From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Strengthens on New Capacity and Solid Plant Activity Despite August Dip

Asia’s steel market displays overall positive sentiment, driven by new capacity additions and generally solid plant activity, although some facilities experienced a dip in August. This report analyzes these trends based on recent news and satellite-observed plant activity. The commencement of Danieli’s greenfield project in Vietnam, detailed in “Danieli greenfield project in Vietnam starts production,” adds new rebar production capacity to the region. The impact of “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group” on steel production levels could not be directly confirmed with satellite data. Likewise, the report could not establish any direct relationship between the news of “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” and changes in plant activity levels.

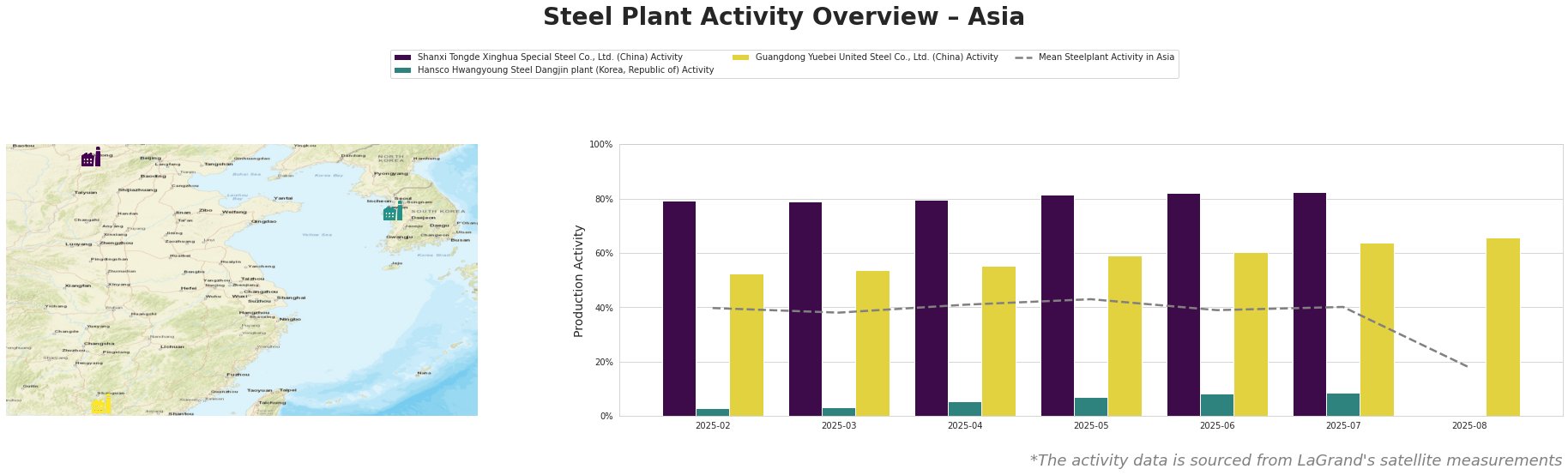

The following table presents recent monthly steel plant activity trends:

Observed activity data shows a significant drop in the mean steel plant activity in Asia to 18.0% in August 2025. Prior to this, mean activity had fluctuated between 38% and 43% from February to July. The Shanxi Tongde Xinghua Special Steel Co., Ltd. showed consistently high activity, starting at 79% in February and peaking at 83% in July. Conversely, Hansco Hwangyoung Steel Dangjin plant operated at very low activity levels, reaching only 9% in July. Guangdong Yuebei United Steel Co., Ltd. demonstrated steadily increasing activity, reaching 66% in August, the only plant still reporting. Note that no data was collected for Shanxi Tongde Xinghua Special Steel Co., Ltd. and Hansco Hwangyoung Steel Dangjin plant for August.

Shanxi Tongde Xinghua Special Steel Co., Ltd., an integrated BF-BOF steel plant in Shanxi, China, with a crude steel capacity of 2.5 million tonnes per annum (mtpa), primarily produces billets and rebar. The satellite data indicates consistently high activity levels, peaking at 83% in July, significantly above the Asian average. The drop in mean activity in August is not reflected by this plant as no data was captured, making it impossible to correlate the company’s contribution to this decrease.

Hansco Hwangyoung Steel Dangjin plant, an EAF-based rebar producer in South Korea with a capacity of 800,000 tonnes, showed consistently low activity levels. Throughout the monitored period, its activity remained significantly below the regional average, peaking at only 9% in July. The August mean activity drop is not reflected by this plant as no data was captured, making it impossible to correlate the company’s contribution to this decrease. There is no apparent correlation between the plant’s observed low activity and the provided news articles.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-BOF steel plant in Guangdong, China, produces rebar with a crude steel capacity of 2 mtpa. The plant’s activity steadily increased over the observed period, reaching 66% in August 2025. This indicates robust production in contrast to the sharp decrease in the mean activity across the region. There is no apparent correlation between the plant’s observed increase in activity and the provided news articles.

The Vietnamese steel market is bolstered by the commissioning of Danieli’s rolling mill, increasing rebar production capacity by 500,000 tonnes per annum, as reported in “Danieli greenfield project in Vietnam starts production“. At the same time, the overall activity indicates a drop in Asia due to the steel plants, whose activity levels were not captured during August. For steel buyers focused on rebar procurement in Southeast Asia, consider securing supply agreements with Vietnam-Italy Steel (Kyoei Steel Group) to leverage the new capacity detailed in “Danieli greenfield project in Vietnam starts production“. Diversify suppliers and closely monitor the operations of Guangdong Yuebei United Steel. Buyers should also closely monitor the activity of Shanxi Tongde Xinghua Special Steel Co., Ltd. when this data becomes available again.