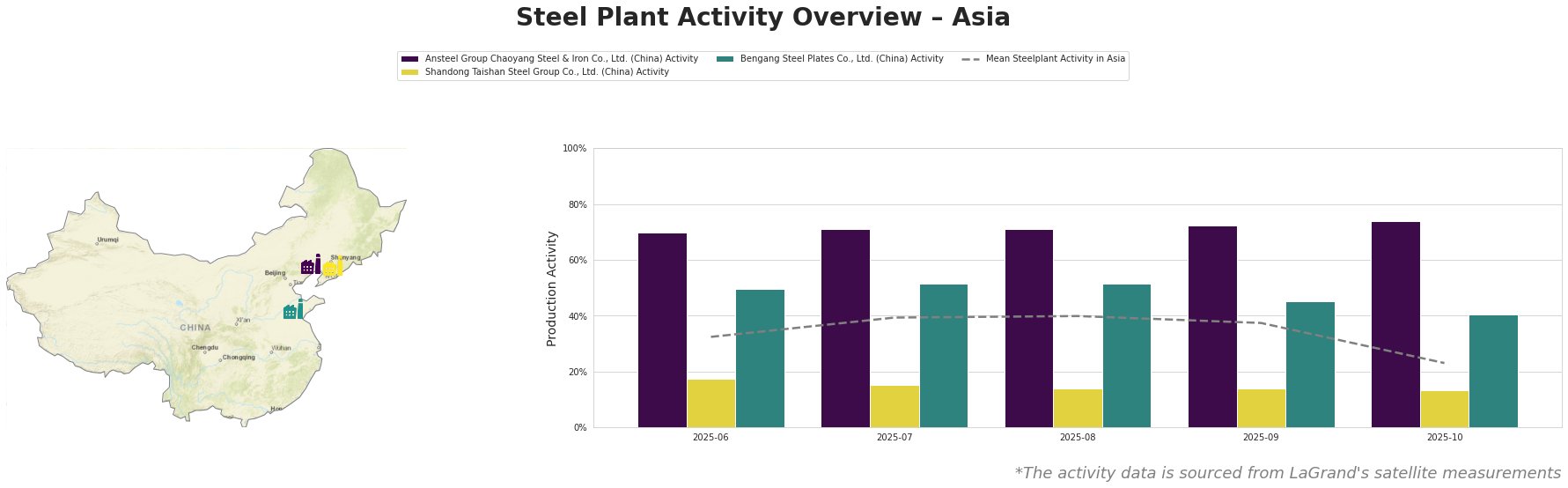

The mean steel plant activity in Asia declined sharply from 40% in August 2025 to 23% in October 2025. In contrast, activity at Ansteel Group Chaoyang Steel & Iron Co., Ltd. displayed a consistently high activity level and has steadily increased from 70% in June 2025 to 74% in October 2025. Shandong Taishan Steel Group Co., Ltd. consistently reports the lowest activity of the measured steel plants. Bengang Steel Plates Co., Ltd. activity closely tracks the overall mean but is consistently higher and drops to 40% in October 2025.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., an integrated BF-BOF steel plant in Liaoning with a crude steel capacity of 2.1 million tonnes, has shown strong and increasing activity (70% to 74% between June and October 2025), significantly above the Asian average. As an integrated plant specializing in steel plate and pipe products and holding ResponsibleSteel certification, its sustained output suggests continued regional demand, but no explicit connection to the EU-US trade negotiations can be established.

Shandong Taishan Steel Group Co., Ltd., another integrated BF-BOF/EAF steel plant in Shandong with a 5 million tonnes crude steel capacity, has exhibited persistently low activity levels (17% to 13% between June and October 2025). Given its ResponsibleSteel certification and production of hot/cold rolled coil and stainless steel, this low activity suggests potential supply-side constraints or strategic production adjustments. However, there’s no direct link to the named news articles.

Bengang Steel Plates Co., Ltd., based in Liaoning, is a major integrated steel producer with a crude steel capacity of 12.8 million tonnes. Its activity decreased from 50% in June to 40% in October, while remaining above the mean Asian activity for most of the measured time frame. Specializing in automotive, home appliance, and pipeline steel, any prolonged decrease in activity could impact these key downstream sectors. The observed activity cannot be directly linked to EU-US trade negotiations.

Evaluated Market Implications:

The sustained high activity at Ansteel, coupled with the decline at Bengang, suggests a possible shift in regional supply dynamics. While EU-US trade discussions are ongoing, they do not appear to directly influence these specific Asian steel plants based on available information.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor Bengang Steel Plates Co., Ltd.’s production for potential supply disruptions, particularly if reliant on their specialized steel plate products. Diversify sources or negotiate forward contracts to mitigate risks. Given the continued high activity levels at Ansteel Group Chaoyang Steel & Iron Co., Ltd, explore securing additional supply from this supplier.

- Market Analysts: Investigate the reasons behind the activity decline at Shandong Taishan Steel Group Co., Ltd. to determine if it’s a temporary adjustment or a longer-term trend. Analyze regional inventory levels and downstream demand to assess potential price impacts.