From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Strong Rebar Production Amid Base Oil Dynamics

Asia’s steel market shows robust rebar production, particularly in China and Pakistan, occurring alongside shifting base oil trade flows that may indirectly influence energy costs for steel production. “South Korea’s Sep base oil exports hit 11-month high,” “India’s Group I heavy-grade base oil prices fall in Oct,” and “Singapore’s base oil imports hit four-year high in Sep,” reflect a complex energy market potentially impacting steel plant operational costs, though no direct causal link can be established based on the provided information. These energy market dynamics occur in parallel with the activity data shown below.

Monthly Activity Levels:

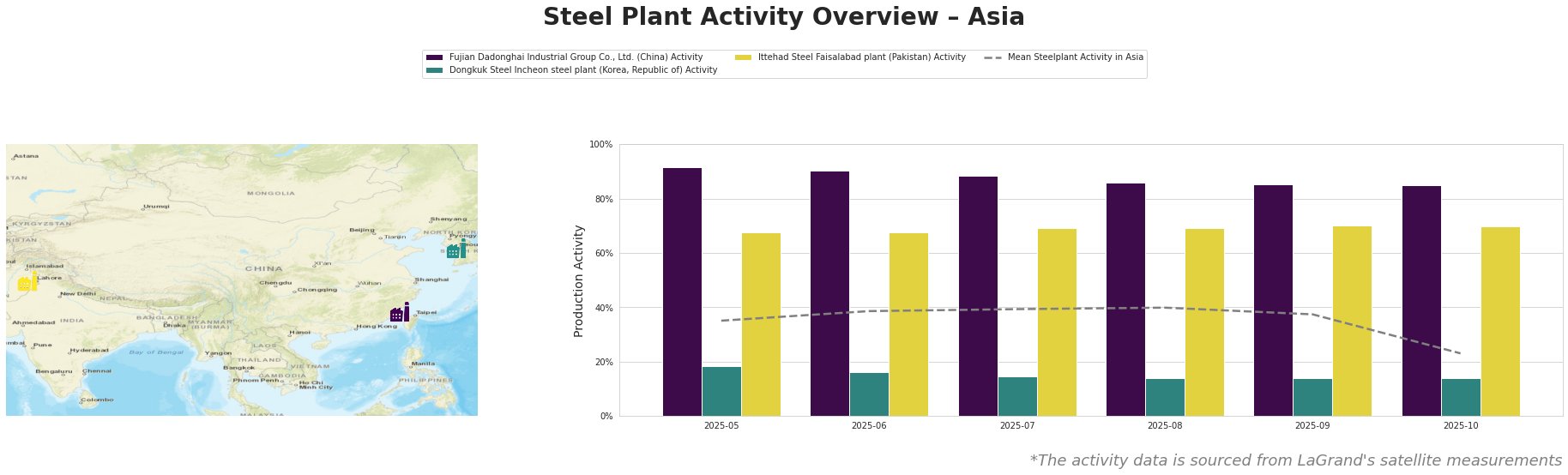

The average steel plant activity in Asia experienced a significant drop in October to 23%, after hovering around 35-40% in the preceding months. Fujian Dadonghai Industrial Group Co., Ltd. maintained consistently high activity, while Dongkuk Steel Incheon steel plant reported very low but stable values. Ittehad Steel Faisalabad plant also showed relatively strong and stable output throughout the period.

Fujian Dadonghai Industrial Group Co., Ltd., a major integrated steel producer in Fujian, China, utilizes BF and BOF technologies with a crude steel capacity of 2.2 million tonnes per annum, primarily producing rebar. The plant’s activity remained exceptionally high at 85-92% from May to October, significantly exceeding the Asian average. This sustained high output level suggests strong domestic demand for rebar, but no specific connections to the provided news articles regarding base oil market changes can be directly established.

Dongkuk Steel Incheon steel plant, located in South Korea’s Seoul National Capital Area, focuses on EAF-based steel production with a capacity of 2.2 million tonnes per annum, also producing rebar. Its activity remained consistently low at 14-18% throughout the observed period. While “South Korea’s Sep base oil exports hit 11-month high,” no direct relationship between these base oil exports and the low activity at the Dongkuk Steel Incheon plant can be confirmed based on available data.

Ittehad Steel Faisalabad plant, an EAF-based rebar producer in Pakistan with a capacity of 400,000 tonnes per annum, maintained a stable activity level between 67% and 70% from May to October. This stable production, exceeding the Asian average until October, suggests consistent demand for rebar in Pakistan, possibly supported by construction activities. Although “India’s Group I heavy-grade base oil prices fall in Oct”, it is unclear whether that has a link to the operations in Pakistan.

Evaluated Market Implications:

The consistent high production activity at Fujian Dadonghai suggests a reliable supply of rebar from this producer. The stable activity at Ittehad Steel Faisalabad plant indicates consistent rebar availability in the Pakistan market. However, the average steel plant activity in Asia had a significant drop in October. This decline, coupled with fluctuating base oil prices described in “India’s Group I heavy-grade base oil prices fall in Oct” and “Singapore’s base oil imports hit four-year high in Sep,” may indicate emerging challenges in the broader Asian steel market, but warrants cautious monitoring.

Recommended Procurement Actions:

- Monitor Energy Costs: Steel buyers should closely monitor base oil price trends, particularly in India (“India’s Group I heavy-grade base oil prices fall in Oct”) and Singapore (“Singapore’s base oil imports hit four-year high in Sep”), as these may indirectly influence energy costs for EAF-based steel producers, potentially impacting rebar prices.

- Diversify Suppliers (South Korea): Given the consistently low activity at Dongkuk Steel Incheon, steel buyers reliant on this plant for rebar should consider diversifying their supply base to mitigate potential supply disruptions.

- Assess Regional Rebar Demand: The high activity at Fujian Dadonghai suggests strong rebar demand in China. Buyers in other regions should assess relative price advantages for rebar imports from China, while considering logistical costs.