From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Strong Production in India Offsets Export Declines, Creating Procurement Opportunities

Asia’s steel market presents a mixed picture, with increased production in some regions counteracting export decreases elsewhere. According to “Japan’s steel exports down 2.8 percent in January-May 2025”, Japanese exports have declined year-on-year, potentially impacting regional supply dynamics. However, the satellite data does not establish a direct relationship between these export declines and specific plant activity in Japan (data not provided).

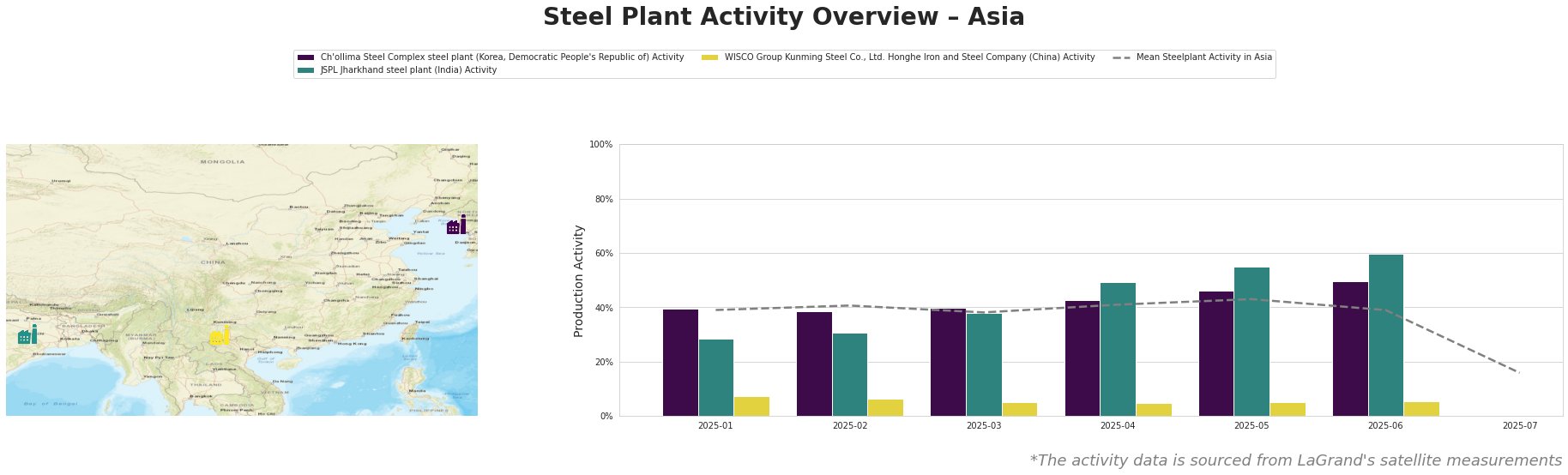

Here’s an overview of steel plant activities observed via satellite:

The table reveals diverging trends. The mean steel plant activity in Asia shows volatility from January to July 2025 with a sharp drop in July. JSPL Jharkhand in India is showing continuous increase over time to a maximum of 60% in June. The Ch’ollima Steel Complex shows a similar increase from January to June, whereas WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company activity remains very low and almost flat during the same time.

Ch’ollima Steel Complex steel plant

The Ch’ollima Steel Complex in North Korea, with a crude steel capacity of 760 ttpa, primarily produces semi-finished and finished rolled products like plates and wire rod. Satellite data shows activity steadily increasing from 40% in January to 50% in June. There is no immediately obvious impact of “Japan’s steel exports down 2.8 percent in January-May 2025” on the facility based on the presented data, since there is no information on export activity in North Korea.

JSPL Jharkhand steel plant

JSPL Jharkhand steel plant in India, an EAF-based facility with a 1600 ttpa crude steel capacity focused on semi-finished products like wire rod and bar, demonstrates a consistent upward trend in activity. Activity levels climbed from 28% in January to 60% in June. This increase in production at JSPL does not show an apparent correlation with “Japan’s steel exports down 2.8 percent in January-May 2025”, suggesting a focus on domestic or non-Japanese export markets.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company in China, an integrated BF/BOF plant with a 1150 ttpa crude steel capacity, manufactures finished rolled products including bar, wire, and various sheet types. Its activity has remained consistently low, fluctuating narrowly between 5% and 7% from January to June. There is no direct connection between the low activity at WISCO and “Japan’s steel exports down 2.8 percent in January-May 2025” that can be established based on the provided information.

Evaluated Market Implications:

The increase in production activity at JSPL Jharkhand steel plant in India, coupled with the overall decline in Japanese steel exports, suggests a potential shift in regional supply dynamics.

Procurement Action: Steel buyers should explore potential procurement opportunities from JSPL Jharkhand. Given the rising production activity at this plant, it may be possible to negotiate favorable pricing or secure supply contracts, particularly for wire rod and bar products. Diversifying supply chains to include Indian suppliers could mitigate risks associated with reliance on Japanese exports, especially if “Japan’s steel exports down 2.8 percent in January-May 2025” signals a continued downward trend.

Given the lack of correlation of the news with satellite activities, procurement strategists should continuously monitor the situation and expand the scope of the news outlets monitored and satellite data collection to include production and export activity in India.